IN PARTNERSHIP WITH

Good morning 🌄

Netflix is taking important steps to promote filmmaking in Africa.

The streaming service has launched the Creative Equity Scholarship Fund (CESF), a $1 million fund geared towards enabling students of film and television in sub-Saharan Africa.

The fund will kick off later this year in South Africa with an open call for applications in the Southern African Development Community (SADC).

In today’s edition

- Buju-welling fans with crypto

- Spacing out with South Africa and Egypt

- Spot

ifythe problem - TC Insights: BNPL prospects

- Tech Probe: Answers

- Job opportunities

BUJU-WELLING FANS WITH CRYPTO

How would you like to earn a little bit out of the streaming income of your favourite artistes?

This is what Daniel Benson, a.k.a. Buju, is doing with his music. Last week, the Nigerian musician released some info about his NFT project, “HeadsbyBuju“.

Getting a-head of the game

“HeadsbyBuju” is a collection of 10,001 unique NFTs of Buju’s face. Holders of these NFTs will get perks like access to physical and virtual concerts hosted by Buju, merch items, and a part of the revenue the musician makes from specific music projects.

It is, perhaps, the first time any African musician will use crypto technology to establish a connection with fans and reward them.

Will fans want these rewards?

The project, scheduled for release this year, is divided into three quarters.

In the first, the “HeadsByBuju” project will be minted publicly and pre-sale will start. Holders of these will get perks like access to special events and interactions with Buju, AR filters on Instagram and Snapchat, and even access to PlaySpace.

In the second quarter, holders will get special access to Buju’s concerts, events, and studio sessions. Future releases will also see holders getting real-life perks like discounts to restaurants, clubs, hotels, and health centres.

The project also plans to dedicate 10% of its primary sales to a creator fund.

