Sup’ ☀️

This week, you can stay smarter and step ahead of everyone by signing up to receive breaking news from TechCabal.

Lyca Mobile shuts down in South Africa

South Africa is seeing another multinational exit with network operator Lyca Mobile’s shutdown.

The news: Last week, the mobile virtual network operator (MVNO) stated that it’s cutting ties in SA. Users had until January 9, 2024, to hop onto another network or face the risk of losing their phone number and access to text, call and data services.

The reason: Lyca’s announcement didn’t say much, but the company’s long-time partner Cell-C is facing significant financial challenges. Lyca launched in SA in 2017 thanks to a partnership with Cell-C. As an MVNO, Lyca uses other telecoms’ physical infrastructure—in this case, Cell-C’s.

Cell-C, however, has lost 9 million customers between 2021 and 2013, and has a R10.7 billion debt ($576 million). Some analysts deem the company technically insolvent.

South Africa is expensive for telecoms: South Africa’s load shedding is also leaving businesses blind. The country’s continuing declining electricity supply forced MTN to spend an extra $84 million on power supply and security last year. Vodacom has spent at least R4 billion ($218 million) on generators since 2020, and Telkom says it spent R655 million (35.2 million) on diesel and batteries in 2023 alone.

While Lyca didn’t have to deal directly with these as an MVNO, its partner certainly did as Blue Label, Cell-C’s parent company, also reported profit declines due to load shedding.

Meanwhile, Lyca is still active in Tunisia and Uganda where, in October 2023, it refuted rumours of a shutdown. Around the same time, it also suffered a hack that disrupted services for its 16 million customers across the world. Lyca is the second MVNO to exit South Africa in three years; the first was Virgin Mobile which exited the country in 2021 after succumbing to financial hurdles.

Access payments with Moniepoint

Moniepoint has made it simple for your business to access payments while providing access to credit and other business tools. Open an account today here.

Citigroup to lay off 20,000 employees

In what is the biggest layoffs of 2024 so far, global investment bank Citigroup has announced that it will cut 10% of its workforce, about 20,000 jobs, by 2026.

A tough quarter = tough decisions: According to chief financial officer Mark Mason, the layoffs are part of the company’s reorganisation and bid to boost its bank results. The company has had four rough quarters culminating in Q4 2023 when it recorded $1.8 billion in losses, the biggest losses recorded since 2009 when it recorded $8.9 billion in losses in its fourth quarter.

At the time, the company was recovering from a humbling financial crisis that saw 73,000 jobs cut in 2008 due to a $20 billion loss. To recoup some of its 2008 losses, the company sold off some of its business arms and raised $9 billion in the process.

History repeats itself: Citigroup is playing the same card. The bank has sold some of its operations outside the US including its China consumer unit, its Vietnam business unit, and several other businesses across South East Asia. In Mexico, failed efforts to sell its consumer unit Banamex have led the company to list it as a standalone firm in pursuit of a 2025 IPO listing.

Woven denies shutdown news

A surprising turn of events has Nigerian fintech Woven has retracted its shutdown announcement.

In an email shared with customers last Wednesday, the company had announced an imminent shutdown. “After a thorough analysis of the current market dynamics and their impact on our business model, Woven Finance has resolved to cease its payment services operations in the first quarter of 2024,” the email read.

And now? Woven says the email was sent in error. In a call with TechCabal, a highly-placed source said the email was unauthorised. The company also backtracked on its service transfer to Hydrogen. Woven says it will continue to operate until its board or shareholders decide to cut the wool.

Woven acquired a PSSP licence in 2022, and this could mean the company is exploring new avenues for their operations without abandoning existing services.

Zoom out: The incident exposes communication problems at Woven. While the company promises to send updates, mixed messages won’t reassure customers and could spark a bank run if there isn’t one already.

Secure payment gateway for your business

Fincra payment gateway enables you to easily collect Naira payments as a business; you can collect payments in minutes through cards, bank transfers and PayAttitude. Create a free account and start collecting NGN payments with Fincra.

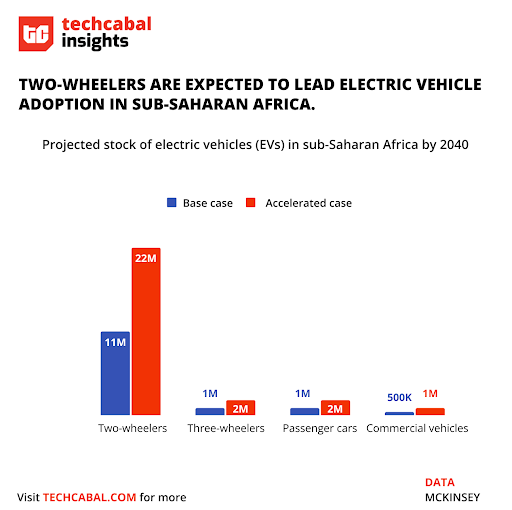

The future of EVs in Africa

Electric mobility in Africa is still in its development stage. Although the sales of electric vehicles (EVs) on the continent have increased in recent years, they have remained the lowest worldwide.

