Good morning ☀️

Apple is loosening its grip around the iPhone in the European Union.

First, the EU forced it to replace its lightning ports with the USB-C, and now, EU regulations are pushing the company to allow users download apps directly from websites.

It’s not set in stone yet, but later this year, iPhone users will be able to download apps from sites other than just the Apple Store which has been the only legal way to download apps on the iPhone for over 15 years. 🤯

Nigeria grills Binance for info on top 100 users

On February 26, the Financial Times confirmed the arrest of two Binance executives in Nigeria who had flown into the country to resolve the ban on the company’s website.

Latest reports indicate that Nigeria is now grilling the detainees for information on the top 100 Binance users in the country as well as other data including a six-month transaction history. The country also wants Binance to settle any tax liabilities which it has in Nigeria.

While both executives were previously unidentified, a new Wired report has now identified the two arrested executives as Tigran Gambaryan, a former crypto-focused US federal agent, and Nadeem Anjarwalla, Binance’s Africa regional manager.

Both executives have been held in Nigeria’s capital city Abuja by the office of the National Security Adviser (NSA) after moving into Nigeria two weeks ago to resolve a ban on their website. Gambaryan and Anjarwalla were stripped of their passports upon entry into the country and neither has been charged with any criminal offence. Nigerian authorities are yet to disclose new information about their arrest, but the duo’s relatives are now calling on the US government to negotiate their release.

A crypto crackdown? While Nigeria has had a public lifting up of crypto since the resumption of crypto transactions in the country last December, other significant changes have hinted at a casting down. Regulators blocked access to the websites of several exchanges, aiming to curb speculation and prevent the unofficial exchange rates set on these platforms. These websites have become a popular alternative for trading the Nigerian naira and have unofficially established a market-driven exchange rate. Binance was accused of operating illegally and handling $26 billion in unidentified funds.

With this latest report, the country might also be considering action against crypto users who have facilitated the transfer of these funds.

While Binance’s executives remain in detention, the company has paused trading of the naira against bitcoin and tether digital coins on its exchange. The executives, per Nigerian law, were set for release yesterday, Tuesday, March 12, but a court order set for today, March 13, might see an extension.

Launch your tech career with Moniepoint

Launch your tech career with paid mentorship from fintech industry leaders and potential full-time employment. Apply now!

Interswitch acquires $1 million MVNO licence

Interswitch is known for quite a few things. It was one of Africa’s earliest unicorns reaching the $1 billion valuation as early as 2019. It’s also one of the very few payments companies which processed over 1.2 billion transactions across Nigeria in March 2023.

But like Oliver Twist’s hunger, these successes aren’t enough for the fintech giant. Now, it’s doubling down on telecoms.

The Visa-backed company reportedly entered Nigeria’s telecom sector in May 2023, after it acquired a Tier 5 Mobile Virtual Network Operator (MVNO) license for $1 million from the Nigeria Communications Commission (NCC).

Why diversify? Interswitch has a large customer base and has issued over 50 million debit cards through its payment services. It aims to leverage this customer base and utilise its MVNO licence to offer combined payment and telecom services to both business-to-business (B2B) customers and consumers. Their strategy focuses on a low-capital-expenditure virtual telecoms model.

Interswitch holds the highest tier license—a unified virtual operator, which allows them to partner with existing telcos and leverage their infrastructure to offer cheaper mobile services—including 4G/5G—and expand reach to underserved areas, especially in rural regions.

The big picture: Nigeria’s telecom regulator issued 25 MVNO licences in 2023 to boost competition. Despite the country’s large population—200 million—only 60% have access to mobile connectivity, less than 5% have access to 4G, and 0.8% have access to 5G. If Interswitch’s fintech ambition is any pointer, Nigerians will see stronger connections in the future.

No hidden fees or charges with Fincra

Collect payments via Bank Transfer, Cards, Virtual Account & Mobile Money with Fincra’s secure payment gateway. What’s more? You get to save money for your business when you use Fincra. Start now.

