TGIF ☀️

In case you missed it, African startups raised $3.19 billion last year.

Is that less than 2022’s ~ $5 billion raise? Yes. Should everyone be worried? Nope. Okay, maybe a little bit. There’s a funding winter across the globe with VC firms and investors holding their purses almost as tightly as African presidents hold onto power. What this frugality spells for the ecosystem—home and oversees—is sustainable practices and startups.

If it’s not going to be viable, don’t build it…at least not yet. 🫶🏾

Multichoice will not broadcast AFCON

Africans will have to look elsewhere to watch the most prized football tournament on the continent.

Multichoice-owned SuperSports channel will not show this year’s edition of the Africa Cup of Nations after it lost its broadcasting rights to a Togo-based platform, New World TV (NWT).

“An unmatchable deal”: The deal is said to be the biggest in the tournament’s history. The Confederation of African Football (CAF) president Patrice Motsepe described it as “a mega deal that no other broadcaster could match.” New World TV secured the exclusive rights to cover both AFCON 2023 in Ivory Coast and 2025 in Morocco.

Why does this matter? While SuperSport’s extensive coverage and promotional efforts have traditionally contributed significantly to the overall hype and excitement surrounding the AFCON, New World TV’s newly acquired hosting right poses new competition in the market for MultiChoice which formerly aired previous editions of the competition.

Football fans across the continent also fear that their viewing experience might be hampered as SuperSport is known for its strong network of local commentators and analysts who provide context and insights specific to different African regions. It remains to be seen whether New World TV will live up to the hype.

Several fans debate that NewsWorldTV might not have the robust infrastructure—like SuperSport—to fully cover the competition. There are worries that English-speaking countries might be left in the dark because NewsWorld TV primarily serves a Francophone audience

New World TV? The pay-TV channel set up shop in Togo in 2015 and made a remarkable entry into broadcasting sports after it acquired broadcasting rights in French-speaking Africa for the 2022 World Cup in Qatar. The streamer also won the rights to broadcast the 2022–2028 editions of the UEFA Nations League as well as the broadcasting rights in Francophone Africa for Euro 2024 and 2028. Present in Lome, Togo, the NWT aims to set up shops in other parts of sub-Saharan Africa in the coming years.

Another side of the coin: The competition which will kick off on January 14 had been aired over the years on SuperSport. However, the South African broadcaster has shown a reduced appetite for showing African competitions. SuperSport did not broadcast the newly launched African Football League, where South African-based side Mamelodi Sundowns clinched the first-ever title.

Where to watch AFCON: If you’re looking to watch AFCON, New World TV subscriptions cost about CFA 3,000 to 7,000 ($5–$18) which is cheaper compared to DStv’s $10–$40. Alternatively, AFCON will also be available on Startimes and Viaplay.

More DStv news: Meanwhile, multiple customers have accused DStv of adding Disney+ services to their accounts and wrongly charging them for its use. DStv partners with the Walt Disney Company to allow subscribers to add a Disney+ subscription to their monthly bills. The company claims the charges were made in error to subscribers who signed up for a 3-month trial. While it claims it has started making refunds, customers the refunds are only partial.

Access payments with Moniepoint

Moniepoint has made it simple for your business to access payments while providing access to credit and other business tools. Open an account today here.

Cellulant CEO resigns

Surprise, Surprise!

Akshay Grover, Group CEO of Cellulant has left his position to focus on personal matters. Grover was appointed as Group CEO of Cellulant in July 2021, taking over from longtime CEO and co-founder, Ken Njoroge.

The big picture: Grover, who joined Cellulant in January 2021 has blamed his departure to focus on personal matters. It appears that the move might be a part of a restructuring play at Cellulant. The company fired 27 staff members in early 2023. It then trimmed 20% of its workforce in August 2023, consolidated some roles, and created new ones. TechCabal has also learned that it executed another layoff in December 2023, although details of the layoff were not disclosed.

Zoom out: While details of the exit remain unclear, Peter O’Toole, the company’s CFO, will replace Grover as the acting CEO. The company also said it will make new additions to its leadership team in the coming months.

