IN PARTNERSHIP WITH

MTN has launched 5G services in Zambia.

In partnership with Huawei, the telecoms company joins South Africa as one of the only countries in the region to have the network.

While there are about 18 countries—including Nigeria and Kenya—across Africa testing or trialling 5G network, adoption rates are still low due to the cost of development and regulations.

At least we’ve moved away from conspiracy theories on how 5G is the cause of Covid.

In today’s edition

- Event: Building From Ground Up

- Powering blockchain apps for Africans

- Uganda’s plan to boost e-transactions

- Microsoft’s quest for custom chips

- TC Insights: Funding Tracker

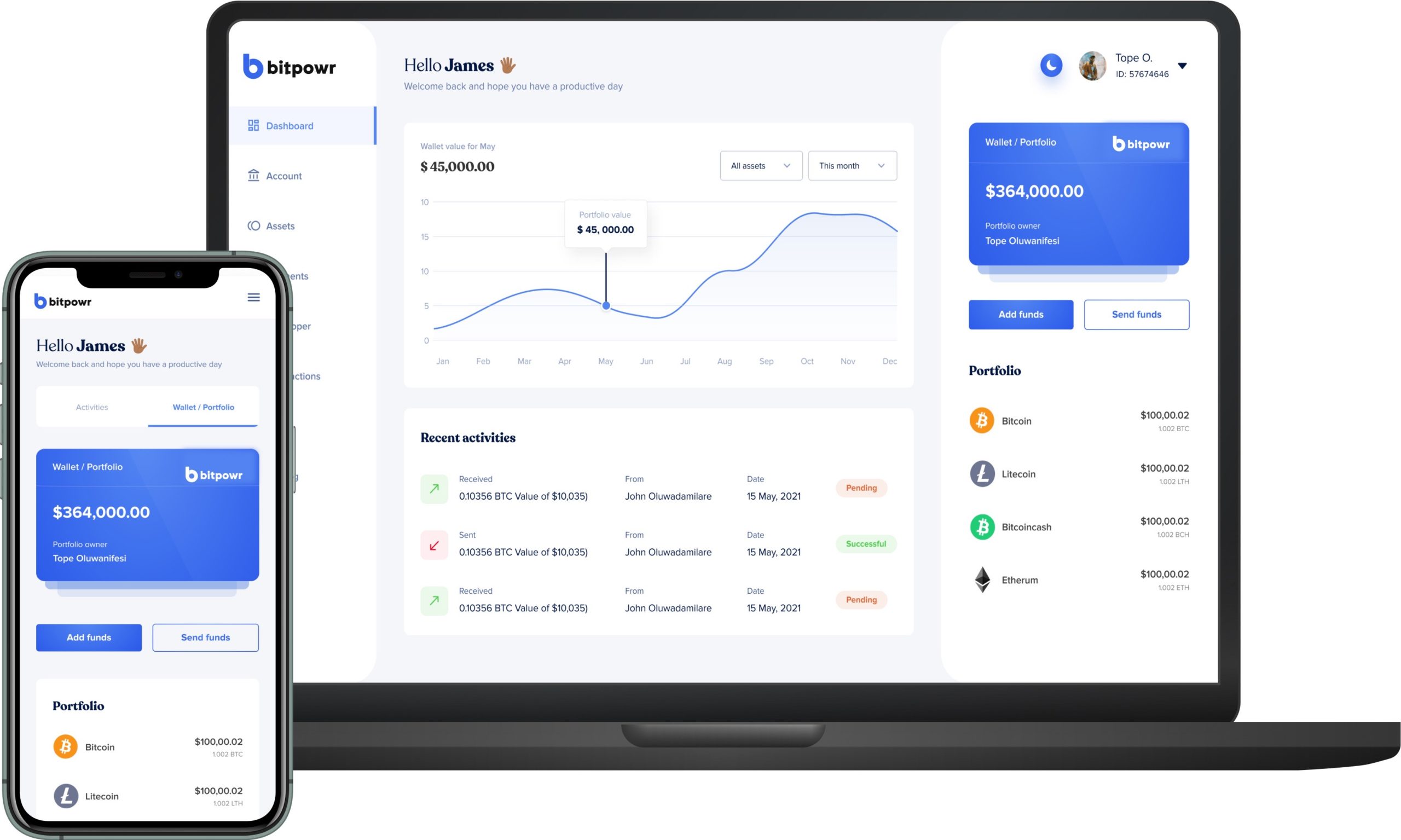

POWERING BLOCKCHAIN APPS FOR AFRICANS

While interest and use in blockchain has grown significantly in other regions of the world, in Africa, the use of this emerging technology is still quite limited.

One reason, of course, is education on what blockchain is all about and how useful it is. Another is the expense—in time and money—required to integrate blockchain into business processes. For example, building crypto payments systems for retail platforms can take five months, and cost $3,000 per month to complete and maintain.

A Bitr power

The good news is that there are startups speeding up this process.

One is BitPowr, a Nigerian startup that provides African organisations with tools to easily build and integrate blockchain applications.

Essentially, BitPowr is the go-to platform for any company looking to create and integrate blockchain applications—from fintech startups that need crypto wallets for exchanges, to e-commerce platforms that want to incorporate crypto payments.

BitPowr also cuts down expenses by 96%, offering a $100 base fee for businesses who want to access its infrastructure that supports at least 10 blockchain nodes.

UGANDA’S PLAN TO BOOST E-TRANSACTIONS

East Africa is by far the largest region in terms of mobile money. In Uganda, the industry is worth $46 billion with over 26 million active mobile money wallets in circulation, and it’s still growing.

Current projections estimate that the industry will grow by 26.6% by 2026 (try saying that six times in a row).

