First Published 04 Febuary, 2024

Asset financing was meant to help the mobility sector progress, but it has encountered a few problems. Could local manufacturing re-balance the model?

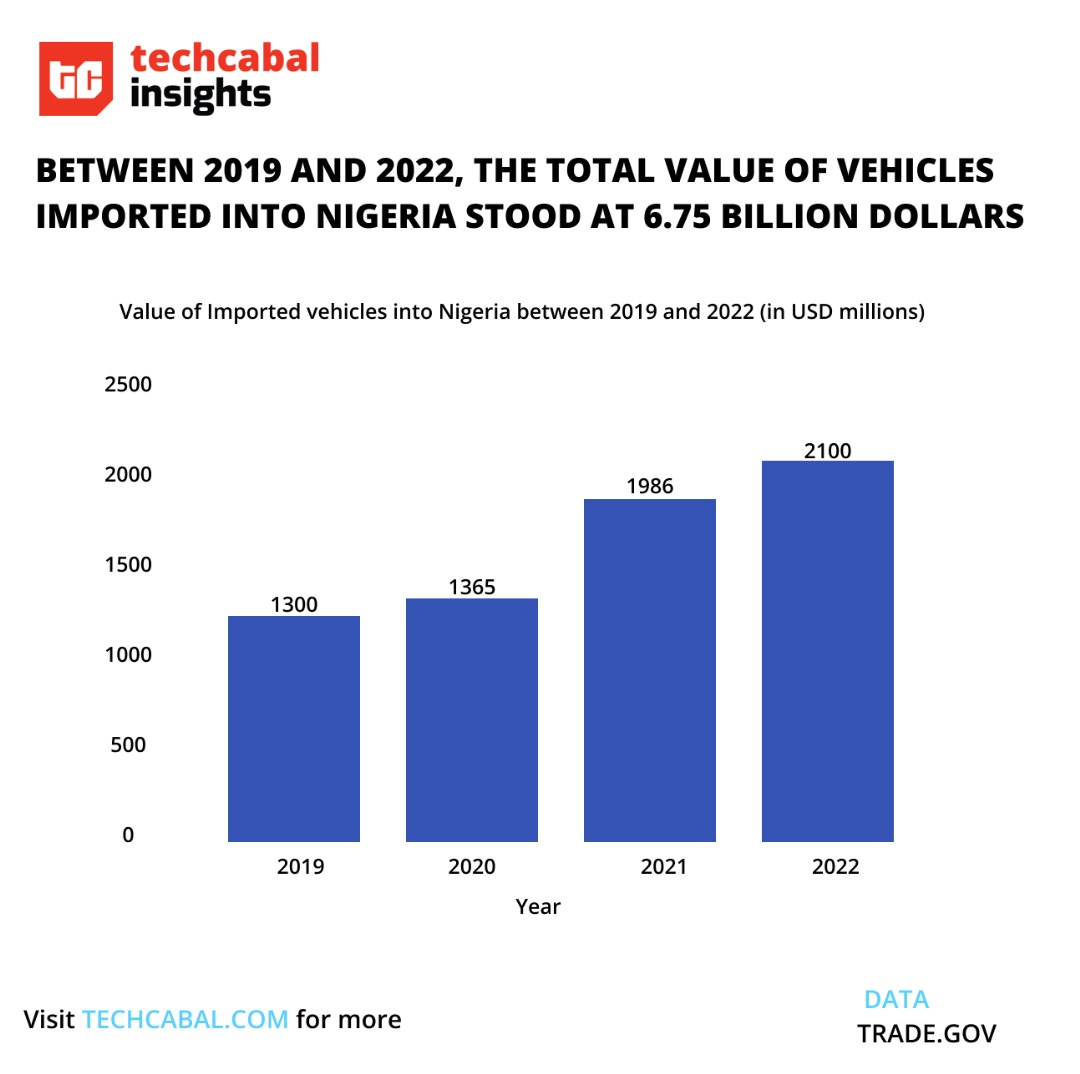

Owning a car should never have to be a luxury, especially if you hope to venture into the ride hailing business. But in Nigeria, car ownership is slowly getting out of reach. There are several factors responsible for this. Nigeria, with an estimated population of 200 million, does not produce cars. Per data from the nation’s statistics office, the country boasts over 12 million registered vehicles, of which almost 90% are imported, representing a motorisation rate of just 0.06 vehicles per person. Vehicle importation is denominated in dollars, a currency that Nigeria’s naira has weakened against in the last few months ever since President Bola Tinubu’s reforms. The naira is currently the worst performing currency in the world as it exchanges somewhere around ₦1,400–₦1,500 to the greenback.

