Ventures Platform, one of Africa’s biggest VC firms which has invested in over 90 companies, claims it has generated returns on four out of six investment cohorts, according to its 2023 impact report.

In 2021, the VC firm announced the first close of its $40 million Ventures Platform Fund I to invest in startups across Fintech, Logistics, Healthtech, Cleantech. Ventures Platform raised that first close from limited partners and other organisations including Paystack CEO Shola Akinlade, Nigeria Sovereign Investment Authority (NSIA), and UAC Nigeria. The VC firm also raised part of that fund from global investors like Y Combinator CEO Michael Seibel and Adam Draper. Ventures Platform closed the $46 million fund in 2022.

The VC firm, which has backed some of the biggest companies on the continent including Piggyvest, Remedial Health and OmniRetail, disbursed $19.6 million from its $46 million fund across different startups on the continent.

It has deployed more than half of the fund in pre-seed (51.49%) and seed stage startups (40.84%). It deployed a tiny fraction (7.64%) in Pre-Series A startups.

The VC firm invests in startups that address critical challenges faced by low-income populations on the continent, such as limited access to healthcare, education, and financial services.

Of the $46 million fund, fintech startups got $6.8 million in funding while investment in SaaS startups ($2.8 million), B2B ($2 million) and Healthtech ($2.4 million) were the next highest.

The firm also invested $7.9 million across other sectors including logistics, autotech, insurtech and cleantech. The VC firm which predominantly invests in fintech believes there are more opportunities in the sector.

“We see opportunities in Intra-African remittance,” Kola Aina, founding partner at Ventures Platform told TechCabal.

Although Ventures Platform has recently talked up plans of investing outside of Nigeria, 80% of the Fund I investment went to startups headquartered in the Big 4.

While Africa’s startup scene has witnessed a drop in funding, Aina says the funding downturn has not affected its investment thesis.

“We believe this is the best time to invest, there is less noise. We are now focused fundamentally on solid unit economics,” he said. “Businesses don’t have to rely on follow-on funding to figure things out.”

Investing comes with learning. A key challenge for VP has been a mismatch between the fund’s lifespan and the long-term needs of promising startups. Its workaround is providing follow-on funding for these startups.

“Even as a seed-fund, we are data driven. We don’t do spray and pray, we let the data inform us on our follow-up funding.”

In July 2024, Ventures Platform talked up spreading its investment across Africa. The VC firm had previously invested in 12 Non-Nigerian startups like Notto in South Africa, Union54 in Zambia, Karcel in Egypt.

“Even though we started from Nigeria and most of our investments are based in Nigeria, we always set out to be a pan-African investor,” said Dotun Olowoporoku, the managing partner of Ventures Platform.

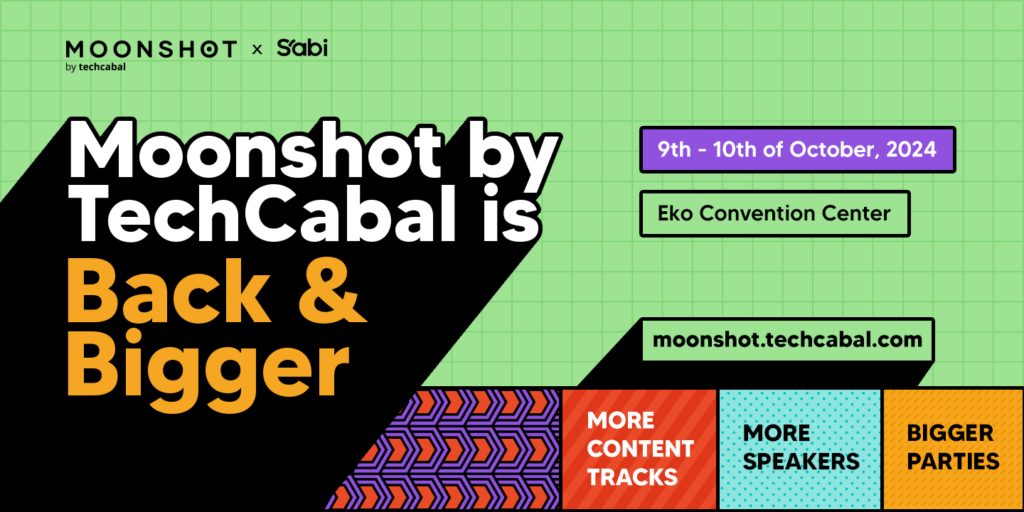

Have you got your early-bird tickets to the Moonshot Conference? Click this link to grab ’em and check out our fast-growing list of speakers coming to the conference!