IN PARTNERSHIP WITH

TGIF 🌞

So, something huge is coming soon to TC Daily and you’re getting an exclusive sneak peek.

We’re announcing a milestone and introducing something new. If you want the tea before the rest of the party, join this waitlist and we’ll be in touch 🙂

In today’s edition

- Crypto market: Crypto platforms must get licensed in South Africa

- Kloud Commerce founder petitioned for fraud

- SCIL acquires Polaris Bank

- Coursera partners with NITDA

- Fifteen startups selected for CATAPULT: Inclusion Africa

- TC Insights: Funding tracker

- Event: Ecobank Fintech Breakfast Series

- Job opportunities

CRYPTO MARKET: CRYPTO PLATFORMS IN SA MUST GET LICENSED

|

|

|

|---|---|---|

|

Bitcoin

|

$19,026 |

– 0.53% |

|

Ether

|

$1,281 |

– 0.35% |

|

BNB

|

$268 |

– 1.13% |

|

Solana

|

$28.18 |

– 3.24% |

|

Cardano

|

$0.33 |

– 3.20% |

|

|

Source: CoinMarketCap

|

|

* Data as of 23:55 PM WAT, October 20, 2022.

Crypto is having an eventful week in South Africa.

On Wednesday, the Financial Sector Conduct Authority (FSCA) announced that crypto assets in the country would be treated as financial products.

A day after, the regulator announced that it had—in fact—not legitimised crypto with its earlier declaration. According to FSCA head Unathi Kamlana, the regulator’s earlier decision was targeted at helping South African authorities tackle crypto scams and fraud.

Yesterday, the FSCA also announced that starting next year, crypto platforms in the country will need to get licensed in order to continue operations. There’s no rush though, all crypto platforms will have between June and November 2023 to get licensed.

KLOUD COMMERCE FOUNDER PETITIONED FOR FRAUD

Another African startup has shut down, and this time, investors aren’t letting the perpetrator off easy.

On September 30, CEO of D2C Kloud Commerce Olumide Olusanya announced to employees that the company would be shutting down effectively.

What went wrong?

A couple of things.

For one, Kloud Commerce didn’t have a product. The startup also ran out of money—all $765,000 pre-seed it raised in May 2021.

An investigative piece published by WeeTracker revealed that investors at the startup are petitioning Nigeria’s Economic and Financial Crimes Commission to investigate founder and CEO Olumide Olusanya who has been accused of fraud and misappropriation of funds.

Kloud Commerce described itself as a direct-to-consumer (D2C) that helps brands sell and build relationships directly with African consumers. In an interview with TechCabal earlier this year, Olusanya announced that the company had several offerings including Omni, a B2C solution and GoDigital, a B2B product. The founder also mentioned that the startup was already powering retail sales for 10 global brands—including Nike and Adidas—in Nigeria and Ghana.

According to WeeTracker’s investigation, these claims are false. In December 2021, the founder told investors that one product was live in 800 locations across Ghana and Nigeria.

“The progress he shared was deceptive, probably all lies, giving us make-believes just to unlock more money from investors,” said a leading investor.

The plaintiffs also accuse Olusanya of mismanaging company funds and fraud. Aside from a bloated payroll of employees working on non-existent or non-performing products, investors also claim Olusanya diverted funds from the company for personal use. Olusanya reportedly withdrew ₦4 million ($9,000) as “entertainment allowance” between August and September 2021, as well as ₦22 million ($50,000) for publicity events in Ghana where he spent $100/night in hotels.

A $15,000 angel investment allegedly also awent into the founder’s accounts.

Investors reportedly tried to remedy the situation earlier in the year by removing Olusanya as CEO—a deal the founder initially agreed with, but changed his mind last minute and announced to employees that investors attempted to effect a “hostile takeover”, and then tried to fire employees despite owing salaries.

Zoom out: Olusanya has yet to respond to the allegations but is allegedly in the process of liquidating the company to settle its debts—or at least some of it.

Don’t just send money, send money fast. Send and receive money directly to mobile wallets, bank accounts, Barter or through cash pickup with $end.

Visit send.flutterwave.com and do it now!

This is partner content.

SCIL ACQUIRES POLARIS BANK

Strategic Capital Investment Limited (SCIL) has acquired Nigerian commercial bank Polaris Bank for ₦50 billion ($115 million).

