Good morning☀️

MultiChoice is leaving its users spoilt for choice with a new streaming app GOtv Stream, which launched in Kenya yesterday. The app will allow users to download or watch movies, sports shows and shows live on phones, tablets, and web platforms.

This launch comes hot on the heels of its recently reported triumph over Netflix. Weeks ago, we reported that MultiChoice’s other product ShowMax surpassed Netflix as the market leader. The year is coming to an end, but it looks like Multichoice is only getting started.

Naspers thinks Amazon will lose in South Africa

Naspers, owner of South African e-commerce platform Takealot, has broken its silence on the company’s brooding competition with e-commerce giant Amazon…and it sounds assured of victory.

Amazon has been in talks with South Africa’s regulators concerning its plans to launch in the country in 2024. It has begun fighting for Takealot’s market share by slashing the money it charges sellers on its platforms from R400 ($21.44) per month to only R1 ($0.054) per month. Despite this aggressive move by Amazon, the Takealot owner says that it is “untroubled” by the competition.

What cards does Takealot have up its sleeve? Anyone would be scared when a large global company like Amazon enters a country. Amazon is already throwing around a lot of money to gain both consumers and sellers to its side, but per Sunday Times, Naspers is prepared to make necessary investments in Takealot to maintain its position as the market leader. Naspers South Africa CEO Phuthi Mahanyele-Dabengwa thinks that winning over a market requires more than just deep pockets—it takes understanding the locals’ needs. Per MyBroadband, Mahanyele-Dabengwa said that Amazon has previously failed in certain markets because of the lack of local knowledge of businesses that are there. Naspers is betting on Takealot’s experience of doing business in the country to give them a competitive advantage.

The true winners: In this e-commerce face-off, the ultimate victor might just be the South African consumer. In pricing battles, both Takealot and Amazon will vie for their loyalty and wallets. It’s a win-win for shoppers and sellers alike.

Access payments with Moniepoint

Moniepoint has made it simple for your business to access payments while providing access to credit and other business tools. Open an account today here.

AstraZeneca to use AI to maintain 6 million trees in Kenya

Biopharmaceutical company AstraZeneca wants to plant up to six million trees across Kenya, and it’s going to use artificial intelligence to monitor them.

The reforestation project will cover more than 3,500 hectares of land. This follows the country’s recent announcement of a new nationwide holiday for tree planting.

ICYMI: As part of a plan to plant 15 million trees in 10 years, Kenya assigned 13 November as a public holiday for its residents. The East African country hopes that this will reverse the climate change which has been resulting in disasters like flooding. The tree planting will be monitored through an internet app, the Jaza Miti app, which has reportedly seen over two million registrations.

What will the AI technology do? It will monitor tree health, long-term survival and carbon sequestration. However, technology is not enough. Per ITNewsAfrica, over 5,000 local farmers and local community members will be engaged in AstraZeneca’s project. Aside from Kenya, AstraZeneca has also planted millions of trees in Ghana and Rwanda since the project began in 2021. The project has engaged 1,200 farmers across 23 communities. In Rwanda, 6,000 farming households are signed up for the project to grow a range of indigenous and fruit tree species.

Cell C remains insolvent

South African mobile operator Cell C is still grappling with insolvency, with liabilities towering almost three times higher than its assets. The latest report tells us that Cell C still has more debts than assets with a gap of R9.294 billion ($499.9 million).

Side bar: The full-year 2022 results come after the largest shareholder in Cell C, international telecom Blue Label, concluded a series of agreements with Cell C and its financial stakeholders to restructure and refinance the mobile operator. The agreements led to the settlement of debts at a discounted rate of 20 cents to the rand, aiming to ease Cell C’s hefty debt load.

After this move, Cell C’s immediate debts dropped from R17.691 billion ($950.87 million) to R10.732 billion ($576.83 million). However, non-current liabilities increased by R1.1 billion ($58.9 million) due to an increase in contract liabilities and other payables.

