Swedfund, a Swedish development finance institution, extended a $30 million loan to Access Bank, Nigeria’s biggest bank by assets, to support small and medium-sized enterprises (SMEs) in Nigeria. The loan is part of a $295 million syndicate led by Dutch development bank FMO.

“Access Bank, known for its strong market presence and with a committed MSME strategy, serves as an effective partner to reach MSMEs in need of financing in Nigeria,” Kitanha Toure, Regional Director of West Africa at Swedfund said in a statement.

“This facility not only enhances our capital reserves, but also strengthens Africa’s trade capabilities and export potential,” said Roosevelt Ogbonna, MD/CEO of Access Bank Plc, at a signing event held in Hague, Netherlands. “Putting these funds to use, we aim to catalyse growth across various sectors, stimulate business development, create jobs, and deepen financial inclusion.”

The $30 million commitment is the third of its kind arranged by FMO for Access Bank, reflecting a shared commitment to boost Nigeria’s local economy and provide jobs. In 2018, the lender secured $10 million as part of a $100 million loan arrangement. The syndicate was arranged by European Development finance institutions FMO, Proparco, Norfund, and Finnfund.

Informal businesses estimated to be nearly 40 million are the backbone of Nigeria’s economy, accounting for roughly 90% of jobs. These businesses contribute over 45% to the country’s gross domestic product (GDP). Micro businesses make up a staggering 98.8% of this vast network.

“Access Bank is eligible to meet the 2X Criteria, a global baseline standard for gender finance, and recognised as the best SME bank for women entrepreneurs in Africa,” the statement read in part.

Access Bank has supported small businesses in Nigeria. In November 2023, the bank planned to target four million small businesses in total. This year, it increased its Micro, Small, and Medium Enterprises (MSMEs) loan scheme from N30 billion to N50 billion.

Swedfund, with a focus on empowering women in sub-Saharan Africa, recently ventured into Cote d’Ivoire. In February 2024, the fund invested in West African financial services firm Teyliom Finance to support female entrepreneurs in the country.

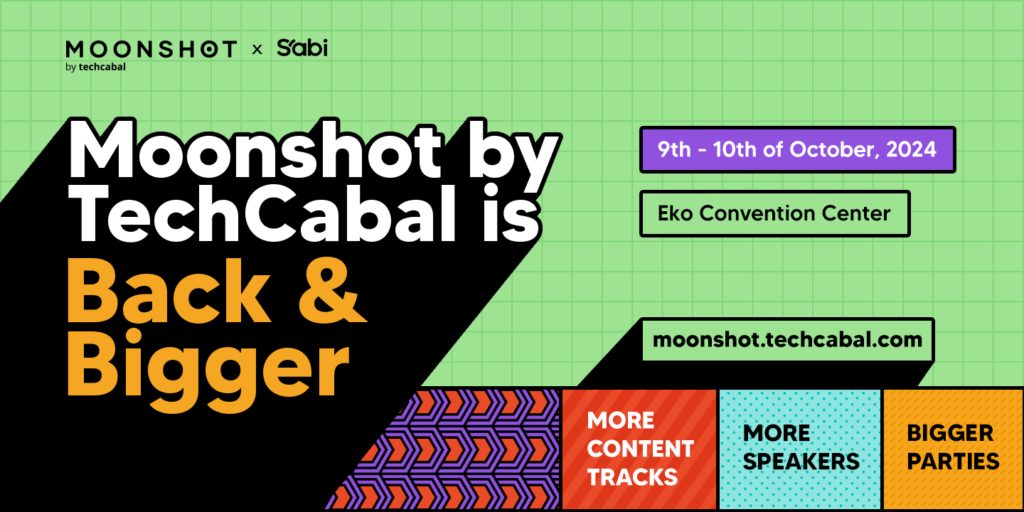

Have you got your early-bird tickets to the Moonshot Conference? Click this link to grab ’em and check out our fast-growing list of speakers coming to the conference!