Good morning ☀️

The pressure is getting worser for everyday Nigerian citizens.

The country’s inflation rate, which hit a 28-year high at 29.90%, is making it difficult for people to afford essentials even when there’s a buy-now-pay-later option.

According to BNPL startups we spoke to, it’s a double-edged sword. On one hand, these startups are getting new customers with less disposable income who now want to use BNPL, and on the other, there are now customers who can’t afford to pay off their debts. Here’s how inflation is affecting BNPL startups in Nigeria.

Lagos to use tech to track kidnappers

Last month, the former Nigerian minister for comms, innovation and digital economy Isa Pantami made a statement, in a now-deleted X post, that surprised many Nigerians: that Nigerian security officials were refusing to use SIM cards to apprehend the increasing number of kidnappers.

Side bar: The country, in 2019, approved $433 million to bankroll a five-year project that would provide everyone with unique 11-digit identification numbers that would be registered to every SIM card. So far, about 102.39 million NINs have been registered.

While Nigeria saw a slight decline in kidnapping reports in 2023, the ex-minister’s statement still made a splash as it concerned the kidnapping of five sisters—one of whom was murdered—in the nation’s capital territory of Abuja.

The news today: Now, security officials in the country’s tech capital of Lagos have announced the reactivation of tracking devices to apprehend kidnappers. The Lagos State Commissioner of Police said, on Friday, that it’s working with several other agencies to apprehend culprits in hot zones.

Re-activation? Per the officials, the tech used to track SIM cards and match the national identity numbers registered to the cards has been deactivated since 2021.

Per Punch, sources at the Nigerian Police Force say that the police don’t have adequate tracking devices, and sometimes have to depend on tracking systems by the domestic intelligence agency DSS which increased response time. The sources also revealed that the payment for the tracking service at the NPF was suspended at the same time.

With the service now back on track in Lagos, it’s unclear if other states across the federation, especially in hotspots like Kaduna, FCT, and Niger will also get the same support.

Access payments with Moniepoint

You don’t have to take our word for it. Give it a shot like he did Click here to experience fast and reliable personal banking with Moniepoint.

Flutterwave’s Disha takes a break

Flutterwave’s 2021 acquisition of Disha was a trendsetter. It was one of the very first publicly-known instances of big African startups acquiring smaller ones.

In the same year it became a unicorn, the fintech swooped in to save the creative design agency with 20,000 users which, at the time, was at risk of shutting down.

Now, Disha is going away again: Last week, Disha announced the product will be paused indefinitely from March 31, 2024. Its 100,000 creators have until then to migrate their content and profiles to other platforms.

According to the team, the pause will help the Disha team focus on its product and provide better tools for creators.

While the move seems sudden, a look at Disha’s pages across Instagram, Twitter and LinkedIn shows reduced engagement over the past two years. Disha helped creatives create one-page websites and the Flutterwave acquisition added a payment option for the platform. The platform has grown its users 5x since its acquisition, but it’s likely that this growth isn’t matching Flutterwave’s vision for the platform. Flutterwave’s CEO Olugbenga Agboola had said, at the time, that he considered Disha the creator version of Flutterwave Store which now serves over 900,000 businesses across 154 countries.

Will Disha come back? Disha isn’t the first Flutterwave-owned product that has been “halted temporarily”. Early in 2022, Flutterwave paused its Barter by Flutterwave, its virtual dollar card service, due to problems its partner company, Union54, faced with chargeback fraud. While other companies who also paused their services have since revived their cards, Flutterwave is still yet to bring Barter back.

Last year, Agboola gave a statement that now mirrors Disha’s: that Flutterwave is working to upgrade Barter and make it even more efficient. The company is yet to give any concrete details on the return of Barter.

Secure payment gateway for your business

Fincra’s payment gateway enables you to easily collect Naira payments as a business; you can collect payments in minutes through bank transfers, cards, virtual accounts and mobile money. Create a free account and start collecting NGN payments with Fincra.

Al Nasr to roll out locally-produced EVs in Egypt

We’ve seen a bit of fair interest in indigenous EV solutions on the continent. Just last week, Kenya-based EV company Roam announced a $24 million raise to scale its business across the country.

Roam’s competitor, BasiGo, also recently expanded its operations to Rwanda where it launched electric buses for public transit.

