The million-dollar question in the African tech ecosystem is whether the fintech giant, Flutterwave, will move ahead with its plans to float an initial public offering (IPO) this year. Flutterwave has long been one of the shining lights of the African startup space. But a combination of a bearish public market and a series of scandals means that an IPO no longer feels like a surefire thing. Will Flutterwave move ahead with its IPO plans this year?

Since its launch, the fintech giant has raised over $450 million from VC funds. At its last raise, investors valued the company at over $3 billion, on the back of a $100 million in annualised revenue in 2021. With Flutterwave’s continued growth considered a sure-banker, an IPO for the company will allow early investors to earn handsome returns on their investment. It will also help the company raise even more money while giving the public an opportunity to own a part of the company.

Towards IPO readiness

A Flutterwave employee told TechCabal that “there are a few mentions of the IPO across the company”, and that the general sentiment is that an “IPO is inevitable”. The company’s communications team reaffirmed this in an email to TechCabal. The company said it is moving forward with plans for IPO readiness. Part of the email sent to TechCabal reads: “The timing of an IPO is a function of a number of factors, including but not limited to, market conditions.”

There have been a few indicators that the company is preparing to go public. First, the calibre of investors that participated in its $250 million Series D in February 2022 suggested that the investment was a road-to-IPO round. While existing investors doubled or tripled down their commitment, there were new investors like Whale Rock Capital that could be classified as crossover investors. Crossover investors often buy a significant stake in growing businesses before they IPO. Whale Rock is a hedge fund firm and largely deals in the public market and invests in growth-stage private companies with potential to go public. Flutterwave also added more high-profile executives to its team, including Oneal Bhambani, who joined Flutterwave as chief financial officer (CFO) from American Express (AMEX), where he’d served as vice president.

All will, no way

While these are clear IPO moves from the fintech company, the state of the public market isn’t encouraging new listings. 2022 was the year of reckoning as the global stock market sank to a record low. In the US, where Flutterwave is registered and plans to go public, only 181 IPOs were recorded in 2022. This was 82.5% lower than the 1,035 IPOs in 2021, which was an all-time high record. Data from Renaissance Capital shows that there were 71 IPOs that raised $7.7 billion in 2021, the lowest in more than three decades.

The public market is a no-go area, regardless of Flutterwave’s readiness. This might remain so for a long time. During an interview last December, Elon Musk, predicted that the present market storm would last for another 18 months. If Elon Musk is right, what will it mean for Africa’s biggest startup? And without going to the public market, will the company look to raise money from its existing investors?

Flutterwave is confident of maintaining its $3 billion valuation if it goes public. The company told TechCabal that due to its continual show of positive growth metrics since its last funding rounds, they “believe public market investors will value the company’s growth, market leading position, and marquee customer base at a premium to our private funding valuations”. But this was the public market of pre-2022 not the harsh one we have now. Additionally, in a case where an IPO is not an option, the company said its “strong balance sheet allows for the flexibility to fund operations through existing cash or through private capital.” This is an indication that the company is not ruling out the option to raise money if IPO doesn’t fall through.

Could this mean an inevitable private downround?

A US-based investment banker who spoke to TechCabal agreed that going public is not a wise option for any startup at the moment. He said Flutterwave will have to either cut costs to extend its runway or raise another private funding to continue running its heavy global operations, “but this time a downround that will bring its valuation down to what it’s truly worth”. This sounds like a familiar song as lots of valuable startups have done and continue to do that as the macroeconomics became harsher. For instance, Stripe, the American fintech giant that was valued in a 2021 financing at $95 billion, lowered its internal valuation in 2022 to $74 billion due to market conditions, despite processing $640 billion payments volume in 2021, up 60% from the prior year, and a $12 billion in revenue in 2021. The New York Times reported on Monday that the company is in talks to raise another downround of $2.5 billion at a valuation of $55–$60 billion instead of going public. Flutterwave’s fellow African unicorn, Chipper Cash, raised a downround that cut its valuation from $2 billion to $1.5 billion in 2022.