The company is still optimistic: Cell C is staying positive Despite losing many subscribers over the last two years (going from 17.2 million to 8.2 million). Per MyBroadband, its revenue for the year up to September 2023 is holding strong at R10.09 billion ($542 million), just a bit less than the R10.14 billion ($454 million) in 2022. Plus, the company is banking on a fresh start with a new management team, showing that it’s ready for the road ahead in the competitive mobile market.

Pay With Transfer support on the Paystack API

We made it possible for merchants to white label a Pay with Transfer option on their custom checkout experience. Learn more →

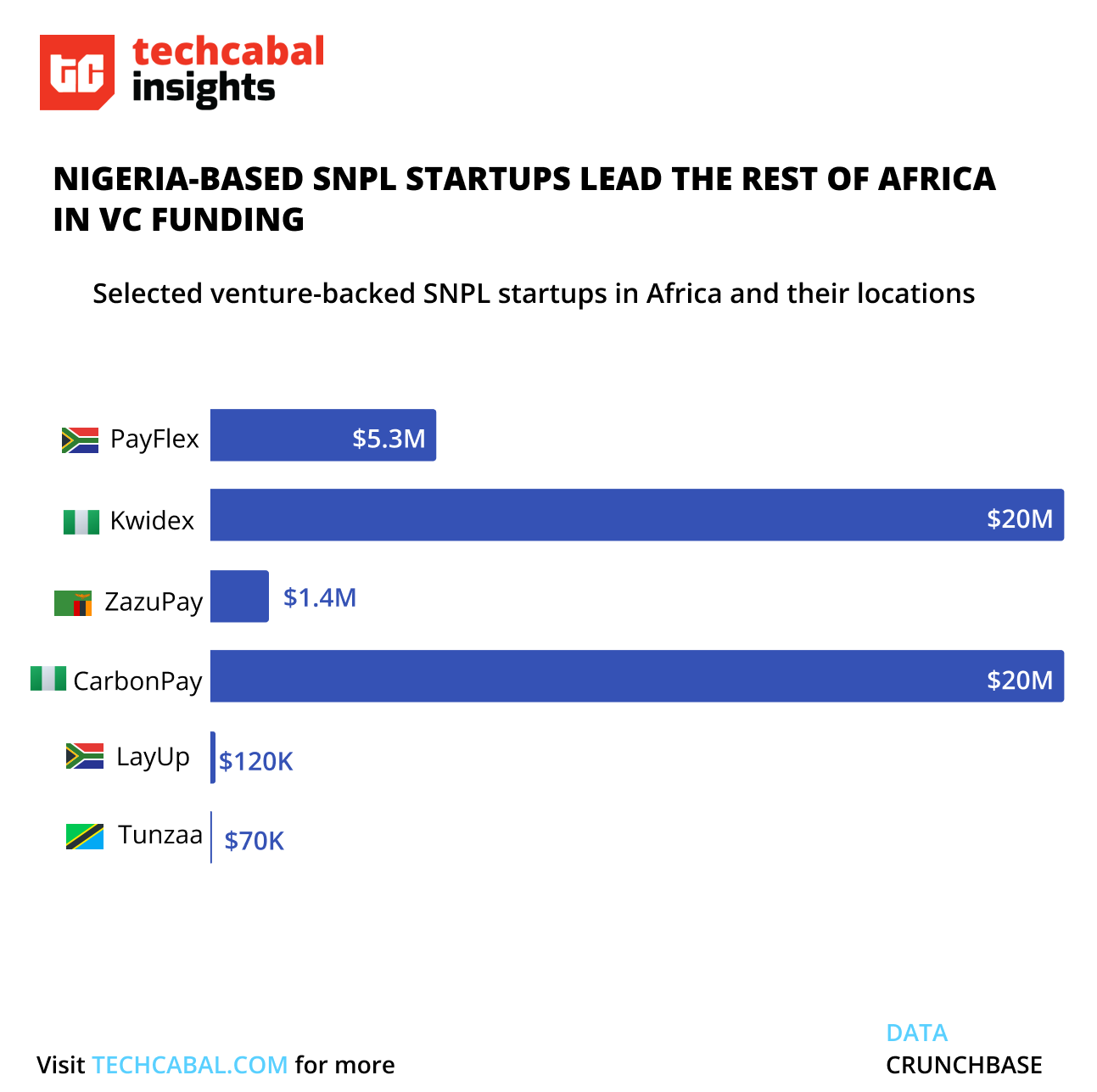

Can Africans save now, buy later?