For instance, South Africa is the continent’s largest e-mobility market, yet electric vehicles account for 0.05% of the total 12 million automobiles in the country at 1,000 EVs as of 2022. While these electric vehicles offer cost-effective and environmentally friendly alternatives, their path to widespread adoption is faced with controversy and challenges.

The chart shows that the projected stock of electric vehicles (EVs) in sub-Saharan Africa by 2040 is expected to be 13.5 million in the base case and 25 million in the accelerated case. The base case assumes that current trends continue, while the accelerated case assumes that there are significant policy interventions to accelerate the transition to EVs.

As the majority of EVs in sub-Saharan Africa are expected to be two-wheelers, this also makes electric motorcycles hold significant potential in Africa, given the continent’s vast fleet of two-wheeled vehicles due to their affordability, durability, and manoeuvrability as attractive options for African riders. Now, the ambitious goals of African EV startups are met with doubts due to several factors such as high EV prices, unfriendly government policies, lack of charging infrastructure, high customs duties, and poorly maintained roads create substantial roadblocks for the industry.

A major hurdle for EV adoption in Africa is the reliability and affordability of electricity supply. Inconsistent electricity availability and sky-high prices are clogging the wheels of EV adoption in Africa. African governments need to elevate their game and invest in improving the grid infrastructure to power up the EV revolution. However, such infrastructure development requires substantial investment. According to estimates, an annual funding of $100 million is needed from international governments and aid organizations to scale EV adoption in Africa to 10% of total vehicle sales by 2027.

Africa’s electric vehicle revolution promises a jolly ride towards sustainable transportation. But there’s controversy already in the air. From carbon footprints to charging challenges and the need for international funding, the road ahead may be a bit bumpy. African governments, alongside international support, need to step on the accelerator, address policy barriers, and spark innovation to make this EV adventure a success to set Africa ready for an electrifying future on its roads.

Accept fast in-person payments, at scale

Deploy your in-person point-of-sale solution to hundreds of sales agents, in seconds. Learn more →

1.6 million: That’s how many point-of-sale (POS) agents Nigeria has.

Source: WeekTracker

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $42,933 |

– 0.36% |

+ 0.66% |

|

| $2,538 |

– 0.91% |

+ 11.40% |

|

|

$0.14 |

– 19.59% |

+ 278.56% |

|

| $96.80 |

+ 4.48% |

+ 24.81% |

* Data as of 17:20 PM WAT, January 14, 2024.

Effortlessly make global settlements in over 30 currencies across 120+ countries spanning four continents, delivering cost-effective and reliable solutions to your clients, suppliers, and customers. Get started today.

Nigeria’s Securities and Exchange Commission (SEC) has approved the launch of a digital securities platform. Nairametrics reports that NASD Plc will launch the Digital Securities Platform (N-DSP), developed in collaboration with Blockstation under the Regulatory Incubation (RI) Programme.

Per the news, the N-DSP is a way for everyday Nigerians to invest in secure digital assets, providing opportunities for young investors and offering a gateway for businesses to raise capital through digital means. The NASD believes that Nigeria ranks second globally for blockchain wallets, and a platform like N-DSP will support high-quality blockchain assets, and the tokenisation of assets like entertainment rights and real estate which could mean more money for Nigeria’s content creators, and increased future investments in real-estate which already has a deficit of 28 million houses.

- Big Cabal Media – Product Manager, Data Analyst Intern, Associate Consultant – Nigeria

- Rubicon – Business analyst – South Africa (on-site)

- Voltrox – Full stack developer – Lagos, Nigeria (remote)

- Sun King – Technical product manager – Lagos, Nigeria (Hybrid)

- Areeb – UI/UX designer – Egypt

- Duplo – Bizdev and partnerships manager – Lagos Nigeria(Remote)

What else is happening in tech?

- Next Wave: Why local IPOs are the wrong priority

- How Africa focused VCs are turning to secondary markets for liquidity lifelines

- Wellahealth Founder wins the fifth edition of Africa’s Business Heroes prize

- BlackRock acquires Bayo Ogunlesi’s GIP for $12 billion

- Safaricom, M-Pesa Africa and Sumimoto launch the Spark Africa Programme

Written by: Timi Odueso

Edited by: Ope Adedeji

Want more of TechCabal? Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- In a Giffy: business decisions powered by data-driven insights and analysis you can trust.

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.