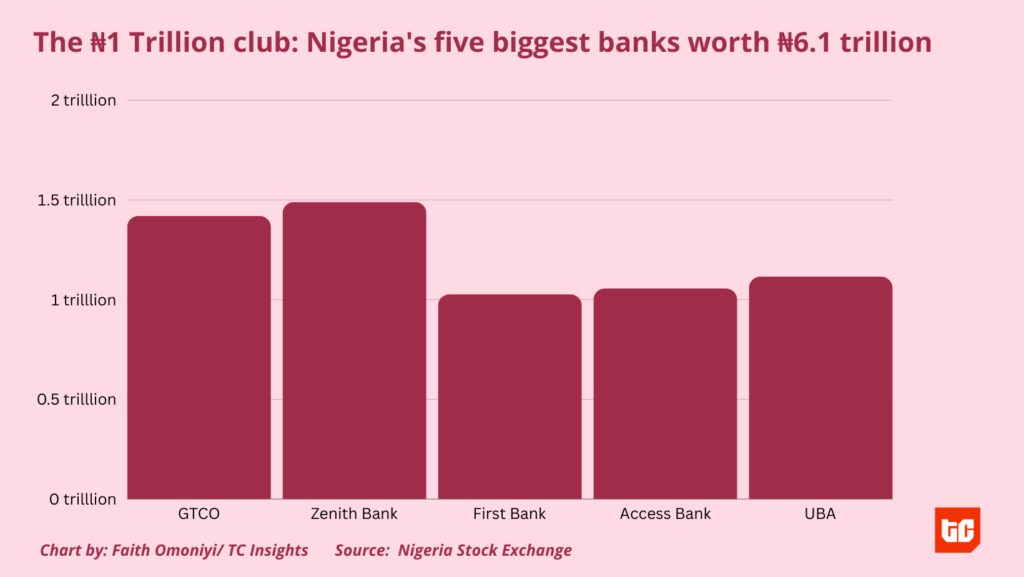

Nigeria’s five biggest banks—First Bank, Access Bank, UBA, Guaranty Trust Bank and Zenith Bank—have achieved a market capitalisation of at least N1 Trillion each on NGX, Nigeria’s stock exchange. All five banks are reaping the rewards of a strong market performance that caused a ₦1.6 trillion gain yesterday.

At the end of Tuesday, the banking index gained 8.2% or ₦6.1 trillion, welcoming the trio of Access Bank, UBA and First Bank to the trillion naira club, joining old timers like GTCO and Zenith that closed trading at a market cap of ₦1.42 trillion and ₦1.49 trillion respectively. [ad]

The three new bank stocks all appreciated an average of 10% to attain their new status this week. Some analysts have previously expressed worries the NGX has been primarily driven by seven trillion naira firms, which represent 66% of the market capitalization of the NGX. Some of those fears may abate now that more banking stocks have attained the trillion naira mark.

Nigeria’s stock market is riding a new wave like never before, giving credence to tech startups to consider listing their stocks on the market. The All Share Index, a metric that tracks the movement of share prices on an exchange, hit a 7-month high of 83,191.84 at the end of yesterday’s trading, leaving more to be desired as trading could close today at another all-time high.

Yet, other analysts warned that the bullish trend of the stock exchange will not last forever, predicting a possible dip later this month. “Investors may begin to take profit towards the later part of the month,” Oyekanmi warned. Investors may want to take their chances as trading commences today. In 2024 alone, the NGX has grown by 11.26%, as it looks to surpass last year’s growth of 45.90%.