To help this growth along, the Ugandan government has lowered limits on cheque payments from Ush 20 million ($5,645) to Ush 10 million ($2,822). This will not apply to transactions made within the same bank or over-the-counter cheque withdrawals.

While the announcement was made in December last year, it will take effect from January 15. By doing this, the government hopes to push the public towards using “alternative electronic payment options, such as the real-time Gross Settlement System (RTGS), Electronic Funds Transfer (EFT) and mobile money among others”.

Even though mobile money and electronic transactions continue to grow in Uganda, cheques are still popular with the Bank of Uganda reporting that cheque payments grew by 5.17% in 2019. Similarly, in Kenya, cheque payments also grew by 8.2% in 2021, amid the lockdown.

For some reason—quite possibly under-education on e-transactions—people still prefer physical payments and countries aren’t standing for it. With its latest action, Uganda joins South Africa and Lesotho—both of which have taken action by discontinuing cheques in 2020 and 2021 respectively.

In Ep. 5 of Artwork, learn how to work with global brands as an African creator

👉🏾 Watch now.

This is partner content.

MICROSOFT’S QUEST FOR CUSTOM CHIPS

It’s poaching season—the desperate time of year when companies battle over employee retainment to plan for their end-of-year goals.

This year, Microsoft is kicking it off with a new hire, high-profile ex-Apple engineer Mike Fillippo who will help Microsoft achieve one of its pressing goals—developing its own custom chips.

What kind of chips?

Sadly, not the digestible kinds. 😔

They’re computer chips for Microsoft servers that help power its cloud services, and possibly its devices. Currently, Microsoft has a long-standing partnership with Intel and Advanced Micro Devices Inc. (AMD) to use their chips for its devices.

However, more recently, Microsoft has been looking to make its own homegrown chips. And it’s not the only one. Apple announced its custom M1 chip in 2020, and both Alphabet Inc. (aka Google) and Amazon are also working on their own chips.

What’s wrong with the stale old chips?

To put it in Amazon Web Services VP Nafea Bshara’s words, “When we improve the hardware, everything that runs on it improves.”

Tech companies want to make chips that are optimised for the services and devices they have, they’re not just looking to buy mass-produced chips that can fit any devices or servers.

There’s also a higher demand for energy-efficient chips which consume low power. Apple’s M1 chips, for example, has not only increased the overall performance of MacBooks, it’s also reduced heat generation and increased battery life.

Big picture: The drive for custom chips could also be due to the shortage of chips manufacturers have been experiencing. What this means for everyone is that we can expect faster devices from Microsoft and Google soon. It also means that companies like Nvidia and Intel will likely experience a drop in stock prices.

Quidax is an African-founded cryptocurrency exchange that makes it easy for you to access Bitcoin and other cryptocurrencies. They also make it possible for Fintech companies to offer cryptocurrency services to their customers.

This is partner content.

TC INSIGHTS: FUNDING TRACKER

This week, Kenyan buy-now-pay-later (BNPL) startup Lipa Later secured $12 million from Cauris Finance, Lateral Frontiers VC, GreenHouse Capital, SOSV, Sayani Investments, and Axian Financial Services. The round was a mix of debt and equity.

Here are the other deals for the week:

- SeamlessHR, an HR-tech startup based in Nigeria closed a $10 million Series A round led by TLcom Capital. Capria Ventures as well as existing investors such as Lateral Frontier Ventures, Enza Capital, and Ingressive Capital, and several strategic private investors also participated in the round.

- Ivory Coast-based e-commerce startup Afrikrea, raised a $6.2 million pre-Series A round and rebranded as “ANKA”. The round was led by Investisseurs & Partenaires, with participation from Alibaba’s executive Vice-Chairman Joe Tsai, Bestseller Foundation, VestedWorld, Enigmo, Groupe Prunay, and Rising Tide Africa.

- Nigerian multi-merchant rewards platform ThankUCash raised $5.3 million in seed funding. This was co-led by 500 Global and Unicorn Growth Capital, with participation from Expert Dojo, Predictive VC, SaaS Growth Ventures, Betatron, Accelerex Holding, former HSBC CEO Andrew Dell, Google Director of Strategy and Operations Craig Fenton, and others.

- BFREE, a Nigerian fintech, secured $1.7 million in pre-Series A round from 4Di Capital, Octerra Capital, VestedWorld, Voltron Capital, Logos Ventures, and several unnamed business angels.

That’s all we’ve got this week.

Follow us on Twitter, Instagram, and LinkedIn for more updates on funding deals.

JOB OPPORTUNITIES

Every week, we share job opportunities in the African ecosystem

- Klasha – Marketing Storyteller, Head of Strategic Partnerships – Lagos, Nigeria

- US Embassy in Uganda – Consular Assistant, Computer Control Assistant – Kampala, Uganda

- Sendchamp – Senior DevOps Engineer, Brand Designer – Africa (Remote)

- Metacare – Software Engineer, Mid-level Back End – Africa (Remote)

There are more opportunities here. If you’d like to share a job opening or an opportunity, please fill this form.

Fincra is a payment infrastructure that provides fintechs, online platforms and global businesses with reliable payment solutions for quick collections and payouts in different currencies. You can gain access to Fincra’s payments platform or integrate their APIs for seamless payments processing.

This is partner content.

What else we’re reading

- Kenyan BNPL startup Lipa Later raises $12 million to expand across Africa.

- Tech leaders are pushing to transform Zambia into Africa’s low-tax startup hub.

- Everyone wants to do it, you can too. Here’s how you can get a job in tech.

- A year to Nigeria’s 2023 elections, its government lifts Twitter ban.