Meta CEO sells over $400 million worth of shares

Mark Zuckerberg has broken his two-year stock-selling hiatus with a sale of 1.28 million shares!

Per Bloomberg, Zuckerberg has been selling the shares every trading day since November 1, 2023, till the end of 2023. The average earnings from each day amounted to $10.4 million, with the largest transaction occurring on December 28, 2023, at $17.1 million.

Before this period, Zuckerberg had held back on selling Meta shares since November 2021. The timing of his recent sales coincided with Meta’s share price bouncing back from its seven-year low in 2023.

Meta shares, which grew by 193%, outperformed those of every other major tech giant except Nvidia Corp. last year and is now near its September 2021 record high.

Zoom out: Zuckerberg isn’t the only tech titan shedding shares. Salesforce CEO Marc Benioff also cashed out over $475 million in the second half of 2023. Despite the sale, Zuckerberg still owns a sizable 13% of Meta which is worth about $125 billion

Secure payment gateway for your business

Fincra payment gateway enables you to easily collect Naira payments as a business; you can collect payments in minutes through cards, bank transfers and PayAttitude. Create a free account and start collecting NGN payments with Fincra.

inDrive expands into financial services

inDrive has a solution to drive away money problems for drivers.

The e-hailing company is expanding its services; it wants to provide small loans to drivers in developing markets. Its primary focus? Nigeria, Kenya, Tanzania, Botswana, Ghana, and Namibia.

Mark Loughran, the company’s president, highlighted the challenges of offering loans to gig workers in these emerging markets, where many lack a banking history. inDrive is currently testing ideas and seeking partnerships to overcome these challenges and provide financial support to its drivers.

This comes after inDrive launched a $100 million programme in November 2023, to invest in startups and businesses in emerging markets, further expanding its impact in the global startup ecosystem.

Zoom out: This is also in line with an industry trend where mobility companies move into financing. There’s Moove, a mobility fintech, which partnered with Uber to help drivers with vehicle financing, and Max, a motorcycle ride-hailing app that also partnered with Bolt, for the same purpose. inDrive is the latest company to explore lending and provide financial services to delivery and ride-hailing drivers.

Sell with Paystack Storefront

Increase your online sales with a Paystack Storefront – a free, beautiful seller page that helps you bring creative ideas to life. Learn more at 👉🏾paystack.com/storefront

