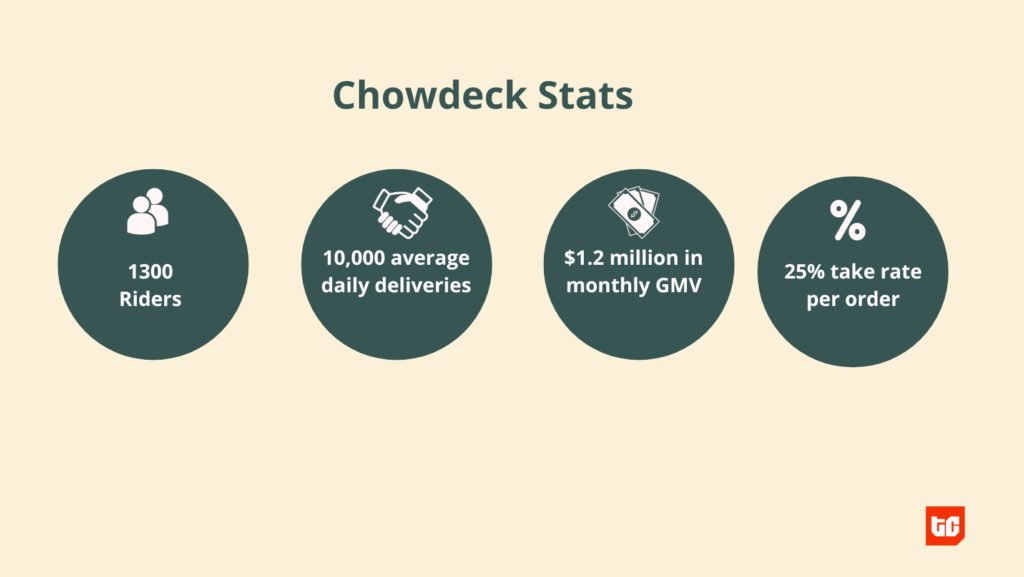

Chowdeck, the Y Combinator-backed Nigerian food delivery startup launched in October 2021, says it has crossed ₦1 billion ($1.2 million) in monthly gross merchandise value (GMV). It marks a 10x growth spurt for a company that reportedly crossed ₦100 million monthly GMV ten months ago. ChowDeck’s CEO, Femi Aluko, told TechCabal that the startup had over 60,000 active users in October, up from 7,000 in January. The company also says it makes a profit from each delivery with more than a “25% take rate per order.”

“Our strength is building products; we execute and grow fast,” Aluko explained. “Even though we’re not the cheapest food delivery service in the country, we are the most efficient.”

Key Takeaways

- Chowdeck has crossed ₦1 billion ($1.2 million) in monthly gross merchandise value (GMV) with over 25% take rate on each order.

- The startup has 1,300 riders across four Nigerian cities who earn an average of $70 weekly.

- It has 300,000 users and an average of 60,000 active users monthly.

He claims that Chowdeck’s growth in October was organic and that the company did not run any marketing campaigns in October to boost its numbers. Instead, it focused on adding new features and applying learnings from Y Combinator, the San Francisco-based accelerator program that has backed dozens of successful startups. ChowDeck has also expanded to three cities, namely Port Harcourt, Ibadan, and Abuja, since January. The startup claims it has over 1,300 riders, making an average of 10,000 daily deliveries across the four cities.

Spurred by the effects of COVID-19, Africa’s food delivery industry has taken off as more vendors and consumers embrace the convenience of digital takeouts to serve customers in major cities like Lagos. The industry is expected to grow 18% annually over the next few years and will cross $7.45 billion in revenue this year, according to Statista.

In Nigeria, Africa’s most populous country, eating at restaurants and other food vendors is a big part of the local culture, with Nigerian households spending 20% of their income on food cooked outside their homes. Noticing this trend, Y Combinator recently backed at least eight food delivery startups in Africa since 2021.

Navigating the fuel subsidy removal

Chowdeck’s feat comes as Nigeria’s economy continues to struggle after the removal of fuel subsidy in May significantly impacted transportation costs, including for mobility businesses across the country. Inflation has also grown unabatedly monthly, with food inflation rising to 30.6% last month as the biggest driver.

Despite the rising operating costs, Nigeria’s online food delivery market is highly contested, with several international companies, such as Glovo, Jumia, and Bolt, competing to own a larger chunk of the market against startups like EdenLife, FoodCourt, and Chowdeck.

ChowDeck’s Aluko described the month of May as one of the company’s toughest periods. As costs jumped, the startup had to increase delivery prices by 50%, becoming the first food delivery company to do so following the subsidy removal.

“No matter how good or bad the economy is, we won’t build our company or product on bad unit economics or subsidise prices based on VC funding,” Aluko said, referring to the popular venture-building model of the last decade that helped create multiple billion-dollar companies that have since struggled to break even as sustainable businesses.

He added that Chowdeck decided not to compete on pricing. Instead, the company is focused on improving its product and increasing the weekly earnings for riders based on the number of food orders they complete. “Chowdeck riders are the best-paid in the delivery space today; we know we can’t afford to have riders that are disgruntled or don’t earn a lot of money.”

Hiring agents to validate orders

One strategy that Chowdeck has used is to hire agents who validate orders for riders at the busiest restaurants. For these busy restaurants, the agents manually verify if a customer’s order is in stock and ensure that an order is canceled if the restaurant does not have the order. Aluko told TechCabal that the startup only hires agents for the top 20 restaurants out of the thousand on its platform and only when “the demand has grown more than the supply at these restaurants.” “At that point, they’re doing enough orders for us to cover the cost of hiring agents and still make us profitable,” Aluko said.

Getting riders to be effective

When Chowdeck entered the food delivery scene, it faced stiff competition from incumbents. However, the company discovered that the average delivery time for its competitors was longer than 30 minutes. Chowdeck set out to differentiate itself in the market with a shorter turnaround time for delivery. Aluko explained that he devised a model for faster deliveries after a trip to Dubai.

At the time, the model relied heavily on more compliant and reliable delivery riders, two attributes the average Nigerian dispatch rider tends to lack. Chowdeck’s management team piloted the model by fulfilling food delivery orders themselves. This helped them understand the challenges, they said. They developed rider incentives like providing housing support and offering promotion opportunities to high-performing riders to join Chowdeck’s operations team. Aluko added that Chowdeck discouraged cash on delivery for newly recruited dispatch riders because this caused accountability problems. Rewarding good behaviour has helped onboard more drivers as Chowdeck scaled across Nigeria, the company shared.

Editor’s note: The exchange rate used in this article is $1 = ₦788.33