But that is not the only factor that makes owning a vehicle out of reach. Anyone hoping to import cars has to contend with cumbersome clearing processes at the ports and import duties placed on used and new vehicles. Vehicle importation may yet again suffer another hike after the Nigerian Customs Service adjusted the foreign exchange for tariffs and duties upwards by 42.5% to 1,356 per dollar, making importation another headache for prospective car owners.

The direct impact of these policies are borne by ride hailing drivers who are quite unfortunate to be working in the automotive industry where a lot of their expenses— fuel and spare parts—are determined by whatever the value of the naira trades in comparison to the dollar. These drivers seem to be losing a battle even before they begin to put their cars on the road.

Prior to now, drivers naturally opted for the hire purchase option which allows them to make a downpayment, and then, at their own pace, settle overtime. Most of these hire purchase moves occur in Nigeria amongst friends and family. For drivers unable to make any significant downpayment due to the fact that they have no capital, the asset financing model came in as a quick fix. Vehicle-financing firms like Moove and LagRide, the Lagos state ride hailing platform, set up a rent to own model to help drivers.

The value of imported vehicles into Nigeria. Chart by Mobolaji Adebayo, TC Insights

Moove partnered with ride hailing startups like Uber to offer Suzuki Alto or S-Presso to drivers. Although the Suzuki vehicles used in the Uber Go category typically sell for $13,500 (₦12.1 million) in Ghana and are sold for $21,500 (₦19.2 million) in Nigeria by Suzuki, Moove rents them out to the drivers for $25,450 (₦22.8 million). At a daily remittance rate of ₦9,400 ($10.43), it would take a driver 41 months (three years and five months) to complete their payments. LagRide offers a similar model which allows drivers to make a downpayment of ₦700,000 ($776.49) for brand-new GAC vehicles (SUV and Sedan options). Drivers spread the rest of the payments across four years by making daily payments of ₦8,900 ($9.87).

However, the asset financing scheme hasn’t had a smooth run. Asides from safety reasons where the Suzuki S-Presso model reportedly fared poorly in at least one crash safety test, drivers have also claimed the offered cars were overpriced and came with a difficult payment structure.

In 2023, some of the complaints were reported in local media, and some of them are referenced here and here. To be clear, the asset financing model is not an exceptionally flawed model. People take car loans or loans to fund some purchases like phones, mortgages or vehicles in other parts of the world. Besides, the asset financing model is offering new car models instead of second-hand cars that local hire purchase models usually parade. Drivers disagree with this model, as they worry that the car’s value (albeit newly purchased) may depreciate at the end of a long repayment period which is usually 3–4 years on average.

Nigerians are not really used to buying things on credit; they’d rather save to own. This author argues that Nigeria runs a largely cash-driven system where people are expected to have cash for every transaction as credit is unavailable. A source at M-Kopa told me Kenyans are different, as they tend to favour installmental payments more. This article here lends credence to that fact.

Can local car manufacturing companies help?

Can local manufacturing sort the asset financing problem? My colleague Abraham Augustine states that building the case for local manufacturing is not easy. To be fair, cars are only assembled in Nigeria by some local players like Innoson and Ford.

However there are few newly assembled Nigerian car brands that could lower the long repayment plan offered by vehicle financing firms. An Innoson sedan car known as Innoson Carris is quite affordable, between ₦4.5 million to 6 million, lower in price than Suzuki and GAC alternatives. Three years ago, Innoson offered its IVM Caris, IVM Smart, IVM Kenga, and IVM Connect at a starting price of ₦4.5 million.

Sure, the price could have gone upwards in 2024, but the possibility of Innoson or Nord offering car discounts to willing ride hailing drivers could make a difference. That difference is enough to make an appealing advert for local participation over foreign goods. Especially in a tech world where Nigerians are beginning to consider local alternatives to cloud computing and office messaging solutions. We may not have all the answers, but this is a clarion call for local car assembly companies to exploit.

Joseph Olaoluwa

Senior Reporter, TechCabal

Thank you for reading this far. Feel free to email joseph.olaoluwa[at]bigcabal.com, with your thoughts about this edition of NextWave. Or just click reply to share your thoughts and feedback.

We’d love to hear from you

Psst! Down here!

Thanks for reading today’s Next Wave. Please share. Or subscribe if someone shared it to you here for free to get fresh perspectives on the progress of digital innovation in Africa every Sunday.

As always feel free to email a reply or response to this essay. I enjoy reading those emails a lot.

TC Daily newsletter is out daily (Mon – Fri) brief of all the technology and business stories you need to know. Get it in your inbox each weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.