First published 26 November 2023

I’m wondering what is changing about how VCs, founders and startup stakeholders (employees and consultants alike) think about how to operate in Africa. No plaititudes. No cached sentences.

Most of the money that goes into venture capital investments in African startups comes from sources outside Africa. If anything is happening to those investors, it affects the capital African companies get. Especially as the continent’s local pool of private and public capital remains severely stunted. Thus, if there is a reset in the practices of firms that channel money into African startups either as venture capitalists (VCs) or as limited partners (LPs), the effect will trickle down to the continent. It’s a no-brainer.

And things are happening. “Fifty-six percent of European VCs haven’t returned capital to their LPs in the last 12 months,” Amy Lewin of Sifted reported almost two weeks ago. In the United States, the story is similar: “Pressure from LPs is poised to intensify while funding for VC firms remains in the pits,” The Information’s Kate Clark wrote recently.

The meaning of this is simple. Investors of all stripes evaluate macro-risk (the overall state of the economy) when they choose to make investments. Africa’s overall economic landscape is challenging enough as it is. However, the deteriorating state of major and mid-size economies outside of Africa is an additional but second-hand macro-risk which investors have to pre-consider before even allocating capital to opportunities in Africa.

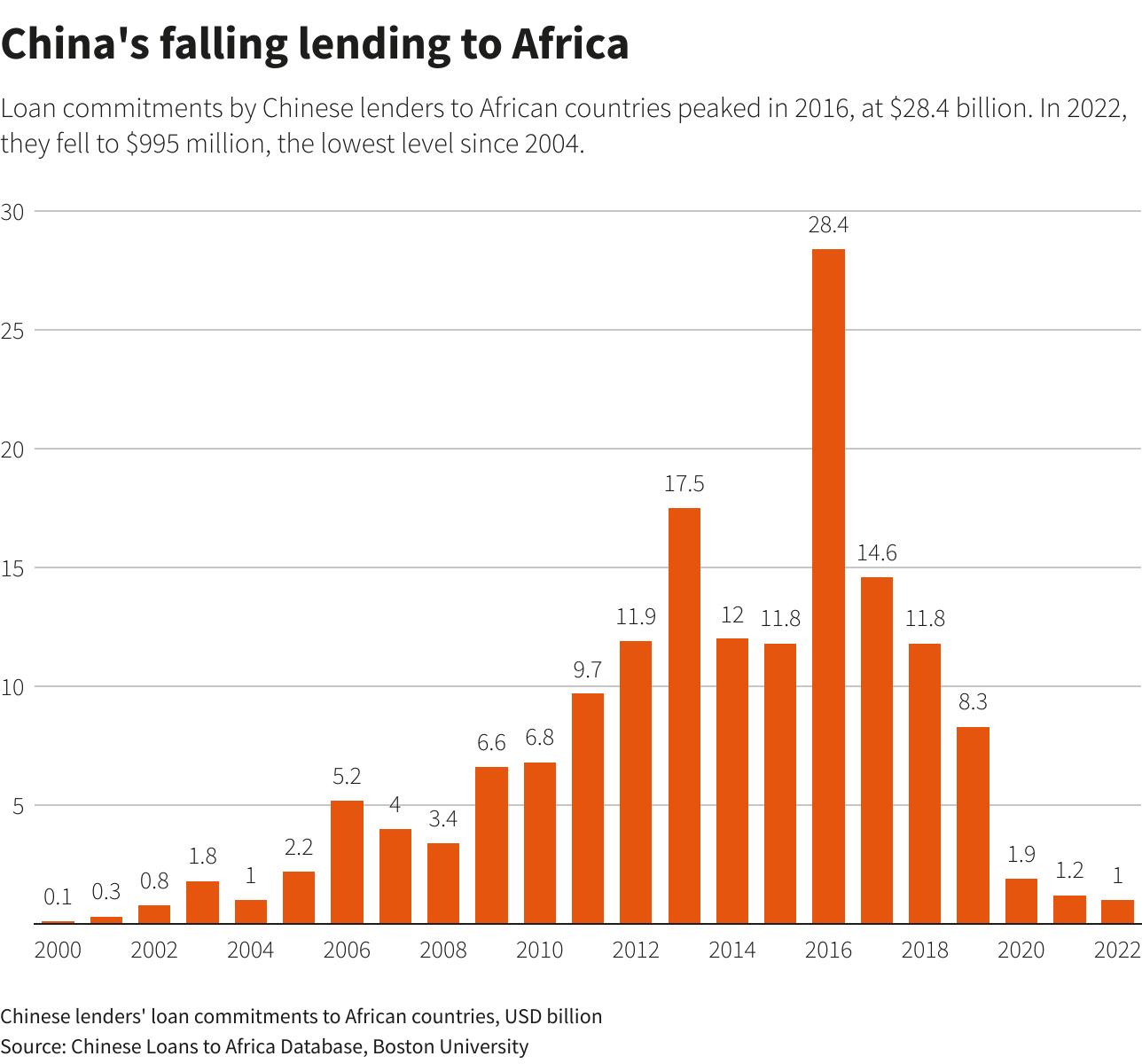

By the way, this is not only affecting venture capital or tech. Take China for example. The Asian giant and second-largest economy in the world has seen a steep crash in the amount of foreign investment that it receives. The real estate sector is under immense pressure and local banks are vulnerable—a consequence of years of poor risk management and assumptions. On the other side of the coin, official loans from the Chinese government to African countries have dropped by more than 87% from their peak in 2016. Globally, China’s Belt and Road Initiative is losing steam. And this is despite an expansion in the BRICS+ group of countries.

This is just one oversimplified example of how the macro-risk Africa faces is not only African. Today, the macro-risk calculus is first a discount of the tradeoffs between American, European and Asian risk, even before African risk is modelled.

Africa’s n-body problem

In classical physics, the n-body problem is the problem of predicting the effect the gravitation fields of individual celestial objects like moons, stars and planets have on each other as they move in orbit. Understanding the n-body problem helps astronomers understand how the earth-sun-moon system works. In general, it’s a useful mental model to think about how complex bodies affect each other.

One important characteristic of this physics phenomenon is that it is a problem that cannot be solved by analysis because it is constantly changing. The world of business is the same. The factors, especially in this day and age, are constantly in motion.

Africa’s n-body problem is something that investors have dealt with for a long time without recognising it as such. It is the complex interplay between a low-depth private and public capital market, capital from foreign partners or development agencies with missions that are not always aligned, and a base of startups or deal-flow that are often created to follow trending narratives rather than create outlier value.