In Egypt, Al Nasr is working to do the same. Last week, the state-owned company revealed that it’s working with an undisclosed Chinese company to roll out locally-produced EVs in Egypt by 2025.

In 2022, the company announced plans to set up Egypt’s first EV distributorship in partnership with the National Automotive Company (NATCO). At the time, the plan was to roll out locally produced EVs in the country by 2023, but things fell apart after Al Nasr struggled to settle on a foreign manufacturing company to handle the assembly.

President of the company Khaled Shedid said on Saturday that the company had finalised deals with a Chinese manufacturer that will see five different types of EVs launch in Egypt next year.

Egypt will get paid to use EVs: While the Egyptian government has plans to use Al Nasr as its entry point into the $500 billion EV market, it’s also giving consumers incentives.

Per the Egyptian Automotive Industry Development Programme (AIDP) which was created in 2022, buyers of locally-produced EVs in Egypt will receive up to EGP50,000 ($1,600) in cash incentives.

So far, there are at least two players other than Al Nasr. In 2023, the Arab Academy for Science, Technology & Maritime Transport’s (AASTMT) announced a project that should have seen the agency launch an EV priced at EGP95,000 ($3,100) late in 2023. The Egyptian cabinet also licensed a private company, EgyptSat Auto, to build an EV factory that will reportedly create electric buses, motorcycles and charging stations by 2024.

Whatever the case, it’s unlikely that Egypt will launch its first locally produced EV anytime soon.

Accept fast in-person payments, at scale

Delight your customers by allowing frontline staff and sales agents confirm bank transfers, instantly. Learn more →

How fintechs should adapt to FX reforms

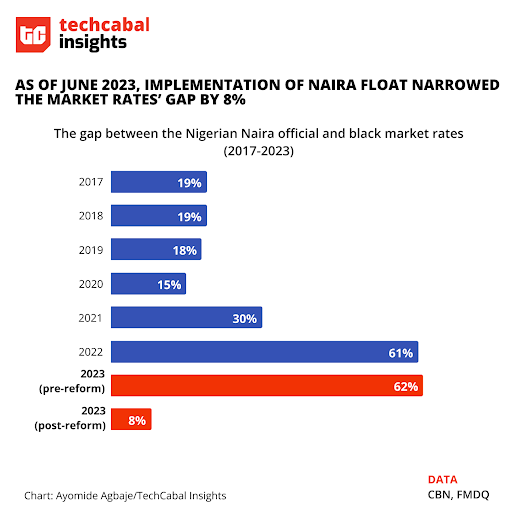

In recent years, African countries have embarked on foreign exchange reforms aimed at fixing inefficiencies within their FX markets and stemming the decline in foreign currency reserves. The Nigerian government, for instance, announced significant changes to its FX market structure, dislodging a multi-market system that had been in existence for over six years. One of the changes involved consolidating various FX windows into the Investors & Exporters (I&E) platform, enabling market forces to determine unified exchange rates between buyers and sellers.

Before the reform, the FX market had been characterised by disparities between official and parallel market rates. Between 2019 and June 2023, the rate in Nigeria surged from ₦362 to ₦760, marking more than a twofold increase.

However, as the FX space gradually transformed, it also had a ripple effect on the cross-border fintech sector. Startups that facilitated FX trading and cross-border payments found themselves at a crossroads as the changes had earlier prompted local banks to halt international payments conducted on naira cards. This has left consumers and businesses turning to alternative means of making payments for services across streaming platforms, online courses, tuition fees, and so on.

Amidst the constraints with traditional banks, fintech innovation is redefining product offerings with virtual bank accounts and dollar cards. This affords consumers seamless means of making international payments by streamlining the process and eliminating the need to source dollars from the black market.

Nevertheless, the attraction of cross-border payment convenience does not come without trade-offs. The exchange rates offered by these platforms often surpass those presented by official channels like the I&E window, primarily attributable to the limited accessibility fintechs have to official FX sources. And in a bid to counterbalance this limitation, they resort to using parallel market rates, which further widens the discrepancy.

But can cross-border fintechs still sustain their appeal if banks embark on a trajectory of offering lower exchange rates and more accessible FX options? More than ever, fintech companies must continue to recalibrate their strategies, ensuring that their value proposition remains attractive even in periods when traditional banks will begin to level the playing field.