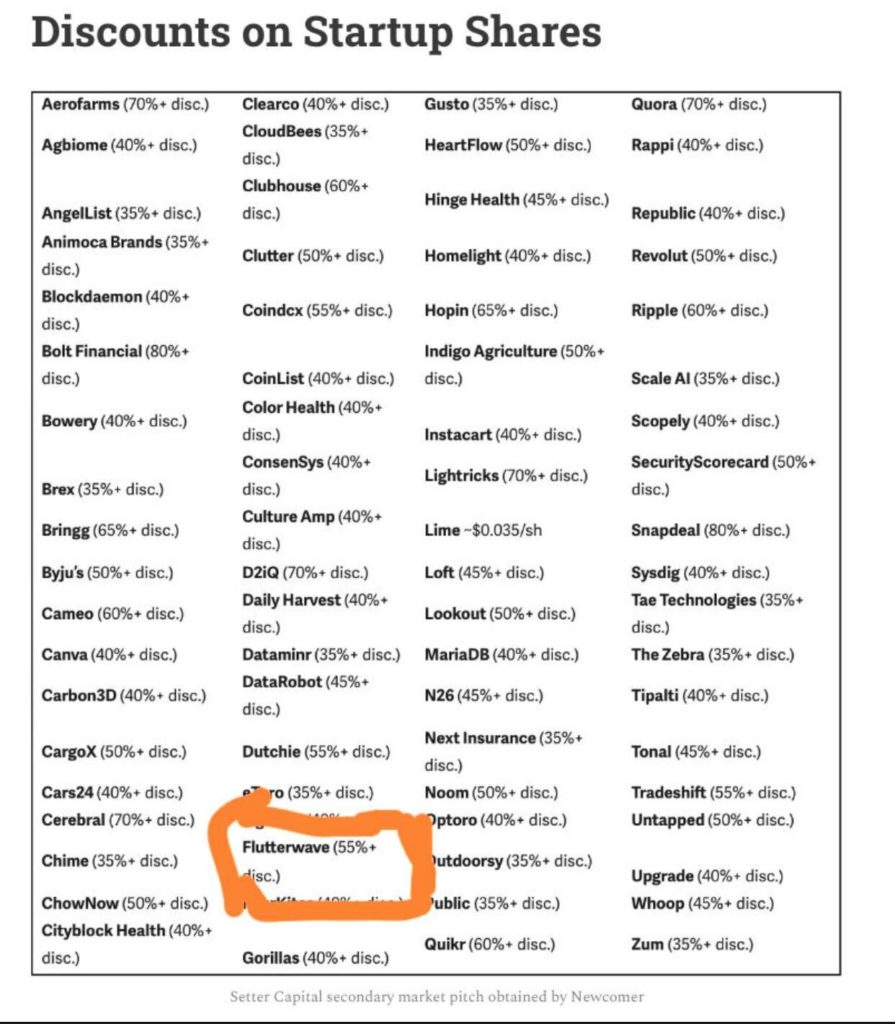

This means that if Stripe, a company ranked as second hottest pre-IPO venture-backed company after SpaceX, would rather raise and cut its valuation to extend its lifeline than risk going public, Flutterwave might have to also reassess its valuation in preparation to raise a downround. Interestingly, the company’s secondary market standing might be a reflection of its actual value and likely make a strong case for imminent downround. Setter Capital, a Canadian secondary market advisory firm, says Flutterwave’s shares are selling at a 55%+ discounted price. This means Flutterwave’s share is selling at less than $1.5 billion valuation in the secondary market, representing a cut of more than half of its over $3 billion valuation. Secondary market is a way for stakeholders like founders, employees, and investors of private companies to liquidate stock in order to gain access to cash in the near term.

“We are not aware of any shares for sale in the secondary market,” Flutterwave told TechCabal via an email. TechCabal has reached out to Setter Capital to understand its methodology, but the Canadian firm hasn’t responded at the time of publication. However, according to an investor who is familiar with Setter’s work, “I know for a fact they dig into data rooms—it’s based on fundamental analysis. They look at performance multiples, public markets, prospects and investor demand slash appetite.”

But if Flutterwave wants to stick to its $3 billion valuation, there is also an option to raise an outright debt or a convertible note, a funding tool that works like a short-term loan that is repaid to investors in equity—typically at a discount. Convertible notes also can benefit the company in the sense of providing upfront cash without having any initial dilution. An example of this is American cybersecurity company, Arctic Wolf, that raised a $401 million in convertible notes, led by an existing investor, after the unfavourable state of the market deterred its plan to IPO. The company was said to be IPO-bound after raising $150 million in a Series F in July 2021, taking its valuation from $1.3 billion to $4.3 billion.

Besides all these discouraging factors, there’s also a precedent of African companies not performing well in the public market. For instance, since March 2021, barely three months after it went public via a special purpose acquisition company (SPAC) with Queen’s Gambit Growth Capital, the market cap of Egyptian Svwl has decreased from $33.58 billion to $437.80 million, a decrease of -98.70%—with a compound annual growth rate of -90.17%. Similarly, since April 12, 2019, Jumia Technologies AG’s market cap has decreased from $2.54 billion to $407.49 million, a decrease of -83.98%—with a compound annual growth rate of -38.19%. Both Swvl and Jumia are running out of the stock market grace but are continually being saved by a tiny cent.

We don’t know how strong Flutterwave’s balance sheet is to understand if it will be enough to fund a 300+ global workforce for another 18 months. But following the company’s fundraising pattern—$35 million in January 2020, $170 million in March 2021, and $250 million in 2022—it’s evident that Flutterwave will need to raise within this period. “If not debt, I’m almost certain a private downround is the company’s best option,” an Africa-focused venture capital leader told TechCabal. “A downround that halves their current valuation ahead of IPO will be healthy. It will help IPO performance and manage private and public investors’ confidence.”