The sale was announced by the Central Bank of Nigeria (CBN) and the Asset Management Company of Nigeria (AMCON) with approval from the Nigerian presidency.

Acquiring equity…and some debt

According to Osita Nwanisobi, director of the CBN’s corporate communications department, SCIL paid upfront for 100% equity in Polaris Bank.

The company also agreed to repay the ₦1.305 trillion ($3 billion) AMCON injected into Polaris Bank in 2018.

Side bar: Polaris Bank transmuted from Skye Bank, a commercial bank that collapsed in 2018. At the time, Skye Bank had over 300,000 shareholders and 6,000 employees, and liquidating the bank would mean lost jobs and livelihoods.

So instead of liquidating, AMCON and the CBN injected ₦786 billion ($1.8 billion) into the bank to help it get back on its feet. The money, injected through consolidated bonds, had a future value of ₦1.305 trillion.

The future is here, and the bank is off the Nigerian government’s neck. CBN Governor, Godwin Emefiele said that the sale of the bank “marks the completion of a landmark intervention in a strategic institution in the Nigerian banking sector by the CBN and AMCON.”

COURSERA PARTNERS WITH NITDA

A day after announcing the approval of the Nigeria Startup Bill, Nigeria’s minister of communications and digital economy Isa Pantami shared another announcement.

And this time, it is connected to Nigerian youths.

Yesterday, the ministry announced that its parastatal—the National Information Technology Development Agency (NITDA)—had partnered with global edtech platform Coursera to upskill 24,000 Nigerian youths with tech skills.

Over a three-year period, NITDA and Coursera will empower young Nigerians with digital and developer skills.

Why’s this important?

Youth unemployment in Nigeria stands at 19.61% with 21.7 million young Nigerians stranded without jobs.

One of the driving factors behind this is Nigeria’s unreliable education sector which leaves millions out of school. For example, over 1.6 million students have been affected by two eight-month strikes in Nigerian federal universities between 2020 and 2022.

Some of these students have used the opportunity to pivot to tech, and it appears NITDA wants to support them using technology.

Big picture: Twenty-four thousand might not be a lot in Nigeria’s fight to educate its youth, but it’s a start. Pantami also urged Coursera to expand its presence in Nigeria and consider partnering with universities.

Increase your online sales with a Paystack Storefront – a free, beautiful seller page that helps you bring creative ideas to life.

👉🏾 Learn more at paystack.com/storefront.

This is partner content.

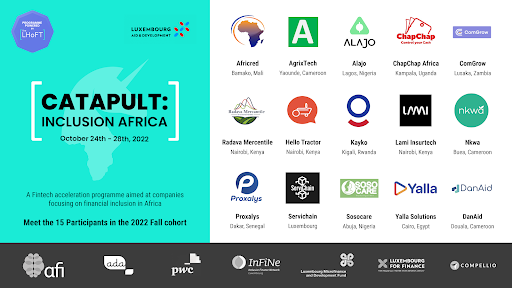

FIFTEEN STARTUPS SELECTED FOR CATAPULT: INCLUSION AFRICA

The Luxembourg House of Financial Technology (LHoFT) Foundation has announced the 15 selected startups that will participate in the 2022 edition of its development project Inclusion Africa.

Wait, where have I seen this?

You probably remember it from this piece we wrote in March when LHoFT announced the 10 fintechs that would take part in the Dubai edition of Inclusion Africa.

JSYK: The accelerator programme was launched in 2018 to provide insight and education for financial inclusion fintechs from MENA and Africa and connect them with key stakeholders like microfinance institutions, investors and industry experts.

For the fifth edition, LHoFT partnered with several firms including the Alliance for Financial Inclusion (AFI), and the European Investment Bank (EIB).

So who’s in?

Out of 400+ applications, 15 startups promoting financial inclusion across 9 countries including Nigeria, Kenya and Zambia were selected.

From Kenya, there’s agritech Ravada Mercantile that connects smallholder farmers to consumers; Hello Tractor, a BNPL platform allowing farmers access to tractors with small loans; Lami Insurtech, an insurance platform for businesses.

Nigeria has Alajo, a female-focused personal finance platform; and SosoCare, a fintech company using recyclable garbage to finance health insurance for impoverished communities.

There’s also Cameroon’s Agrix Tech, agritech helping small farmers scale their businesses; Nkwa, a digital piggybank; and DanAid, a health insurance provider.

