After months of speculation around Nigeria’s FX backlog, Nigeria’s Central Bank Chief has said the country’s “valid forex backlogs” stand at $2.2 billion. The CBN arrived at the figure after subjecting the initial claims of the $7 billion to a long audit.

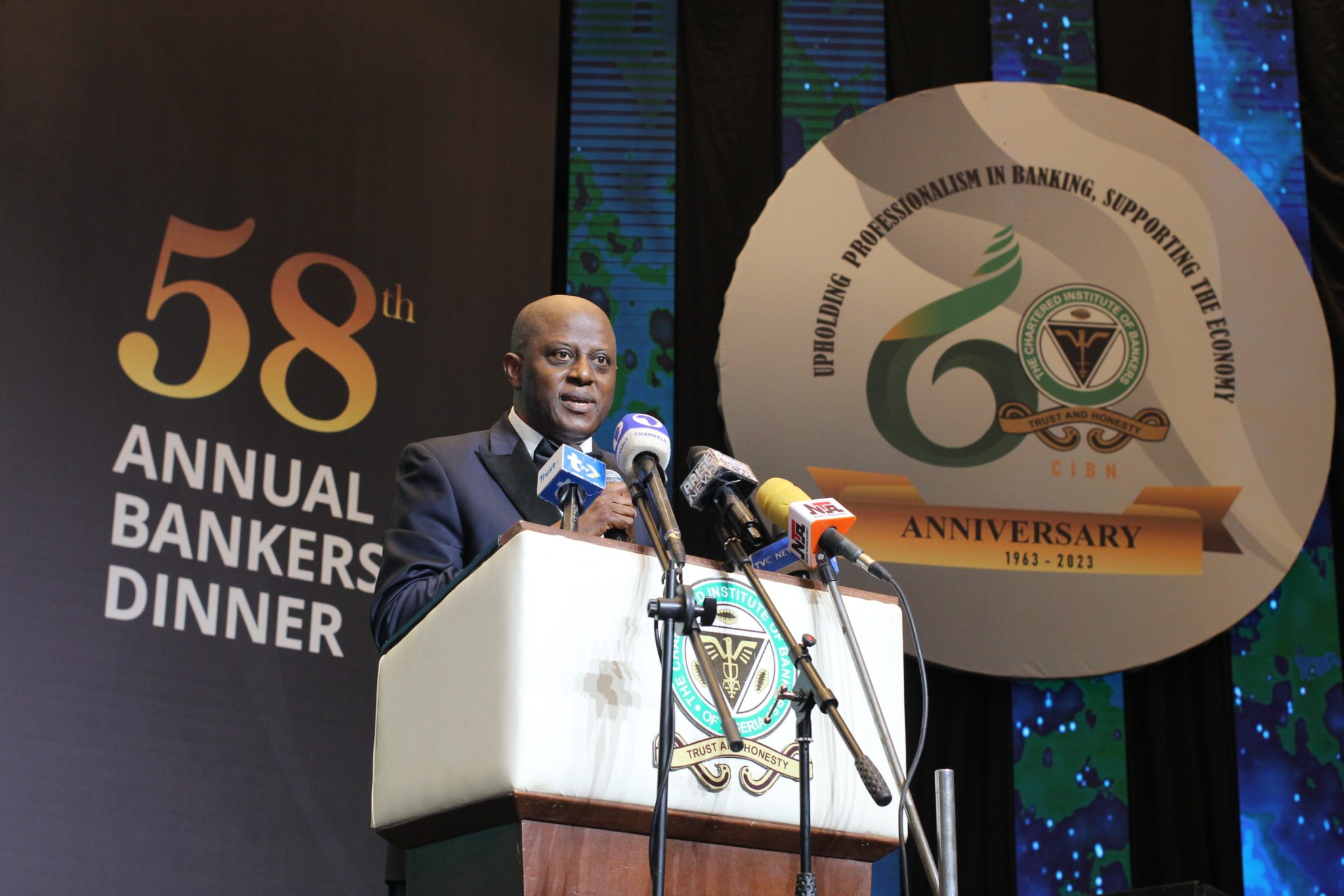

On Monday, Yemi Cardoso, the Central Bank Governor, told Arise TV that the $7 billion figure was audited by Deloitte and around $2.4 billion in “invalid claims” were discovered. [ad]

According to Cardoso, some infractions include not having valid import documents, claims from entities that didn’t exist, beneficiaries and account parties who got more foreign exchange than they asked for and some who did not ask for forex but got it.

“We are not paying these claims if it is not a validly constituted request,” Cardoso said. And while Cardoso claimed the arrears owed to airlines had been paid, the airline association IATA said there was still $700 million unpaid.

“What remains is about $ 2.2 billion to be settled, and I am confident. We would clear all of that very shortly,” he added.

Last week, the CBN issued new policy directions to stabilise the Naira after a week of volatility. The apex bank aims to unify prices and close the disparity between the official FX window and the parallel market.