Orchestrate is an aggregated payment infrastructure that helps fintech and businesses get instant access to multiple payment methods/providers (cards, bank transfers, wallets, crypto, etc) with a single integration.

With over 200 fintechs in Nigeria and South Africa combined, and over 500 fintechs in Africa, the fintech industry continues to overshadow other sectors in this current technology boom. With many fintechs and payment providers cropping up daily, each with its API documentation and process of integration, the payment system in Africa is disjointed, and the process of integrating with payment providers can take too long. It costs businesses weeks or months to fully integrate with a payment provider’s API. With each payment provider needing to be managed individually, offering a faster and easier way to do this becomes essential — hence, payment orchestration.

Upon its brand launch on Friday, May 27, 2022, we spoke to the founder and CEO of Orchestrate, Jerry Enebeli, and a few team members about what Orchestrate is doing and how payment orchestration is the future of fintech solutions.

What is Orchestrate?

Jerry Enebeli is described, by his team, as a product person at heart. Being a product and engineering savant with a long list of work experiences, Jerry’s career is filled with a ton of practical experiences and software solutions across different companies, especially in fintech.

Orchestrate was inspired by an overlooked need in the fintech space. According to Jerry, “There are many people who solve payments, but these solutions are fragmented. In Nigeria, for context, people solve payments for cards, bank transfers, or direct debit. For merchants and fintech who want to process payments, they need to start integrating with these individual payment providers. Still, every time they have to do that, it takes weeks or months to integrate, and sometimes the process can become a hassle.”

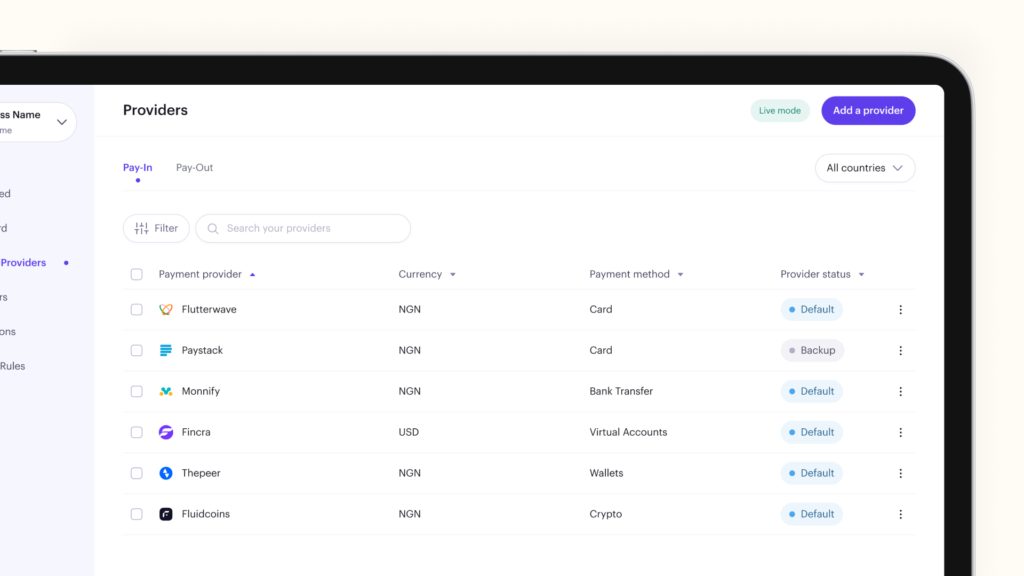

Integrating a payment provider takes skill and time, and this is one critical problem Orchestrate exists to solve. What Orchestrate offers fintech and merchants is the ability to integrate multiple payment providers, from one dashboard, in minutes, with little or no code. You only need to integrate your platform with Orchestrate once. With just clicks, you can add providers/methods like Paystack to process your payments, Stripe for dollar payments or even Fluidcoins for crypto, and other payment processors. By integrating with Orchestrate, you can access all these payment providers easily from one place and start to receive payments.

With Orchestrate, businesses get more value for their money — their engineering team can focus on the core service offering without committing too much time and effort to managing payments integration. With a one-time integration on the platform and a few lines of code, an engineering team for a fintech or a merchant can easily add, remove and manage multiple payment providers without needing to navigate complex API docs or developer support.

While Orchestrate is not a payment gateway or provider itself, it functions as a dongle that helps you connect existing payment providers to your app, product, or website. On this subject, Jerry says that “We’re not here to replace payment providers but to make their relationships with customers better.” He continues that “the value we give these providers is that whatever time it takes users to integrate with their software, we’re cutting it in half. We’re speeding up their developer experience and customer connection.”