SPACING OUT WITH SOUTH AFRICA AND EGYPT

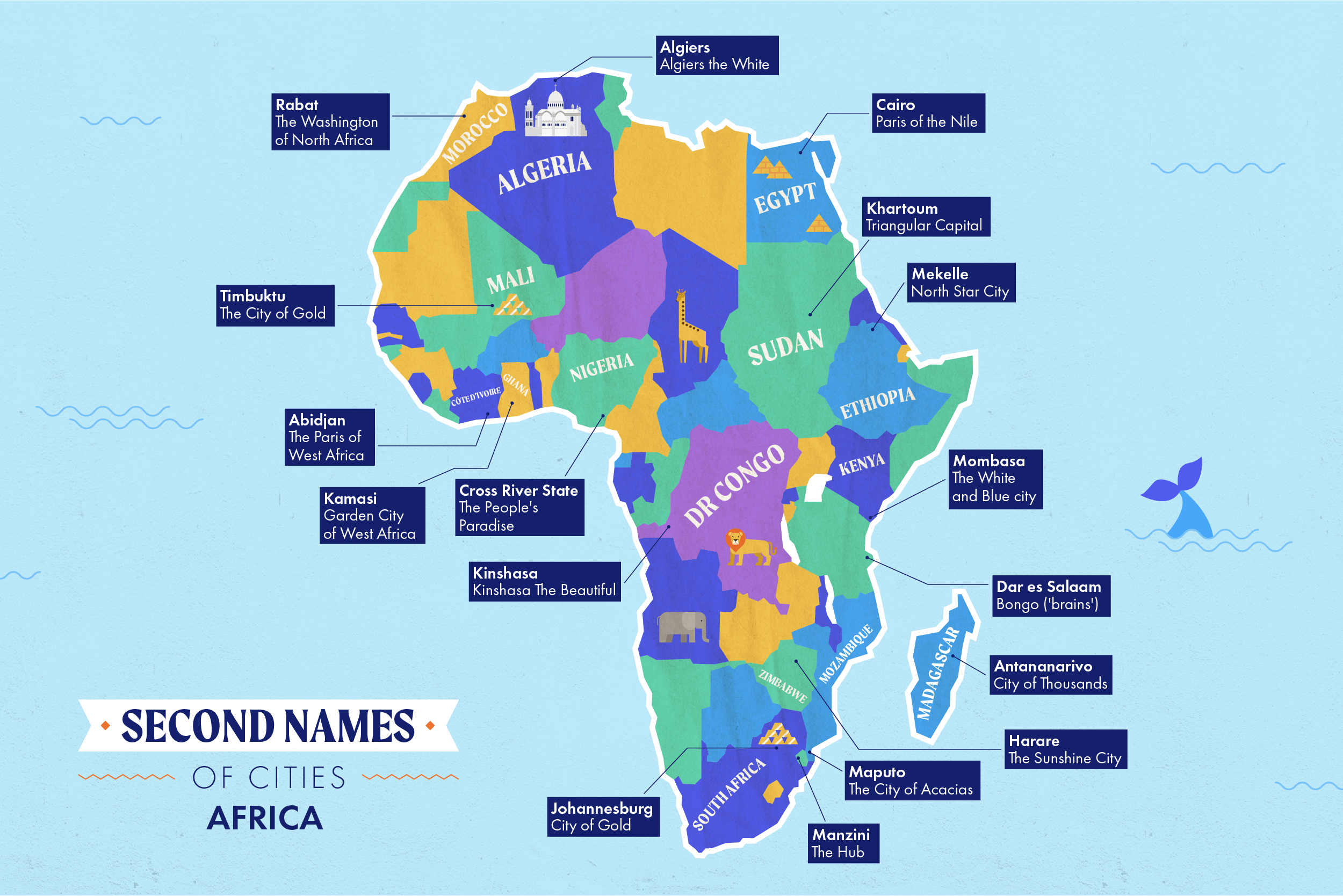

Since the first satellite was launched in 1959, over 5,000 satellites have been sent into orbit. Presently, however, there are just over 3,372 satellites in space. Of that number, the US owns at least 1,897, China owns 412, and Russia owns 176.

Africa has 41 satellites in orbit and at least 11 countries—including South Africa, Morocco, Ethiopia, and Ghana—have sent satellites up. Now, Egypt and South Africa have announced plans to launch more satellites into space this year.

Over the past two years, more African countries have been in a race to send out more satellites into space. The 2021 edition of the Africa Space Industry Annual Report shows 125 new satellites have been lined up for development in 23 African countries by 2025.

The craft race

As Conrad Onyango states, the reason for Africa’s space race is evident: governments need to meet the rising demand for connectivity, which is fueled by fast-changing data consumption patterns. Africa’s internet penetration rate currently stands at just 39%, and many are left without access.

According to the World Economic Forum, data collected by the satellites could also unlock $2 billion worth of annual benefits for Africa. It also helps solve pertinent agricultural problems on the continent by monitoring drought, tracking crop health, and improving sustainable forest management.

In Ep. 6 of Artwork, learn how to convert leads to happy customers.

👉🏾 Watch now.

This is partner content.

SPOTIFY THE PROBLEM

Last week, there were a few important updates on Spotify. First, its stock had lost nearly 25% of its value by Tuesday, along with the dip in other tech stocks like Netflix’s and Peloton’s.

More recently, it was the subject of a COVID vaccine misinformation debate that led to two Grammy winners pulling their songs from the platform.

What’s going on?

On Monday, Neil Young—a Canadian-American rock veteran—gave the platform an ultimatum: to choose between himself and podcaster Joe Rogan.

Rogan hosts the world’s largest podcast—The Joe Rogan Experience—exclusively on Spotify, and it generates a whopping 11 million listeners per episode. Lately on the podcast, however, Rogan has expressed some views on the COVID vaccine which many tag as misinformation. For example, the podcaster has been known to state that hospitals are financially motivated to falsely attribute deaths to COVID. Rogan has also expressed distaste for vaccine mandates.

So, what’s the problem?

Well, Neil Young—who has 6.7 million listeners—believes that Rogan is misinforming people and using his platform to influence millions of listeners across the globe. And they want Spotify to take action and remove or sanction Rogan’s podcast.

The streaming platform, unsurprisingly, refused to budge and Young, in response, ordered his music label to take his music off the platform.

Spotify’s decision is unsurprising as the platform signed a deal worth over $100 million with Rogan in 2020. His podcast generates thousands of dollars in ad revenue for Spotify, and losing the controversial commentator could cost the platform a lot.

The platform does have policies against misinformation, and it recently told the Wall Street Journal that it had taken down over 20,000 podcast episodes that spread COVID-related misinformation. Rogan’s was not one of them.

Following Young’s exit, Joni Mitchell—a folk singer who has 3.7 million listeners per month—also announced her departure from the platform, urging other artists to shun the platform.

Earlier this morning, in response to the exits, Spotify—through its CEO, Daniel Ek—stated that its role was not to be a “content censor”. Ek also noted that the platform would now add content advisory notices to any podcast that explores COVID.

Quidax is one of Africa’s largest cryptocurrency exchanges that allows anyone to access Bitcoin and other cryptocurrencies from anywhere in the world. With the new Quidax app, anyone can trade over 30+ cryptocurrencies, get market reports, easily withdraw funds in your local currency, and do so much more.

Download the new Quidax app today!

This is partner content.