Stanbic pauses launch of Kenyan fintech subsidiary

In recent times, Nigerian commercial banks have been borrowing from the playbook of fintechs and establishing their fintech subsidiaries. GTCO launched Habari Pay in 2018. Access Bank Plc, Nigeria’s largest commercial bank by asset, launched Hydrogen in 2021. Stanbic IBTC Holdings, in 2022, launched Zest, its fintech arm.

Other countries appear to be gleaning from this playbook. In its 2022 financial report, Stanbic Holdings disclosed it was looking to partner or acquire a fintech or mobile network operator to expand its business. The company also stated, the year before, that it was seeking partnerships with Chinese financial technology firms to boost trade between Kenyan traders and Chinese vendors. Stanbic Holdings believed Chinese fintech partnerships would enable Kenyan traders to source quality goods and settle transactions conveniently.

Now, Stanbic Holding has hit a pause on its attempt to launch its fintech subsidiary in Kenya. The company had earlier obtained regulatory approval from the Capital Markets Authority (CMA) to begin operations in Q4 2023, but the bank’s board has decided to put a hold on operations.

While the exact reason for stalling operations remains unclear, the latest disclosure means Stanbic might be reneging on its fintech growth drive. If it launches in the East African country, Stanbic can leverage its existing customer base in Kenya to cross-sell fintech offerings. However, it will face steep competition with established players like M-Pesa—which holds a 98% share of Kenya’s mobile money market—and Cellulant, another pan-African payments company which also has a strong presence in Kenya.

