First published 17 December, 2023

2023 is ending on a humble note for the fintech boom, climate-tech’s wobbly first steps and a back-to-the-drawing-board for e-commerce in Africa. Everywhere you turn, doing the hard things first is back on the menu.

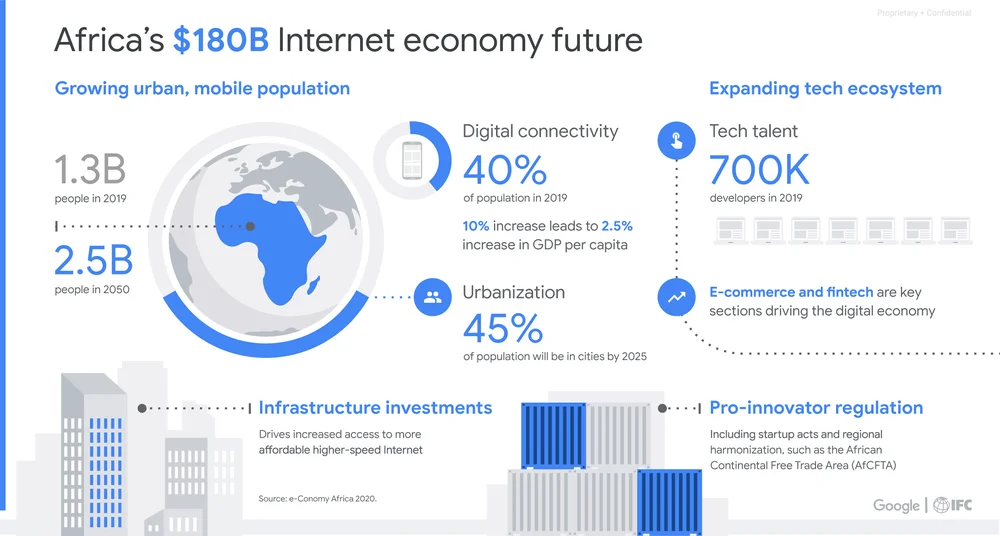

The hard thing about building a $180 billion internet economy in Africa by 2025, as Google and the International Finance Corporation predict, is making an economy that can run without looking at DFI-backed venture capital for handouts. To meet this admittedly difficult $180 billion goal, the attention of the technology sector in Africa needs to finally leave the residue hype of 2019 to 2022 behind in 2023, and continuously solve the series of hard problems that are peculiar to Africa.

2025 is 13 months away. Google and the IFC predicted Africa’s internet economy would be worth $180 billion by that year.

I am not referring to the obvious hard things like bringing millions into the financial system or providing energy to them. Those are the end goals. I am referring instead to the core problems that make things like energy or financial inclusion hard.

Fintech startups for example, find themselves needing to deal with the unruly cyber fraud menace that has cost untold billions in customer and investor losses. It’s not a game many are winning. In fact it has crippled fintech giants, including the Y Combinator-backed Zambian unicorn, Union54. The ecommerce sector in Africa is a venture capital darling that has ebbed and flowed through different models since 2012. Regardless of the model, the sector still has a lot to prove about its profit-making capacity, especially now that the venture capital tide is draining away. Clean energy and climate-tech is a rising star, but modular piecemeal solutions are unsustainable in the long term and do not move the needle on the continent’s energy poverty. In fact the climate tech space is under threat of being swept away by the emerging (and more profitable) nature-based carbon credit industry.

Investors are not left out of doing the hard things. Marketing yourself as an investor and giving speeches is well and good, but returning capital with outsize gain to their limited partners is even better—and harder. Everywhere you turn, doing the hard things first is back on the menu.

African entrepreneurs tackle hard problems, no doubt. Delivering accessible healthcare is difficult. Bringing excluded millions into the financial system is difficult. And helping people shop online is not the easiest dream to live for. But sometimes, and especially in the last capital deluge, a lot of problem fighting has been focused on the wrong end of the hard thing.