The final seven include Egypt’s Yalla Solutions, Senegal’s ProXalys, Rwanda’s Kayko, Zambia’s ComGrow, Uganda’s ChapChap Africa, Mali’s AFRICRED, and Luxemborg’s Servichain.

TC INSIGHTS: FUNDING TRACKER

This week MaxAB, an Egyptian B2B e-commerce company, received $40 million in pre-series B funding from Silver Lake, British International Investment (BII), and DisruptAD, ADQ’s Venture Platform. Existing Investors Beco Capital, 4DX Ventures, Flourish Ventures, and African Platform Capital also participated in the round.

Here are the other deals this week:

- Nigerian mobility startup Moove raised $16 million in debt financing from Emso Asset Management.

- Nigerian fintech Maplerad raised $6 million in a seed round led by VC firm Valar Ventures. Other participating investors include Golden Palm Investment, Fintech Fund, Armyn Capital, Dunbar Capital, Strawhat Investment, Polymath Capital, Unpopular Ventures, and MyAsiaVC.

- Nigerian social e-commerce company, Bumpa raised $4 million in a seed round led by Base10 partners with participation from Plug & Play Venture Commerce Fund, SHL Capital, Jedar Capital, Magic Fund, DFS lab, FirstCheck Africa Angel Program, E62 Ventures, Club 14 and Fast Forward Ventures.

- Egypt’s e-commerce company Kenzz received $3.5 million in seed funding. Outliers Venture Capital, HOF Capital, Foundations Ventures, Samurai Incubate, and some angel investors led the round.

That’s it for this week!

Follow us on Twitter, Instagram, and LinkedIn for more funding announcements. You can also visit DealFlow, our real-time funding tracker.

Protect your hard-earned money from inflation by saving in dollars on Pillow Fund.

Pillow is Nigeria’s #1 savings app that lets you save in dollars and earn 14% interest on it. Download the app, use TCPILLOW signup code to get ₦700 bonus on first deposit.

This is partner content.

EVENT: ECOBANK FINTECH BREAKFAST SERIES

The Ecobank Fintech Breakfast series is back!

On Friday, November 4, Ecobank will host the second edition of the Fintech Breakfast Series. If you missed the first edition, you can catch up here.

This edition’s theme is “Strengthening the ecosystem”. We’ll be focusing on two key areas:

- The role of good corporate governance in the fintech industry

- What fintechs need to know about securing investments.

At this event, startups will learn best practices with regard to corporate governance and will be able to glean relevant lessons from banks. They will also be able to share their challenges with securing investments and learn effective approaches to fundraising.

Register here to join the conversation. This link signs you up for virtual attendance.

If you have any questions on navigating fundraising and corporate governance as a fintech, you can send us your questions here.

This event is brought to you by Ecobank Nigeria in partnership with TechCabal.

IN OTHER NEWS FROM TECHCABAL

This Digital Nomads guest shares her silver lining in the Russo-Ukrainian war: leaving medicine in Ukraine to study journalism in Canada.

MoneyHash expands operations into sub-Saharan Africa to help large companies solve payment collection.

Primedia purchases virtual land in Africarare’s Ubuntuland metaverse.

QoreID offers a new way to carry out verifications using digital identity solutions customised to meet your KYC and compliance needs. The company offers a robust digital identity infrastructure that includes last-mile verifications, consumer insights, fraud prevention engine/tools, financial data analytics, instant identity verification, and much more. Learn more at QoreID.com

This is partner content.

JOB OPPORTUNITIES

- Big Cabal Media – Editor-in-Chief, Citizen – Lagos, Nigeria (Hybrid)

- Big Cabal Media – Community Manager, Zikoko Memes – Lagos, Nigeria (Hybrid)

- Big Cabal Media – Content Creator, Zikoko Memes – Lagos, Nigeria (Hybrid)

- Big Cabal Media – Learning & Development Executive – Lagos, Nigeria (Hybrid)

- TechCabal – News Editor – Africa

There are more jobs on TechCabal’s job board. If you have job opportunities to share, submit them at bit.ly/tcxjobs.

What else is happening in tech?

- Nigerians can now buy directly from Chinese stores as GIG Logistics expands to China.

- Soccer legend Lionel Messi plans to get into tech investing via a new Silicon Valley holding company.

- Amazon is quietly shutting down Fabric.com, one of the largest online fabric stores.

- YouTube Premium’s family plan just went up by $5.