Investors baulked after Jumia’s Q2 results showed the company lost 1 million active customers despite reporting its lowest loss in four years.

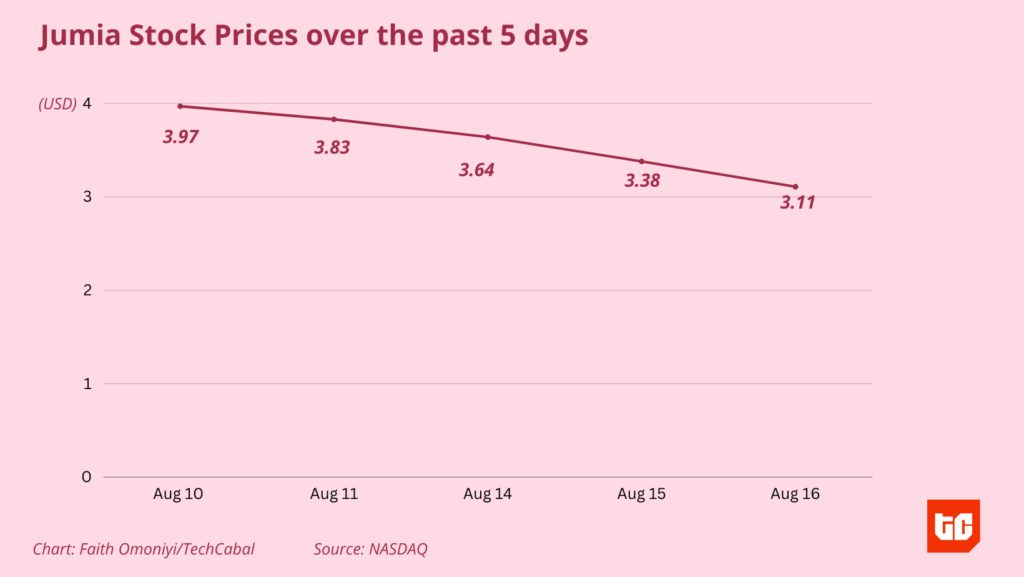

After Jumia shared its financial results for the second quarter of 2023, investors reacted negatively, causing its shares to close at a 17% low on Tuesday. Jumia reported a 15% decline in revenue, with other metrics also declining. Gross Merchandise Value (GMV), number of orders and active customers declined compared to Q2 2022. Jumia also lost 1 million active customers between Q2 2022 and Q2 2023.

One big positive in Jumia’s report was that it reduced its losses to the lowest in four years. Reducing its losses is significant if the company becomes profitable. Yet there are many other worries. Its lower operational losses came from a massive reduction in sales and advertising spend. A significant reduction in its workforce also reduced its General and administrative expenses. While lowering costs is one part of the lever, increasing revenue is the second, and this is where Jumia fell short in Q2.

Macroeconomic headwinds across many of its African markets have made business difficult. Inflation in key markets like Nigeria, Ghana and Egypt and currency devaluation continues to hinder growth; it contributed 14 basis points to the reduction in the company’s GMV. The biggest challenge remains the slow growth of these economies and the decline of the purchasing power of citizens. It remains to be seen if Jumia can be profitable despite the economic terrain.

One thing is clear: Jumia is throwing the kitchen sink at it in search of revenue growth. It has done an about-face on its strategy of focusing on groceries and everyday items. Jumia also insinuated that the theory that selling groceries and everyday items would improve stickiness may not be accurate. “We continue to recalibrate our product and service portfolio, moving away from the most profitable categories with limited consumer lifetime value,” said the company’s CEO, Francis Dufay.

Critically, one effect of reduced consumer purchasing power is that people cut down on non-essentials or switch to cheaper alternatives. Even if Jumia offers groceries, it may not have the more affordable alternatives many customers can find offline.

Jumia is betting on JumiaPay, citing “strong development potential to process payments on behalf of third-party merchants.” Dufay added, “In line with our objective of making JumiaPay an even more effective e-commerce enabler, we are significantly increasing the penetration of JumiaPay in both our physical goods and food delivery platforms.”