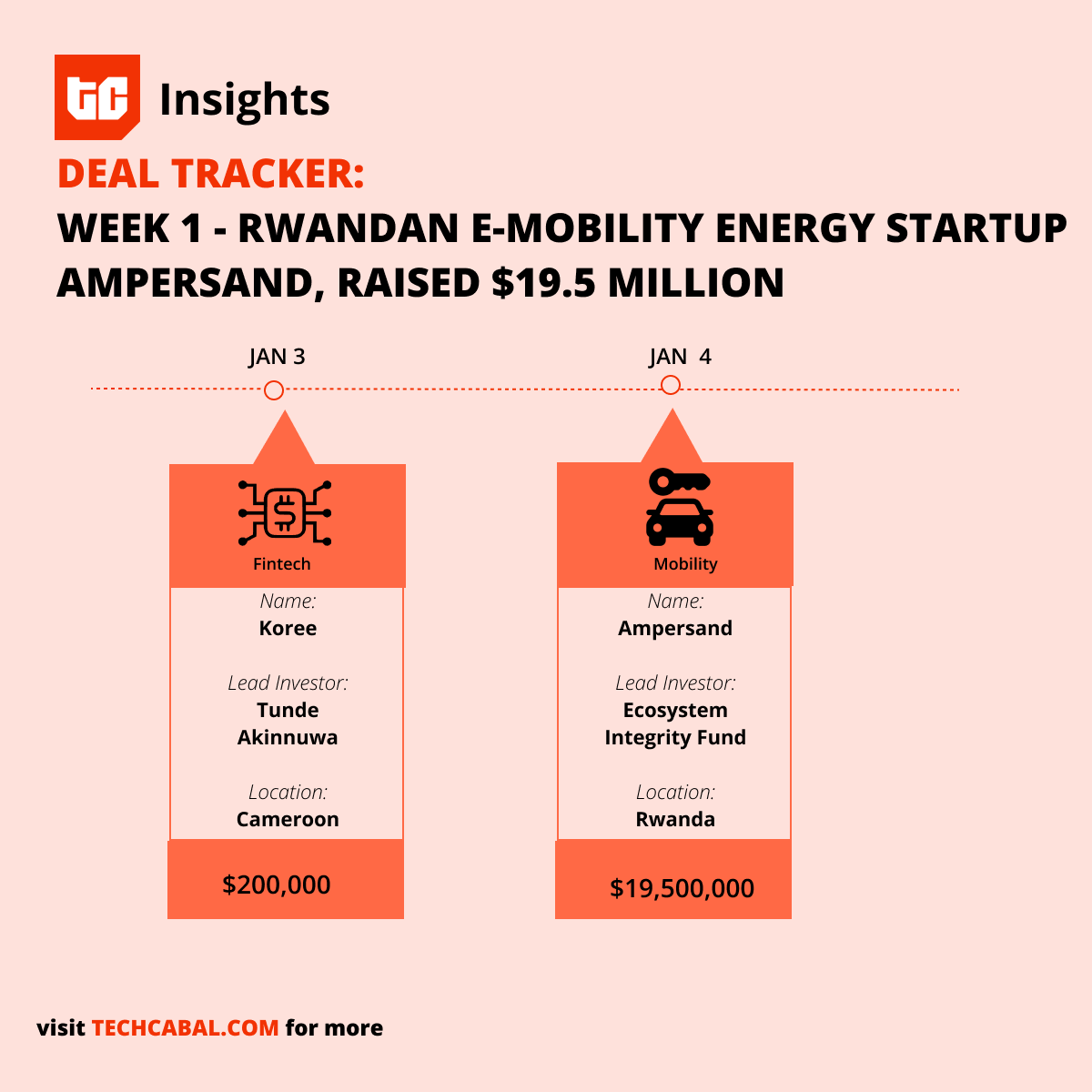

Funding tracker

This week, Rwanda-based electric transport energy company, Ampersand raised $19.5 million in equity and debt funding. The funding round was led by Ecosystem Integrity Fund (EIF) and was joined by Acumen and Hard Edged Hope Fund. The other investors were Alphamundi VC, Societe Petrolieres du Rwanda, TotalEnergies, EIF, and Beyond Capital Ventures. It also includes a $7.5 million debt facility from Cygnum Capital’s Africa Go Green Fund.

Here are other deals for the week:

- Cameroonian fintech Koree closed a pre-seed round of $200,000. The round was backed by Tunde Akinnuwa, co-founder at Duplo, Cameroon Angels Network, Catalytic Africa, Digital Africa, and other private investors.

That’s it for this week!

Follow us on Twitter, Instagram, and LinkedIn for more funding announcements. You can also visit DealFlow, our real-time funding tracker.

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $44,344 |

+ 3.80% |

+ 0.21% |

|

| $2,271 |

+ 3.11% |

– 0.42% |

|

|

$321.76 |

+ 1.60% |

+ 39.60% |

|

| $105.89 |

+ 5.65% |

+ 73.73% |

* Data as of 12:05 AM WAT, January 5, 2024.

Effortlessly make global settlements in over 30 currencies across 120+ countries spanning four continents, delivering cost-effective and reliable solutions to your clients, suppliers, and customers. Get started today.

- Elite Software Automation – Nocode Developer – Nigeria (remote)

- Moksh Tech – Senior Network Engineer – South Africa(remote)

- HHS Careers – IT cybersecurity specialist – Kenya (on-site)

- Clevertech – Mobile Engineer – Ghana (remote)

- ADS Kenya – Project Manager – Kenya (0n-site)

What else is happening in tech?

Written and Edited by: Timi Odueso, Faith Omoniyi & Mariam Muhammad

Want more of TechCabal? Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- In a Giffy: business decisions powered by data-driven insights and analysis you can trust.

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.