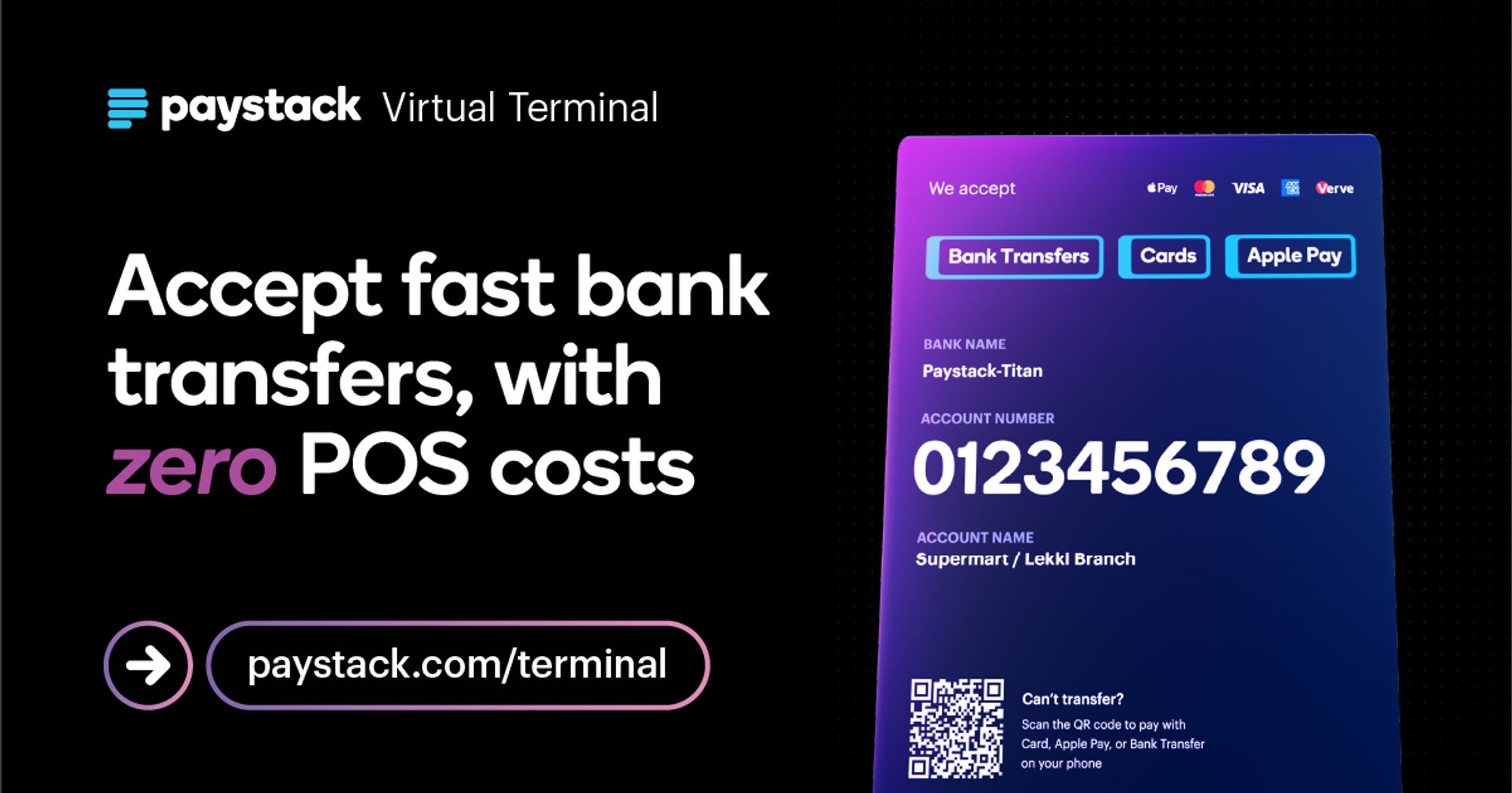

Accept fast in-person payments, at scale

Spin up a sales force with dozens – even hundreds – of Virtual Terminal accounts in seconds, without the headache of managing physical hardware. Learn more →

Unlimit expands cross-border payment solutions to Tanzania

While Sub-Saharan Africa boasts a booming diaspora remittance market, estimated at $53 billion in 2022, sending and receiving money across borders remains a complex and costly affair for businesses.

In 2017, Nigeria’s central bank had to create a special program to provide up to $20,000 per quarter to help small businesses access foreign currency for imports. Last year, Kenyan importers faced limitations as low as $1500 per day due to foreign exchange scarcity.

Unlimit, a London-based fintech company that specialises in cross-border payments, is focused on streaming these payments for businesses across Africa. Since launching in April 2023 with their Nigerian debut, they’ve followed with a successful entry into Kenya in June 2023 and a partnership with Union Pay International (UPI),—a payment service network—to expand its Banking-as-a-Service (BaaS) platform in November 2023.

Another expansion: Unlimit has expanded into Tanzania after it secured a licence from the Bank of Tanzania, making the country its third African market.

This expansion allows Unlimit to offer a range of new services tailored to Tanzania, including solutions for business payments, merchants, and international money transfers. The company will compete with other fintech companies like Flutterwave, Lemfi, and Payday in these African countries.

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $72,172 |

+ 0.54% |

+ 13.33% |

|

| $4,041 |

+ 0.06% |

+ 54.36% |

|

|

$149.60 |

– 2.61% |

+ 41.44% |

|

| $4.31 |

+ 23.23% |

+ 99.08% |

* Data as of 05:45 AM WAT, March 13, 2024.

Experience the best rates and enjoy swift 6-24hrs delivery times. Elevate your business with OneLiquidity–get started today.

- As the world marks the 2024 International Women’s Month, Moniepoint Inc has announced the launch of this year’s edition of the Women-In-Tech initiative. Ten women will take on roles in various teams that include Cloud Engineering, Backend Engineering, Technical Product Management, Data Engineering, Systems Administration, Technical Support and User Experience. These women will be provided with a salary, work tools, merch, the opportunity to work on live projects during the internship and an offer of full-time employment depending on assessment post-internship. Apply by March 17.

- The Corporate Social Responsibility arm of MTN Nigeria, MTN Foundation has opened applications for phase two of its “Yellopreneur” initiative, through which it intends to offer 150 female entrepreneurs with ₦3 million each as loans to boost their businesses. Apply by March 30 .

- Applications are open for the Access Bank Youthrive Program for Nigerian MSMEs. The program is a collaboration between the bank and the Vice President’s office, dedicated to empowering individuals and MSMEs. With a focus on capacity development, financial empowerment, and business exchange, the program aims to impact 4 million youths over the next four years. Apply here.

What else is happening in tech?

Written by: Mariam Muhammad & Faith Omoniyi

Edited by: Timi Odueso

Want more of TechCabal? Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- In a Giffy: business decisions powered by data-driven insights and analysis you can trust.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.