Kenyan banks spend over $900 monthly to run a single ATM, and the bill grows for leading commercial banks with hundreds of ATMs spread across the country.

For years, automated teller machines (ATMs) were the go-to option for customers trying to avoid long queues in the banking halls. But not anymore, thanks to the growth in digital banking options like mobile apps and agent banking. It has allowed traditional banks to reduce their investment in ATMs for the fifth consecutive year.

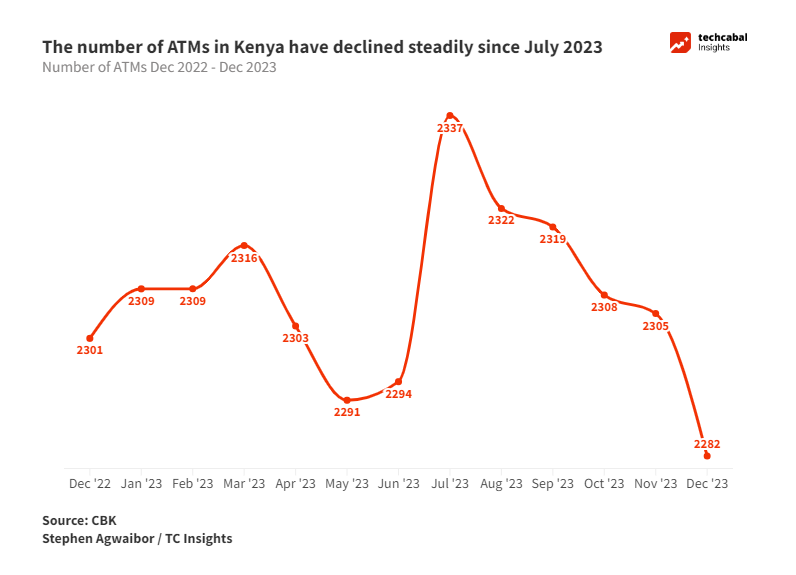

Banks closed 77 ATMs between January and December 2023, bringing the total count to 2,282, according to data from the Central Bank of Kenya (CBK). This is the lowest number of ATMs recorded in the country in half a decade, a notable drop from the peak of 2,573 ATMs recorded in 2019.

The shift is due to the growing popularity of digital banking channels. Starting with Equity Bank, Kenya’s largest bank by market capitalisation, all local banks have adopted digital channels.

Digital banking has grown in Kenya between 2020 and 2024. The value of digital payments in the country rose from $2.63 billion in 2019 to $7.15 billion in 2023 and is projected to reach $8.58 billion in 2024. Digital banking could also reach a net interest income of $255 million by the end of 2024.

Mobile banking was the most used channel, jumping from 52% in 2020 to nearly 68% by March 2024. Internet banking also grew, but at a slower pace, reaching around 23% in March 2024, reflecting increased internet access and device ownership.

ATMs are expensive

Kenyan banks incur a monthly cost of at least KES 117,000 ($906) per ATM, and lenders like Kenya Commercial Bank, which has 380 ATMs nationwide, could spend over KES 44.4 million ($344,000) on maintenance.

“It is costly to run an ATM terminal, so banks tend to save this cost by closing ATMs with less activity,” a bank executive told TechCabal. “These costs are in the form of topping up ATM channels with cash daily and manning the facility. This is not the case for digital transactions.”

In 2023, agency banking grew in Kenya, with 16 commercial banks and five microfinance banks (MFBs) enlisting 87,531 and 677 bank agents, respectively. More than 90% of the bank agents were working for Equity Bank (40,211), KCB (24,055), and Cooperative Bank (15,519), indicating the popularity of the service, especially in rural parts of the country.

The demand for cashless transactions is also evident in mobile money, whose transactions in Kenya grew to KES 788 billion ($6.1 billion) in December 2023. With 38.7 million users, mobile money penetration hit 75%. The value of money moved through these platforms jumped from KES 7.8 trillion ($60 billion) in the year to June 2023.

The COVID-19 pandemic accelerated mobile payment adoption, and many users continued using the channel after the CBK re-introduced transaction costs in early 2023.