Access Bank, a Nigerian commercial bank with a market capitalization of ₦1.01 Trillion, is poised to acquire the National Bank of Kenya from the KCB Group. The deal will be concluded after approval from the Central Bank of Kenya (CBK) and the Competitions Authority of Kenya (CAK).

While the value of the transaction has not been disclosed, KCB Group announced in March it agreed to sell National Bank for 1.25x of the bank’s book value. Given NBK’s book value of $79.77 million in 2023, the deal could be priced around $100 million.

“I am pleased to inform you that the process is nearing completion and is only awaiting the required regulatory approvals, for which we believe we should be concluding very soon. In the coming months we shall communicate the next steps,” Joseph Kinyua, KCB Group chairman, said during the company’s H1 2024 earnings call on Wednesday.

KCB Group acquired NBK in 2019 and has spent over $60 million to ensure it meets CBK’s minimum capital requirements. The Nigerian lender is expected to inject more capital into NBK.

Access Bank did not immediately respond to a request for comments.

“We are on the tail end of the process. I want to acknowledge and make a special mention of the contribution of the National Bank team, it’s not the easiest of a performance environment as it is in the market and when you have the uncertainty of a transfer and you continue to perform, you truly deserve a special mention,” said Paul Russo, KCB Group chief executive.

The acquisition will expand Access Bank’s footprint in Kenya and could be concluded later this year. The deal is Access Bank’s second acquisition in Kenya under five years after the lender acquired Transnational Bank in 2020. NBK has a nationwide network and will increase the bank’s branches from the current 22.

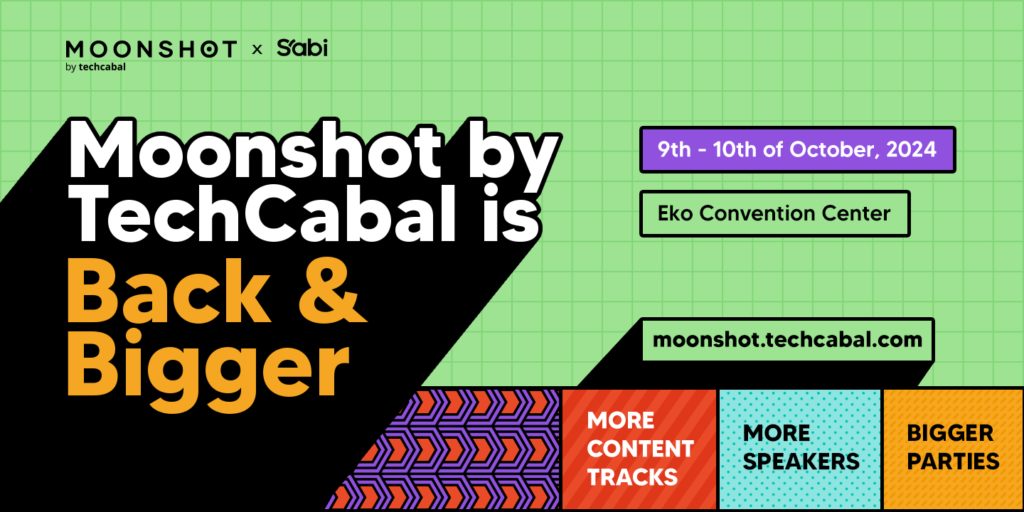

Have you got your early-bird tickets to the Moonshot Conference? Click this link to grab ’em and check out our fast-growing list of speakers coming to the conference!