Fintech is one of the vibrant sectors in Africa’s rising tech ecosystem. The sector received $1.45 billion in funding for 2022, a 39.3% increase from the previous year, 2021, and has seen massive acquisitions. According to an EY report, consumer lending accounts for 23% of fintech businesses, surpassing consumer payments which accounts for 17%. Consumer lending manifests across the continent through the buy now, pay later model (BNPL), giving customers instant access to products after necessary credit checks have been in made.

Despite the rapid adoption of the credit-driven BNPL on the continent, concerns exist about the sustainability of the model, as it could lead to overspending, high-interest rates, and debt traps for consumers. According to data from BVA Group, African financial consumer markets have a savings-first culture. Informal savings groups, known as “susu” in West Africa and “stokvels” in South Africa are a popular way to save money to make purchases. As a result, some fintech startups on the continent are digitizing this model as an alternative to the BNPL to embed savings into the online retail experience for consumers.

With the model’s success in India and other emerging markets, startups in Africa are doubling down by enabling users to save up for desired items in bits, get discounts and avoid debt.

While the SNBL sub-sector is nascent, it has the potential to grow, given the long history of installment savings schemes amongst Africans. In Kenya, more than 1 million people have used SNBL products to avoid high interest credit rates, according to a report by the Central Bank of Kenya. Also, in Nigeria, SNBL is gaining popularity as a payment option for household goods and appliances, according to a recent report by the International Finance Corporation.

Tobi Odukoya, the founder of CDcare, a Nigeria-based digital marketplace, believes SNBL is going to be the winning model in Africa, as he expects new players entering into the space. He believes that for most African markets, the value of BNPL doesn’t meet global expectations, which could make BNPL providers struggle to cover operational costs and service their debt.

However, the SNPL should not completely replace the BNPL model. Rather, it could help bridge the gap between cash and digital purchases, accommodate irregular income streams, align with cultural values around savings, and increase financial inclusion on the continent. Overall, the gradual momentum SNBL is gaining presents a significant market opportunity for existing fintech startups to incorporate or hybridize the model into their platforms to serve Africans better and drive economic growth.

UK Expansion with Traavu

Traavu enables tech businesses expand into the UK market by providing premium advisory and support to their founders, senior executives and teams to secure the Tier-1 UK Global Talent Visa (Tech Nation Visa) endorsement.

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $41,225 |

+ 0.57% |

+ 4.09% |

|

| $2,241 |

+ 0.88% |

+ 3.83% |

|

|

$0.36 |

+ 15.85% |

+ 2.75% |

|

| $16.02 |

+ 0.03% |

+ 0.78% |

* Data as of 06:18 AM WAT, December 3, 2023.

Effortlessly make global settlements in over 30 currencies across 120+ countries spanning four continents, delivering cost-effective and reliable solutions to your clients, suppliers, and customers. Get started today.

- TechCabal – Senior Reporters – Nigeria/Kenya/South Africa

- 9mobile Nigeria – Videographer – Lagos, Nigeria

- White Light Digital Marketing – Social Media Manager– Nigeria (remote)

- Tech365 – – Lagos, Nigeria

- Next Basket – Deputy Chief Technology Officer – Nigeria (remote)

- Africa Resource Company – Full Stack Engineer – Nigeria (remote)

- Pegasus – IT Project Lead (German speaking) – South Africa (remote)

- Tree Top Staffing – IT Manager– EMEA (remote)

There are more jobs on TechCabal’s job board. If you have job opportunities to share, please submit them at bit.ly/tcxjobs.

What else is happening in tech?

Written and Edited by: Ngozi Chukwu & Timi Odueso

Want more of TechCabal? Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- In a Giffy: business decisions powered by data-driven insights and analysis you can trust.

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.