Why choose Orchestrate?

According to Jerry, “the question is “why not?” Orchestrate is the wisest decision to make if you’re processing payments in Africa, and our goal is to change how you think about receiving payments as a business — and improve your business decisions.”

Orchestrate is scheduled to go live by Q3 2022. It plans to offer a host of product features to businesses, such as:

- Pay-in API: The Pay-In API enables businesses to collect payment via multiple payment methods. Fintechs get instant access to all the payment providers supported by Orchestrate with a single integration. Engineering teams can go on to set up and connect their entire payment stack in minutes with just clicks.

- Pay-out API: The Pay-Out API enables fintech to power payouts or customer withdrawals through multiple payment methods, including crypto or a customer’s preferred wallets.

- Orchestrate Checkout tool: As opposed to a customer seeing a single payment method, businesses whose checkout is powered by Orchestrate can display all enabled payments methods to the customers at checkout based on some preset rules such as country, location, transaction value, recurring or one-time payment e.t.c

- Analytics dashboard: Typically, when using multiple payment providers to receive payments, businesses have to manage each one at the backend separately or build their dashboard from scratch, which means more work, money, and time. Orchestrate has a more straightforward solution. By using Orchestrate, you can access all the analytics from all the providers available on one dashboard. You have access to real-time records of how much is being processed through your account from each payment provider and can track all your data in one place. This allows you to aggregate your analytics in one dashboard and easily manage your payments stack.

- Auto-switching: Orchestrate allows businesses to set a backup provider for payment downtimes. Businesses can add a second payment provider as a backup when their primary provider is unavailable. For example, if you set Flutterwave as a backup card payments processor when you use Paystack. In that case, if Paystack is experiencing downtime, Orchestrate can automatically switch to your backup to process payments without causing a breach in transactions or affecting customer experience.

Currently, Orchestrate allows businesses to offer five payment methods to their customers — cards, bank transfers, crypto, wallets, and direct debit. These methods are powered by payment providers such as Paystack, Flutterwave, Mono, Lazerpay, Fluidcoins, Thepeer, and others.

The future for Orchestrate

Previously known as GetWallets, Orchestrate is a pivot away from the Wallet-as-a-Service startup.

GetWallets is a virtual wallet API tool that aids developers with creating and managing wallets. Built for developers, GetWallets offers APIs to help developers integrate wallets into their applications.

Working on GetWallets, they realized that companies dealing with wallets and payments have to hire developers to provide access to funding these wallets constantly. Some of these companies have dedicated payment teams embedded in their engineering departments taking their skill and attention from other company engineering needs to solve payments instead. Asking what more they could do with wallets led the pivot to create Orchestrate.

Orchestrate is built by a growing team of 8, but the startup has set its sights on a lofty goal. According to Praise Philemon, Head of Brand & Design, “the vision for us is to be the world’s largest payment ecosystem. It’s not a plan; it’s our destiny. Our goal is not to become a payment processor ourselves but to make the world a global payments village.”

This means that Orchestrate makes it possible for a business in Canada to expand to Kenya and start receiving payments from Kenyan customers without having to integrate Kenyan payment providers from scratch. Payment expansion becomes as fast as a few clicks.

Anyone anywhere will be able to receive payment from anywhere with instant access to a robust list of payment providers to choose from.

The biggest challenge with building Orchestrate has been integrating payment providers’ API. Some API documentation is difficult to read, and each provider is different in its API structure and support, but this is also the solution that the startup sets out to solve. By automating and improving this process, Orchestrate saves fintech and businesses time and expertise and enhances the payment experience for everyone.

According to Patrick Jesam, Lead Engineer at Orchestrate, they have overcome this minor difficulty with API documentation by being clear on the problem they set out to solve, hiring the right people, and creating the right culture where everyone buys into the vision of what Orchestrate wants to become.

“The team and its culture is most likely the solution to everything we would have faced,” he says, “the key thing from an engineering point of view is that we had challenges with integrating with some of the providers, but we solved them by grit and engineering prowess.”

Wunmi Akinfemiwa, Product Marketing Manager at Orchestrate, shares that “instead of managing different payment methods from four to five dashboards, you can do it all on the Orchestrate dashboard. This will help the business manager access data like peak times and days, most in-demand payment methods, and more. Knowing these helps management make informed decisions across their sales lifecycle.”

This goal of becoming the world’s largest payment ecosystem starts in Nigeria mainly and Africa as a whole. And with the recent launch of the brand, the product is expected to open in public beta within the next few weeks.

To see what’s in the works with Orchestrate, visit the website.