The Central Bank of Kenya (CBK) has lowered the benchmark interest rate after inflation slowed in July. The CBK elected to lower rates by 25 basis points to 12.75%, pointing to an end of the tightening cycle.

This is the first time the interest rates have dropped since April 2020; they held steady at 7% for two years, until April 2022. From then on, they sharply increased, peaking at 13% in April 2024.

“Inflation is expected to remain below the midpoint of the target range in the near term, supported by a stable exchange rate, lower food prices with expected harvests, and stable fuel prices,” CBK said after the Monetary Policy Committee (MPC) meeting on Tuesday.

The central bank’s decision comes as inflation eases in the East African country. Kenya’s inflation slowed to 4.3% in July from 4.6% in June, staying below the government’s target of 5%. Food inflation held steady at 5.6% in both months. In December 2023 and February 2024, the CBK raised interest rates to address high inflation and strengthen the Kenyan shilling.

The Kenyan shilling has been stable over the last six months. Kenya’s economy grew by 5% in the first quarter of 2024, per an earlier report released by the CBK. Strong agriculture and services boosted growth while manufacturing and construction slowed.

“Exports were 11.8 percent higher in the first half of 2024 compared to a similar period in 2023,” the CBK added.

The Kenyan economy is expected to grow 5.4% in 2024, driven by services, agriculture, and exports. However, global risks, including trade and geopolitical tensions amongst the world’s leading economies like the US and Russia, could affect this.

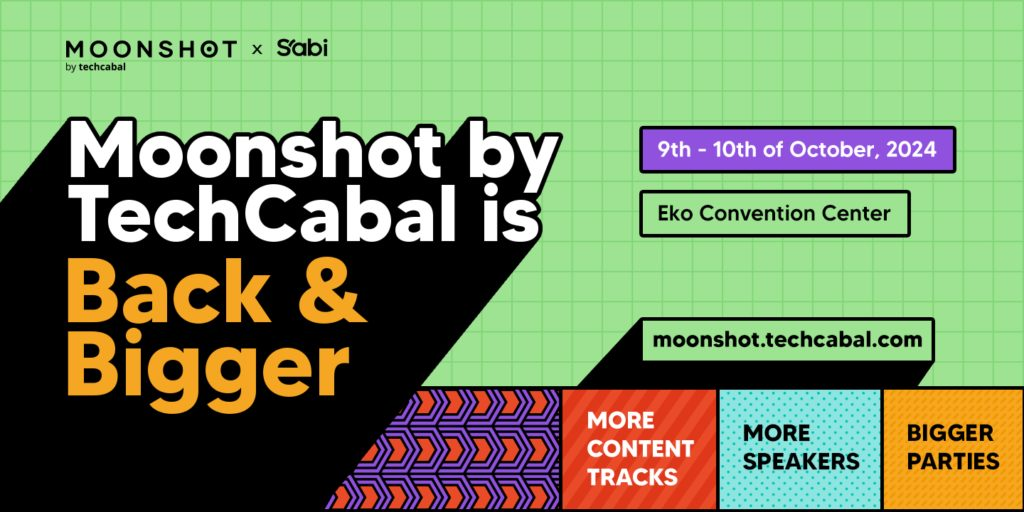

Have you got your early-bird tickets to the Moonshot Conference? Click this link to grab ’em and check out our fast-growing list of speakers coming to the conference!