In 2017 there were 32 financial technology companies in Egypt—including but not limited to payments providers. By 2022, the number of technology companies that offered fintech services had increased five-fold to 177. A new report published by the Central Bank of Egypt sheds light on what has influenced this growth.

The FinTech & Innovation Department of the Central Bank of Egypt attributes the growth of financial technology companies to “rising demand for FinTech & FinTech-enabled solutions” in Egypt. This demand and the natural attention venture investors pay to fintech helped add 151 fintech firms to the country’s fintech market map.

According to the report, 95% of Egyptian fintechs (168) are headquartered in Egypt as opposed to the model where firms receiving foreign investment incorporate in Delaware or similar jurisdiction. These firms are concentrated in Cairo and Giza.

The report highlighted how Egypt’s strong regional relationships with Gulf countries shape much of its fintech landscape. 94% of Egyptian fintech operators also have offices in the United Arab Emirates (58%) and Saudi Arabia (36%). 11% and 7% of Egyptian fintechs also operate in Bahrain and Oman respectively, with Jordan and Pakistan also a favoured destination for Egyptian fintech operators.

Egypt’s fintech firms are expanding Gulfwards in part because they have significant customers in those markets. Roughly 30 Egyptian fintechs serve customers in the UAE, Saudi Arabia and surprisingly, Nigeria.

Venture investment: local “bank” capital steps up

Egypt is not much different from its continental ecosystem peers in the sense that fintech firms receive the bulk of technology startup investments made into Egyptian tech companies. “Venture Capital & Angel Investments represent a great share of overall FinTech investments in Egypt, with an average of 65% across the last 3 years,” note report authors. But in 2022 private equity inexplicably surpassed venture capital firms and angel activity, representing 55% of overall fintech investments into Egypt. The report offers no further insight into this curious activity. A separate report—the 2023 Egypt country spotlight by the African Private Capital Association (AVCA) may shed some light on this peculiarity.

According to 2023 AVCA Country Spotlight: Egypt, private equity funds invested $877 million in Egyptian firms in 2022 across 76 deals, in what the report described as “a double the historical record.” Even as venture capital investment reached record highs. Most important for our purposes, the report pointed out that “Financials was the most active sector by volume (26%) and attracted the largest share of deal value (23%).” It is reasonable to expect that this referred to the financial sector and included fintech firm investment.

Egypt has also fared better in terms of recorded investment inflow to startups this year. Per Africa: the Big Deal data, it was the only African country in the last six months to maintain a streak of raising above $500 million by the end of the half-year.

Women are the beneficiaries of 80% of remittances sent to Egypt… The government wants more of those precious foreign currencies to come through formal channels, so the central bank launched a pilot program to digitise remittances

Despite a 25% decline in funding received by Egyptian startups, the country swapped places with Nigeria whose startups received 77% less than they received in the first half of 2022. Egyptian startups raised $540 million no doubt bolstered by MNT Halan’s mega $400 million mix of equity and debt round.

Government reforms

One theme in discussing Egypt is the impressive startup support system the country built in the form of accelerators and incubator programs. Egyptian tech companies are some of the most accelerated tech startups in Africa. Per Disrupt Africa’s 2021 report. 40% of Egyptian startups have participated in an accelerator or incubation program. In more recent times, fintechs, in particular, have enjoyed a government tailwind—an acceleration of sorts—that has followed the government’s resolve to support digital payments as part of initiatives to formalise the economy.

“In today’s Egypt, the informal economy constitutes up to 50 percent of the country’s GDP,” writes Mohammed Soliman for the Columbia Journal of International Affairs. Mohammed Soliman is the director of the Strategic Technologies and Cyber Security Program at the Middle East Institute. PwC Middle East cited estimates that put the country’s informal sector at 40% of GDP. PwC also points out that 85% of small and medium-sized enterprises in the country are thought to be informal. To capture more of these segments in national economic planning—and revenue, of course, the Egyptian government has pursued reforms that simplify the onboarding of Egypt’s informal workers to financial services platforms.

Women are the beneficiaries of 80% of remittances sent to Egypt. Remittances are a big deal for Egypt which is currently struggling with a foreign currency shortage. A significant portion of remittances are sent through informal Hawala channels. The government wants more of those precious foreign currencies to come through formal channels, so the central bank launched a pilot program to digitise remittances and provide beneficiaries (8 out of 10 of whom are women) “with incentives to encourage them to use banking products (accounts, prepaid cards, mobile wallets).”

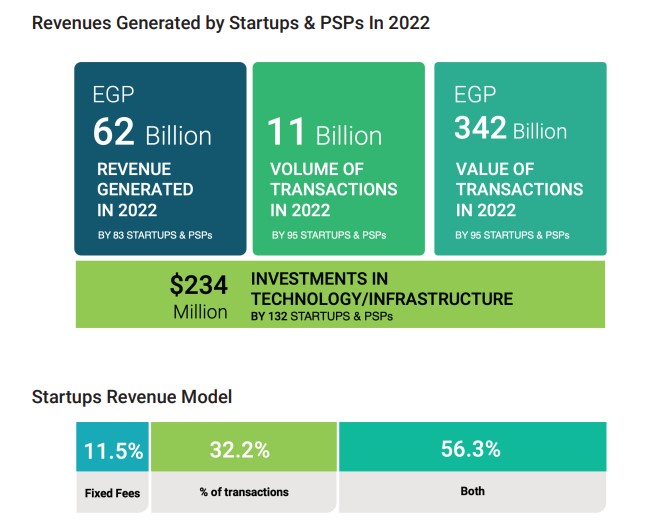

That government tailwind has been helpful. In particular, it helped Egyptian fintechs and payment providers drive 11 billion digital transactions worth an estimated 342 billion Egyptian pounds (about $18 billion using 2022 average exchange rates provided by ExchangeRatesUK.com). On those volumes, Egypt’s fintechs generated revenues of 62 billion Egyptian Pounds or $3.3 billion (see exchange rate explanation above). Egypt’s new payment network, InstantPay has processed 112.7 billion Egyptian Pounds in transactions from launch in March 2023 to March 2023 and has a registered user base of 2.1 million.

But the regulatory tailwind has not completely done away with the speed bumps fintechs face. Suggesting that the government might need to move faster.

Growing bank-to-fintech ecosystem

Egypt is one of the most active startup M&A markets in Africa. The report shows that more than half of Egyptian startups (58%) were partners with another fintech. Note that fintech is used broadly and covers several types of financial technology companies including companies that focus on data analysis, AI and insuretechs. That said, the report also points out that the culture of partnerships extends beyond fintech firms working together. Partnerships between banks and other key stakeholders in Egypt’s financial services industry are also common. A significant point to note is that Egyptian banks are deepening their partnerships with fintechs with investments in the same. At first, they invested directly, but now they are acting as LPs instead.

In 2022, Egypt’s largest national banks: Banque Misr, National Bank of Egypt, and Banque du Caire partnered with Global Ventures, a venture capital firm to create a new fintech fund. The Nclude FinTech Fund, with $150 million as its target has already invested in 8 startups.

“On average, each startup has more than 2 partnership agreements with banks or financial institutions to enable their solution in the market,” the report authors note. 115 fintechs or 65% work with banks in some way and there were 317 partnership conversations ongoing as of the time of the report survey.

The report underscores the progress of Egypt’s regulators more than anything else but it also leaves room for questions about how deep the reforms and bank partnerships could go beyond an obvious focus on payments.

In the meantime, here’s the full report for your reading pleasure.