Before Flutterwave’s launch in 2016, many African businesses and individuals had a hard time paying for services from companies like Google, Amazon or Facebook.

In Nigeria, for instance, subscribing to YouTube Music, or Spotify would mean several calls between customers and their banks, or frustrated attempts using debit cards. Flutterwave’s digital payment infrastructure was part of the revolution, which at the time, included Paystack’s web payments service and Interswitch’s upgrade of WebPay. While Paystack was more involved with helping startups collect payments, Flutterwave focused on helping anyone send and receive money via its API.

Since then, the digital payments service has transformed payments in Africa with a number of solutions. It’s taken a leading role in solving payments problems by enabling merchants and banks to receive multiple payment integrations with one simple API. It allows African merchants collect payments from their customers anywhere in the world, on web and mobile. Other than payments solutions, it’s also created several products including Flutterwave Store, an online marketplace for merchants; Flutterwave Grow, which helps users register and incorporate their businesses in the US and UK; and Flutterwave Mobile, an app that allows MSMEs use their phones as POS machines. This year also saw the release of an integration with PayPal, which allows African merchants in 50 countries to receive payments through PayPal.

Flutterwave Send

Its latest product, Flutterwave Send, is taking payments to the global level.

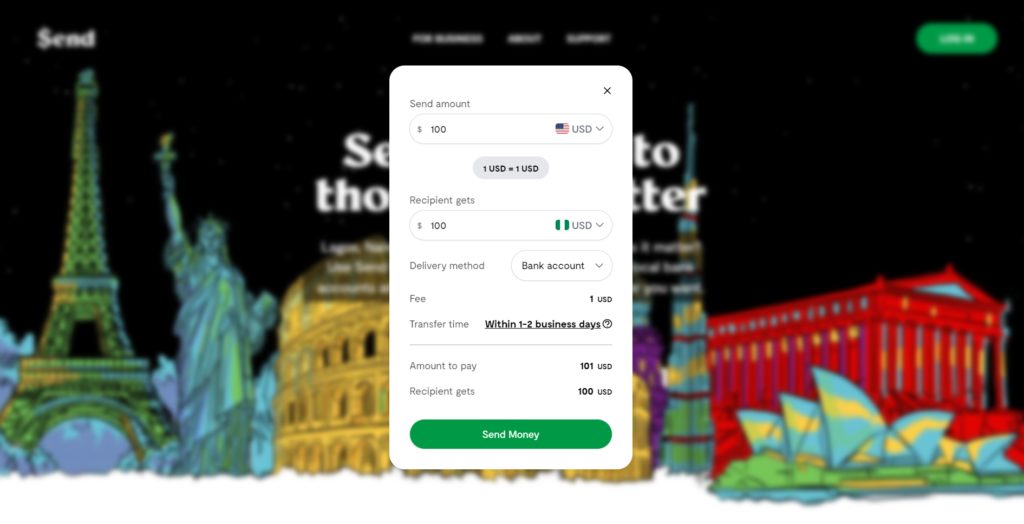

With Send, Flutterwave is empowering customers with a product that allows them to instantly send money “in a way that’s convenient to the recipient”. According to Flutterwave, users will be able to process payments—in over 150 currencies—in 40+ countries. Merchants, for example, can use Send to process payments to contractors and employees all over the world. Individuals can use it to top up their bank accounts, allowing constant access to financial services regardless of location. “Send is finding yourself in Nairobi and being able to add your US-issued bank card to a product that will allow you to patronise local businesses straight to their mPesa wallet,” Flutterwave announced.

The Essence of Flutterwave Send

At the helm of Flutterwave Send is Afrobeats artiste, Ayodeji Ibrahim Balogun—popularly known as Wizkid—who was signed on as Flutterwave’s global brand ambassador.

Like Flutterwave, superstar WizKid has also risen to global fame in the past decade. Around the same time Flutterwave was building blocks for its now widely used service in 2016, starboy Wizkid had just started receiving worldwide recognition following his collaboration with Drake for “One Dance”, a song that reached No 1 on US Billboard Hot 100 and got two Guinness World Records for being the most streamed song on Spotify [at the time], and for being the first song to reach a billion streams on Spotify. Since then, the artiste has been celebrated worldwide, getting four Grammy nominations and winning one for his collaboration with Beyoncé.

For Flutterwave, Wizkid will be leading adoption across African countries by drawing his fans in. “I’m excited to work with Flutterwave in bringing more Africans into the digital economy through Send,” he said. “Flutterwave is an African product, a quality product that actually caters to the everyday problems we face back home. For me, Flutterwave is easy and simple because you’re able to send money any time, any day.”

Wizkid will help drive Flutterwave’s goal to increase global awareness of the affordable remittance service. Studies have shown that celebrity endorsements help about 85% of consumers gain confidence in brands; 50% of people are more likely to use products and services celebrities use.

Speaking on Wizkid’s appointment, CEO Olugbenga Agboola said, “Wizkid’s story is that of hard work, resilience, and excellence. The way he constantly represents Africa in the global entertainment stage is something we love. As a leading technology company out of Africa, our values align, and we’re excited to have him join us to drive adoption for Send. He’s genuinely interested in our brand, he knows payments, and he understands what we’re trying to solve. “