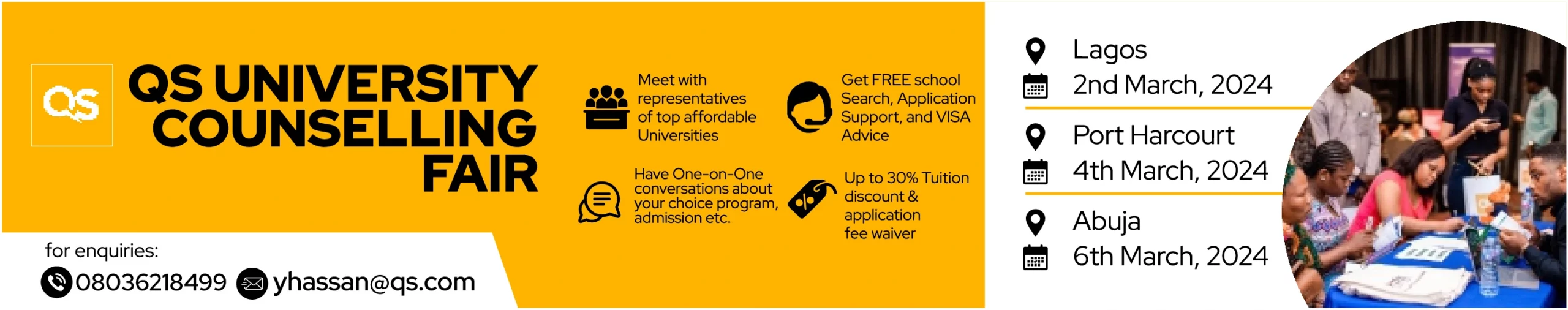

Ignite your career with QS

Ignite your career journey at the QS Study Abroad Fair 2024! Explore global opportunities, top-tier universities, and exclusive scholarships. 🚀 #QSStudyAbroad. Connect with admission directors from leading universities in the US, UK, Australia, Europe, Canada, and beyond. Attendance for this event is completely FREE.

Click here to register for LAGOS! Click here to register for ABUJA! Click here to register for PORT HARCOURT!

30,000: And 43% of these are small businesses. This is still a small number compared to how many phishing emails—about 3.4 billion—are sent everyday.

Source: GetAstra

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| 51,734 |

+ 0.63% |

+ 24.40% |

|

| $2,829 |

+ 2.01% |

+ 14.51% |

|

|

$0.16 |

+ 1.15% |

+ 61.35% |

|

| $6.06 |

+ 25.57% |

+ 144.42% |

* Data as of 20:30 PM WAT, Febraury 18, 2024.

Experience the best rates and enjoy swift 6-24hrs delivery times. Elevate your business with OneLiquidity–get started today.

- Meta, in collaboration with Ingressive for Good, has partnered to address the surging demand for digital marketing skills in the industry by offering scholarships to empower at least 5,000 youths in Nigeria, South Africa, Côte d’Ivoire and Kenya to thrive in their digital careers. Upon successful completion of the programme, participants will embark on a transformative 30-day job readiness bootcamp, acquiring essential soft skills and gaining exclusive access to industry thought leaders for mentorship and guidance. Apply here.

- Selar, Africa’s leading creator platform, is thrilled to introduce the Selar Tuition Funds initiative, a project aimed at providing financial support to students in Nigerian tertiary institutions. This year, Selar will grant ₦100,000 to 50 final year students, helping them overcome the escalating cost of education and successfully complete their studies. In addition to the financial aid, Selar will offer internship opportunities to further enhance the recipients’ educational journey and foster their career growth. Apply by February 21.

- The National Information Technology Development Agency (NITDA) and Tech4Dev have opened applications for the DigitalforAll Challenge 2.0. The program, which is divided into three categories: Young Learners (Ages 12-18); Youth Category (Ages 19-45); and Civil Servants, will reward winners and runners-up in each category with cash prizes. the winner from each category will receive₦10 million cash, while the first runner-up will get a consolation prize of ₦7.5 million. The second runner-up for each of the categories will receive ₦5 million. Apply here.

What else is happening in tech?

Written by: Timi Odueso

Edited by: Olumuyiwa Olowogboyega

Want more of TechCabal? Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- In a Giffy: business decisions powered by data-driven insights and analysis you can trust.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.