As competition intensifies in Africa’s streaming market, Netflix, the previous market leader, which held more than 40% of the market, has lost its status as the market leader to Showmax.

Netflix, the world’s largest paid video streaming service, is losing market share in Africa as competition from Amazon Prime and Showmax intensifies. While Netflix controlled around 40% of the African streaming market in 2021, the latest industry data shows its dominance is shrinking. The California-based company now accounts for 35% and is no longer the market leader, as Showmax now accounts for 40% of the continent’s streaming market, according to Omdia Research, a tech research-based firm.

As more competitors enter the region and step up their playbook, they’re squeezing market share for other players, including Netflix. The streamer has lost its lead in the market to Showmax, which now has 1.8 million subscribers. Marc Jury, Showmax CEO, previously said that the streaming service experienced a 26% year-on-year growth in paid subscribers in the last four years as it doubled down on local content production. The company also dedicated $1 billion to content production and acquisition on the continent in the financial year ending in 2023.

According to data from Digital TV Research, an industry analytics firm, Africa had 41 million pay-TV subscribers at the end of 2022, with video streaming accounts for less than 10% of the subscriber base. Streaming players like Netflix and MultiChoice’s Showmax have deployed several growth tactics over the last three years, including splurging on new content and cutting subscription prices to win new customers. But the market has continued on its slow pace.

[ad]

Last week, TechCabal reported that IrokoTV, Africa’s oldest streaming service, had only 46,000 active users in December 2022, a 76% decline from the beginning of the year. IrokoTV’s CEO Jason Njoku shared that the service had invested $30 million in Nigeria but had yet to profit from the country.

Netflix and its African push

Netflix entered Africa in 2016, racing quickly to a few hundred thousand subscribers, which put pressure on incumbent players, including market leader MultiChoice, to brace for more competition. Despite the expansion of Amazon Prime Video and, more recently, NBC Universal’s Peacock to the continent, the market has grown slowly as broadband costs, stable internet, and low income continue to plague households on the continent.

Africa’s streaming video-on-demand industry is expected to grow by 10.4% annually while Netflix is expected to grow by half of that as other platforms are expected to take up more of Netflix’s slowing subscriber base.

Netflix’s strategy in Africa combines licencing content such as Nigeria’s Black Book from local studios with producing original content such as The Origin: Madam Koi-Koi. This two-pronged approach has cost Netflix $175 million in six years, according to a report released by the streaming service in April. Although Nigeria had the most licensed content in Africa, it got $23 million, while South Africa got the lion’s share with $125 million. Netflix has more than recouped its investment, making more than $230 million in the last two years.

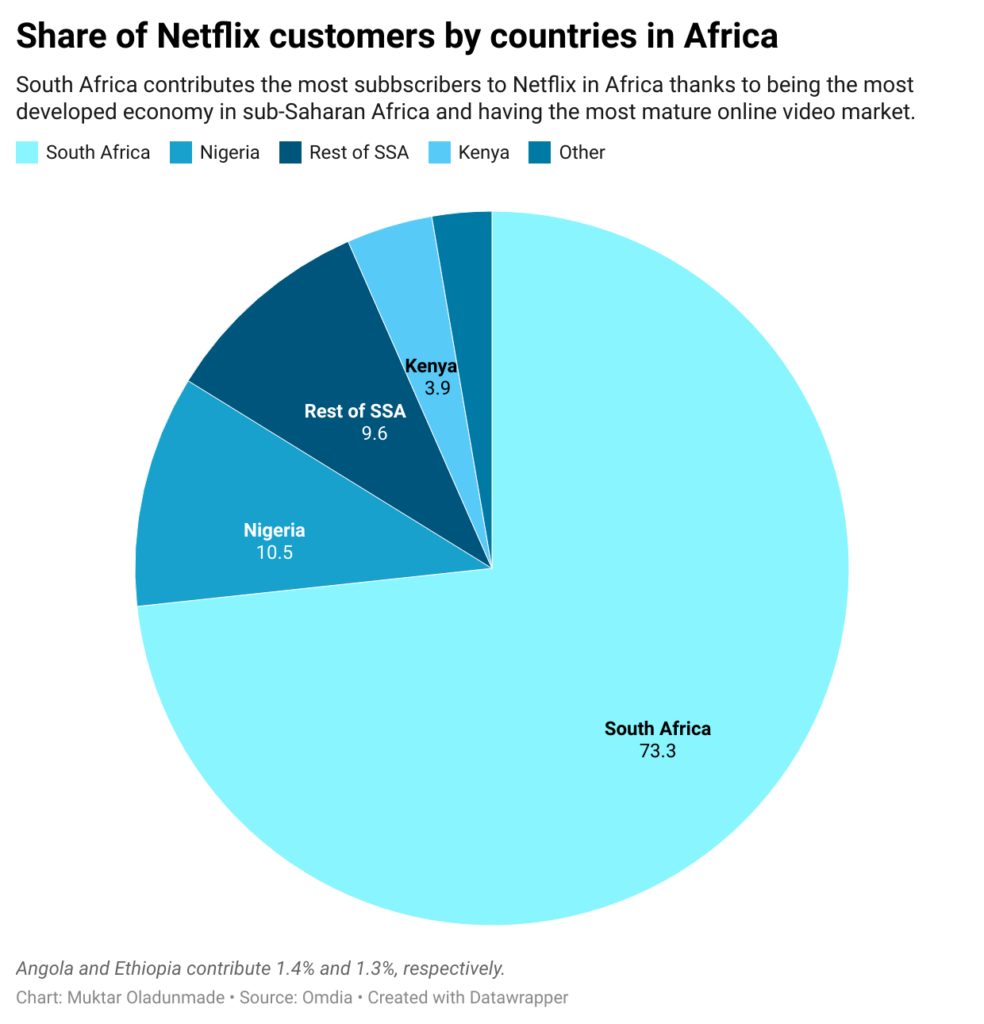

After racing to 400,000 within its first two years on the continent, Netflix has added 1.2 million subscribers in the past four years. South Africa remains Netflix’s largest market, accounting for 73.3% of its subscriber base. At 10.5%, Nigeria, Africa’s most populous country, remains a small market for the streaming service despite significant marketing activities and a major content acquisition push in the West African country, according to Omdia Research.

Netflix has worried about stagnation in subscriber numbers in mature markets like the US and Europe. It has been pursuing international expansion to offset any decline in its home market. The platform, which is experiencing declining growth in subscribers in more mature markets like the United States, is growing in Africa thanks to a move to reduce prices in some markets in the first quarter of the year. The growth in subscribers—6.8%— has directly increased the streaming platform’s revenue by 13.7%, exceeding $135 million in 2022.

According to Omdia, one hindrance to Netflix’s subscriber growth is the low penetration of credit and debit cards in many regions, which has affected how Africans pay for the streaming platform.