Kenya’s economic situation is dire, with unsustainable borrowing, soaring debt servicing costs, and limited revenue generation. IMF keeps approving loans despite the country’s escalating debt, leading to widespread criticism, protests, and loss of faith in the government.

Like many other African countries, Kenya is dealing with a challenging economic landscape and dwindling revenues following a global economic downturn and rising inflation. The country’s borrowing has increased even as it struggles to raise revenue. The government struggles to pay salaries as citizens protest increased living costs. As part of efforts to dig itself out of a fiscal hole, the International Monetary Fund (IMF) recently approved the disbursement of a $1 billion loan to Kenya. This loan is intended to support the nation’s efforts in addressing the ongoing economic crisis and the country’s efforts in fighting climate change.

Kenya’s external debt has increased significantly, from $10.2 billion to $34.8 billion between 2013 and 2020. Such a notable jump in debt has caught the attention of the IMF, leading to criticism over the lender’s approval of extra loans to the Kenyan government. Many have questioned the rationale of providing more financial assistance to a country already struggling with growing debt, leading to protests from its opposition and raising doubts about the government’s ability to manage its financial obligations.

After noting the seriousness of Kenya’s debt, the IMF has recommended measures to the issues. These measures include cutting tax leakage and subsidies to decrease the country’s fiscal deficit, advocating for debt reduction, and encouraging the government to fund its budget internally. However, many Kenyans remain skeptical about the purpose and impact of these loans because of the country’s struggles to meet its debt obligations.

In defense of the IMF loans, the Kenyan government asserts that financial assistance is key to bridging the gap between the budget and the funds available, thus supporting essential government projects and, in the end, alleviating the burden on citizens. This argument has not addressed all concerns, mainly as some argue that the IMF’s involvement has increased taxes for ordinary citizens, leading to perceptions of reduced income due to high taxation laws.

While pursuing enhanced revenue mobilisation makes sense in achieving long-term economic stability, implementing such measures amid harsh economic conditions has proven challenging. This has led to growing dissatisfaction among Kenyans towards the IMF and the government’s ability to cushion them from the harsh economic realities.

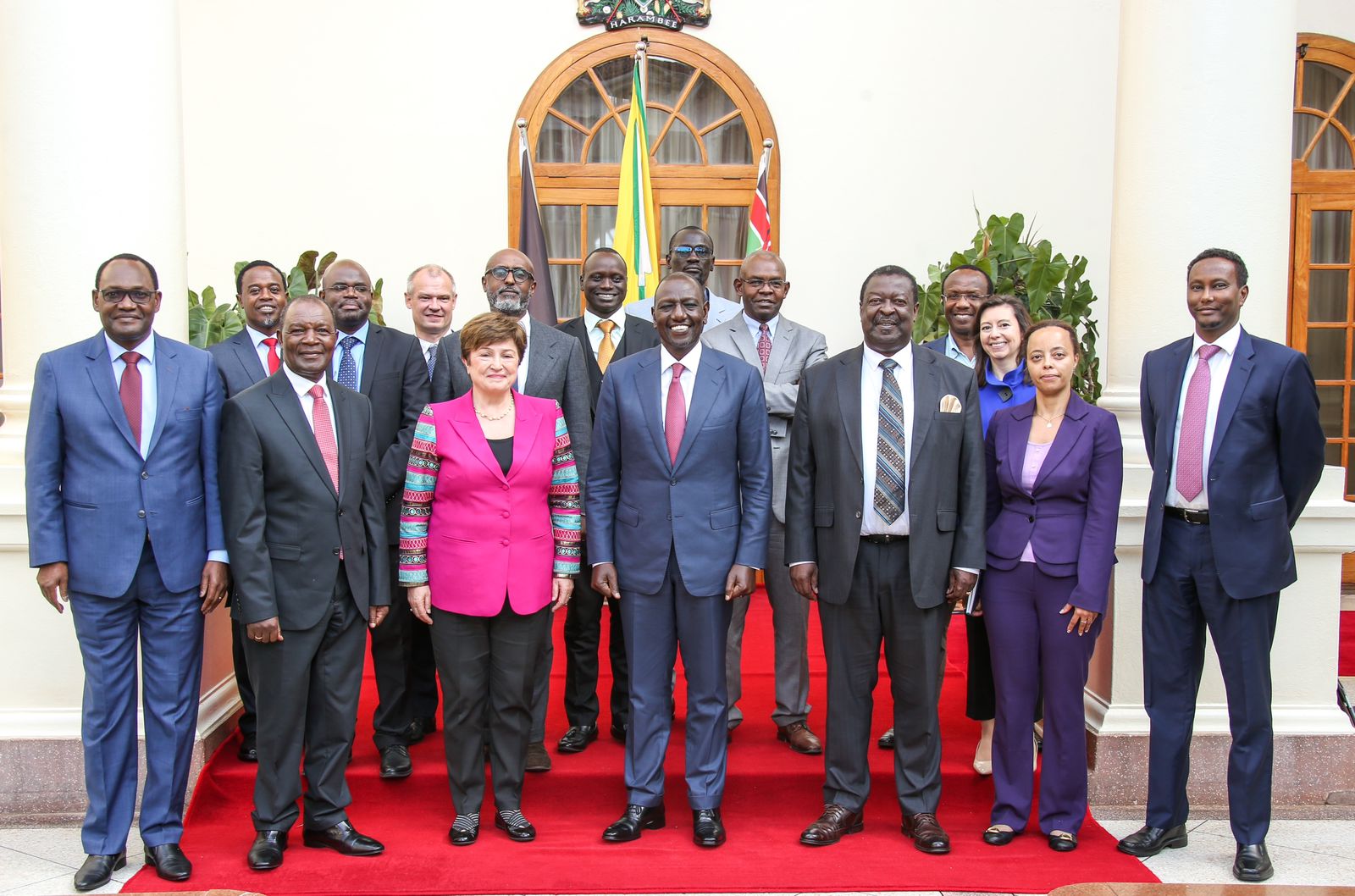

President William Ruto and his Kenya Kwanza team had promised to be cautious about international loans. But they have veered sharply off course, borrowing KES 1.2 trillion in the past eight months. This debt accumulation further burdens the citizens because they will likely foot the cost of the loans.

The situation has placed Kenya in a difficult position. Amid the debt crisis, Kenya finds itself in a situation where IMF loans are necessary to fund critical programmes, as the country’s internal revenue is insufficient to meet its financial obligations. While the IMF’s involvement and the stringent conditions attached to the loans are targeting to promote a more economically sustainable climate, they also raise concerns about the potential worsening of the debt crisis in the short term. Kenya is facing economic challenges that have necessitated the approval of IMF loans to provide vital financial support. Although these loans have faced criticism and sparked protests, they are essential to addressing the fiscal gap and supporting the country’s economic initiatives.