TC INSIGHTS: BNPL PROSPECTS

Across Africa, most people save up lump sums before making important purchases. For a long time, it was rare to spread purchases across several months, compared to some regions of the world. In recent times, however, buy-now-pay-later (BNPL) startups have begun to offer this option to teeming customers across the continent. Some of them received millions of dollars in VC funding in the past year, signalling a vote of confidence in their ambitions.

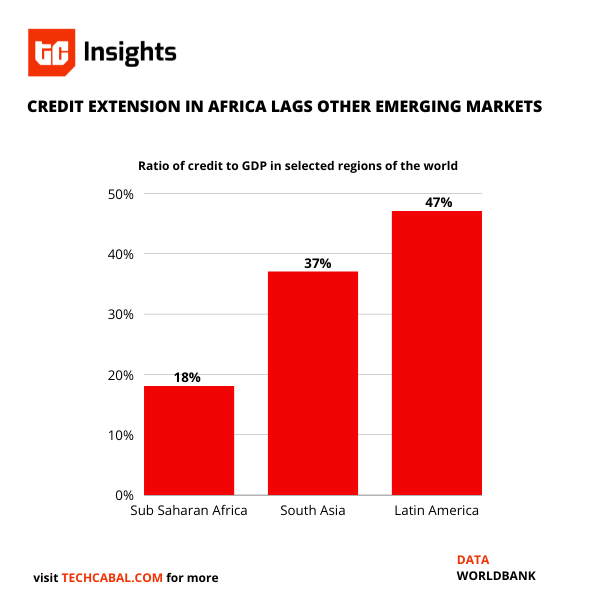

According to a PYMNTS’ report, 9.6% of millennials worldwide had used BNPL as of September 2020. This demographic constitutes a large percentage of Africa’s population. Traditional credit is only accessible to a small minority across the continent. In sub-Saharan Africa, the ratio of credit to GDP is only 18%, while that of South Asia and Latin America are 37% and 47%, respectively. Thus, with the recent economic downturn in many African countries, the offer of BNPL becomes a great alternative.

The numbers back this potential. For instance, e-commerce in Africa is expected to grow by more than 18% annually from 2021 to 2024. Digital wallets are set to gain ground, accounting for more than one-fifth of e-commerce spending by 2024. Also, transactions via mobile wallets are expected to double by 2024.

The promise of BNPL startups to users is payment flexibility. Yet, there are concerns about credit rating. As credit facilities across the continent are still evolving, the BNPL model has its work cut out for it, and managing default will be critical to its sustainability. Hence, it is important for BNPL startups to partner with existing financial institutions and telcos to navigate this and drive the adoption of their offerings.

Finally, it is important for players within the industry to embrace interoperability and ensure that defaulters do not have a field day switching across diverse platforms. The buy-now-pay-later (BNPL) revolution has just begun and young Africans are set to partake in it.

You can download all our reports here and watch videos from our events. Send your custom research requests here.

TECH PROBE: ANSWERS

Here was last week’s question, and below are some of the most interesting responses we received:

- “Hmm, good question. It would depend on the frequency and value of the content,” – daba finance (@dabafinance, Instagram).

- “Not in this lifetime. Unless they can guarantee entertainment every time or they give vital information,” – Nnorom Chidiebere (@nnoromchidi, Instagram).

- “If they will take me to heaven, yes,” Fikayo Idowu (@FikayoIdowu, Twitter).

- “Yes. That’s the future of digital consumption. It gives more importance to what creators are doing,” – haute (@haute_, Instagram).

- “It should be the other way round,” Strange (@abba_m, Twitter).

Every week, we share job opportunities in the African tech ecosystem.

- Big Cabal Media – Software Developer, Sales Associates – Lagos, Nigeria

- Decagon – Design Intern – Africa (Remote)

- Backdrop – Graphic Designer – Africa (Remote)

- Mono – Senior UI Designer – Lagos, Nigeria

- Moni Africa – Operations Analyst – Lagos, Nigeria

There are more opportunities here. If you’d like to share a job opening or an opportunity, please fill this form.

Fincra is a payment infrastructure that provides fintechs, online platforms, and global businesses with reliable payment solutions for quick collections and payouts in different currencies. You can gain access to Fincra’s payments platform or integrate their APIs for seamless payments processing.

This is partner content.

What else we’re reading

- Why the emergence of the metaverse and web3 requires rethinking online privacy.

- Breaking down tech terms: What do blockchain, NFT and DAO mean?

- A crypto lender, Genesis, has decided to accept NFTs as collateral for loans.

- Myth busters: Are Nigerian legacy companies losing talent to startups?