All the above sit on precarious economic situationships that are themselves another type of an n-body problem. The first part of this essay discusses how the economics of Africa are further complicated by dependence on global economics. But in late 2020, and up to the first few months of the third quarter of 2022, Africa’s investors seemed to have found stability in the quick pace of markups and flowing cash. That stability is long gone today, but I see little sense of urgency to get ahead of the curve. I am yet to find attempts to define and find another centre of gravity. Everyone seems to hope that with the turn of New Year’s Eve, things will begin to get better, i.e. return to 2021. But that is a mistake.

Article continues after this ad

“It is not necessary to change. [Only because] survival is not mandatory”

If seed-stage investors and founders created wealth and returned capital because big funds from the US and Europe bought a stake in their companies, how would they create wealth or return capital today when the big money is in retreat? If LPs are punishing VCs who mindlessly played the pass-the-burnt-potatoes game in 2021, what lessons are the investors learning? If we played the power law to its breaking point, where do we start to pick up the pieces? And lastly, as Dan Gray of Equidam asks, “If there’s an impending cull of early-stage VCs, which group will survive? The actual performers, or the best networked?”

Last week, I wrote: “If the venture capital story is not working then maybe investors in Africa need to create something new. If however the philosophies that underpin venture capital are intrinsically undamaged, then we ought to look elsewhere to find the mismatch in expectations.”

“Things change and evolve,” Morgan Housel, founder of Collab Fund, wrote last week, “so the phrase ‘this is how we’ve always done it’ should be replaced with ‘what do we need right now?’ A full reset, unburdened by the past.” (Emphasis mine). In other words, the environment has changed too much to pursue previous assumptions as infallible.

If you are a founder, investor or even tech employee, what infallible assumptions are you ditching? What part of the n-body problem are you leaning on to find stability? I have seen a lot of schadenfreude from the few investors who may have escaped being burnt badly. But even they make the mistake of assuming things will return to the way they were before. Spoiler alert. They won’t.

Abraham Augustine,

Senior Reporter, TechCabal.

Feel free to email abraham[at]bigcabal.com, with your thoughts about this edition of NextWave. Or just click reply to share your thoughts and feedback.

Partner Content:

NIGCOMSAT is open for business, leverages broadband service to launch edtech solution

We’d love to hear from you

Psst! Down here!

Thanks for reading today’s Next Wave. Please share. Or subscribe if someone shared it to you here for free to get fresh perspectives on the progress of digital innovation in Africa every Sunday.

As always feel free to email a reply or response to this essay. I enjoy reading those emails a lot.

TC Daily newsletter is out daily (Mon – Fri) brief of all the technology and business stories you need to know. Get it in your inbox each weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.