First Published 4 August, 2024

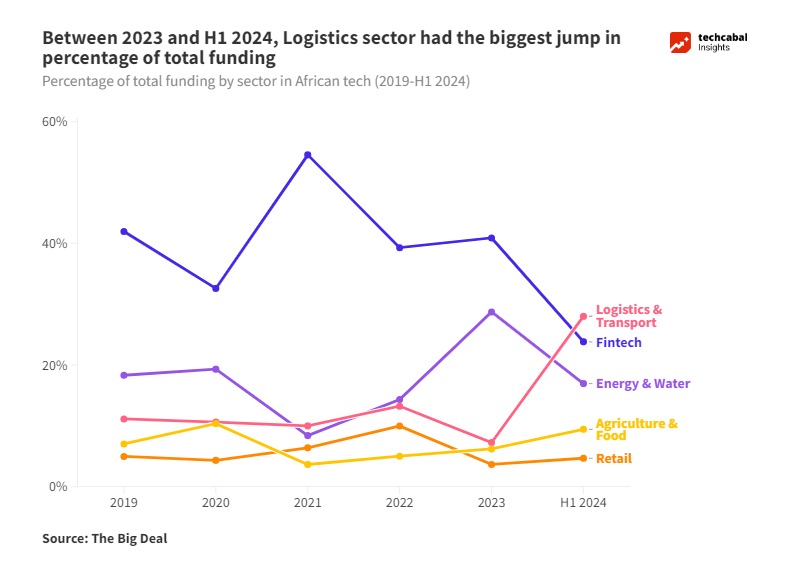

In the first half of 2024, the transport and logistics sector attracted the most funding—$218 million—knocking fintech off its long-held top spot as an investment darling. This interest in the sector is underpinned by the continent’s burgeoning e-commerce market and rising smartphone penetration and a growing digital middle class. Two of the three largest deals announced in H1 came from Moove and Spiro. Both mobility firms have markets in the four countries—Kenya, Nigeria, South Africa and Egypt—that dominate African tech.

The significant driver for logistics and mobility’s ascent can be linked to the rise of digital commerce during the COVID-19 pandemic, which positively impacted the growth of e-commerce and mobility in Africa. A survey by GeoPoll identified electronics and clothing as the most purchased items on the continent. For the Nigerian audience, their needs were more diverse. They ranged from home decor to hygiene products, alcoholic to non-alcoholic beverages, groceries, and automotive products.

The share of logistics funding in the last five years. Chart by Seun Joseph, TC Insights

Africa’s transport and logistics sector is far from fully developed; there is still poor road connectivity, insecurity, and problematic riders and drivers. Despite these inefficiencies, the sector is projected to surpass $200 billion in market size by 2029. Some investors have been enticed by the opportunity that logistics could create by connecting multiple high-growth industries such as e-commerce, last mile delivery, agriculture, electric vehicles (EV) and fintech.

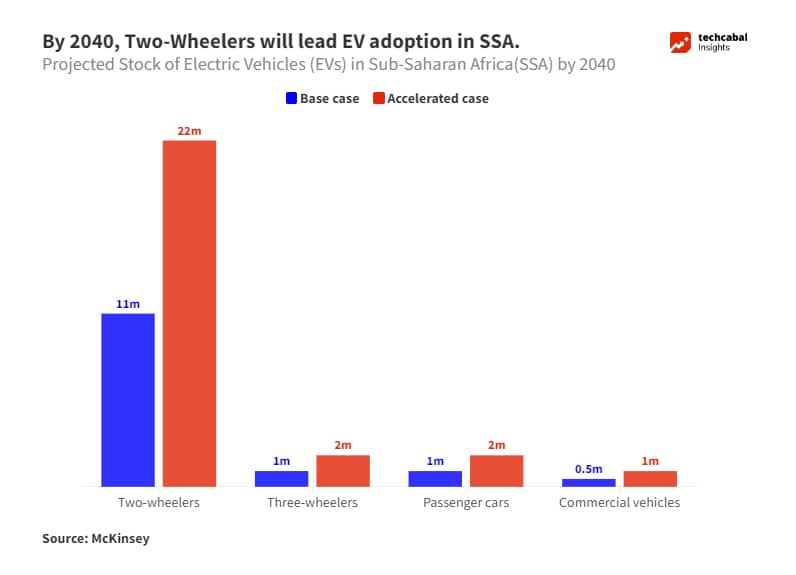

A good example of this convergence is the growing electric vehicle (EV) industry in East Africa. The region’s access to critical minerals like lithium and cobalt is attracting significant investor interest. To capitalise on this opportunity, infrastructure development is paramount. The revitalisation of rail corridors such as the Lobito and TAZARA lines is crucial for transporting these raw materials efficiently to global markets. These transportation networks will not only support the EV revolution but also create new economic opportunities along their routes, potentially stimulating growth in agriculture, manufacturing, and trade.

Next Wave continues after this ad.

The integration of logistics with fintech can streamline payment processes, improve supply chain visibility, and facilitate cross-border trade. As Africa’s digital economy expands, logistics providers that can leverage technology to optimise operations will gain a competitive advantage.

In its outlook for the future, audit firm PricewaterhouseCoopers (PwC) predicts a wave of mergers and acquisitions in the transport and logistics sector, driven by digitisation and AI adoption in H2 2024. The groundwork is already being laid. Companies like Ampersand in Rwanda and Spiro in Nigeria are demonstrating how the integration of energy infrastructure (charging stations) with mobility services (electric motorbikes) can disrupt traditional transportation models.

Ampersand’s evolution from an EV infrastructure provider to a dominant motorbike manufacturer in East Africa highlights the potential synergies between these sectors. By controlling both the charging infrastructure and the vehicles, Ampersand has achieved significant market penetration in Rwanda. Spiro’s rapid expansion of battery-swap stations in Nigeria indicates a similar strategy to capture a substantial share of the growing electric motorbike market.

By 2040, two wheelers will lead EV adoption in Sub-Saharan Africa. Chart by Seun Joseph, TC Insights

These developments suggest that the convergence of logistics, energy, and technology is not merely a future aspiration but a present-day reality in the African context. As the EV market continues to expand and the demand for sustainable transportation grows, we can expect to see more such collaborations and integrations across the continent.

While the full-scale mergers and acquisitions predicted by PwC may still be far ahead, the foundational partnerships and integrations necessary for these deals are already happening.

Joseph Olaoluwa

Senior Reporter, TechCabal.

Feel free to email joseph.olaoluwa[at]bigcabal.com, with your thoughts about this edition of NextWave. Or just click reply to share your thoughts and feedback.

We’d love to hear from you

Psst! Down here!

Thanks for reading today’s Next Wave. Please share. Or subscribe if someone shared it to you here for free to get fresh perspectives on the progress of digital innovation in Africa every Sunday.

As always feel free to email a reply or response to this essay. I enjoy reading those emails a lot.

TC Daily newsletter is out daily (Mon – Fri) brief of all the technology and business stories you need to know. Get it in your inbox each weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.