Chris Maclay, programme director for the Jobtech Alliance, first introduced me to the monkey vs pedestal framework that guides how X, one of Alphabet’s most ambitious innovation labs, operates. So I went off and read a bit about it. Astro Teller, Captain of Moonshots at X, describes the monkeys versus pedestal problem as having to decide between training a circus monkey on how to perform its routine and focusing on building the pedestal on which it would stand to perform magic tricks at a circus. Building a pedestal, or the performance stage where a monkey will perform a magic trick at a circus, is analogous to doing the easy portion of a task. But training a monkey to do the actual magic tricks is the most difficult part. It is obviously easy to build pedestals. It is also what most people will default to, because building pedestals is an easy way to show progress. For the entrepreneur, employee, investor or policymaker reading, think of things like joining a new accelerator program, raising new funding, discovering the next best idea, writing banging tweets complete with stunning charts, or even passing a new startup bill. These are the easy parts of building a thriving healthy and non-venture capital dependent technology ecosystem.

Partner Content:

2023 has been a wild ride for everyone. If you’re a founder, please share your thoughts on the outlook of tech in Africa. Click here to start.

On the other hand, figuring out how to keep a beautiful startup as a going concern when the VC money dries up is a hard thing. Turning the best idea into something that makes money is not easy. Building a payments company with zero cyber fraud is much more difficult than launching a new payments app. Carrying out proper due diligence as an investor is not as easy as speaking on a conference panel about the future of African tech. In every scenario, training monkeys to perform magic tricks before building pedestals is the hard part.

Take the case of the much-celebrated boom in mobile telecoms in Africa. The hard thing involved fighting and lobbying for deregulation and a fair licensing process. It meant building out a wide-enough network for mobile communications to have value right off the start on a tight budget. It meant creating the prepaid billing pricing strategy and collaborating with external partners like mobile phone suppliers and informal airtime retail agents to supply the devices and retail the airtime. Doing these hard parts allowed the early mobile network carrier networks to win in the face of adverse and entrenched state-owned landline opposition.

That model holds true today. It is how the next stage for innovation that wins in Africa will be created. Not more capital—although more will certainly be needed—but better cost models and a bias towards finding out now if something isn’t going to succeed, versus finding out years later at greater expense. This is another peculiar thing about hard things. Sometimes they are just too hard and it is better to cut your losses. The next wave of African tech should be where we collectively decide to get serious across board, double down on the hard parts of growing the collective pie and making technology a tsunami-level force for development in the continent.

When this happens, we will have put pedestals like venture capital or any capital for that matter (except customer payments), in its place. That is, as an important variable, but not the only or even the most important weight on the index of success. When this happens startup bills will not be celebrated as an end and promptly forgotten in the humdrum of regulatory bureaucracy. When this happens governments will not be in a rush to host tech conferences, as the provision of efficient infrastructure and healthy private-sector partnerships will be an even greater concern.

Will it be easy? Of course not. Will it be worth it? Absolutely.

Article continues after this ad

Abraham Augustine,

Senior Reporter, TechCabal.

Feel free to email abraham[at]bigcabal.com, with your thoughts about this edition of NextWave. Or just click reply to share your thoughts and feedback.

We’d love to hear from you

Psst! Down here!

Thanks for reading today’s Next Wave. Please share. Or subscribe if someone shared it to you here for free to get fresh perspectives on the progress of digital innovation in Africa every Sunday.

As always feel free to email a reply or response to this essay. I enjoy reading those emails a lot.

TC Daily newsletter is out daily (Mon – Fri) brief of all the technology and business stories you need to know. Get it in your inbox each weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.

24bottlesclima adidas yeezy prezzo basso 24hbottle ynotborse 24hbottle gioie-di-gea nike air jordan 1 mid se blundstoneoutlet 24hbottle lecopavillon ynotsaldi air max goaterra 2.0 loevenichhut vondutchmutzen benettonoutlet