On Thursday, Leatherback, a cross-border startup founded in 2019, announced that Ibrahim Ibitade, co-founder and CEO, was stepping down. In his place, Toni Campbell was named interim CEO, while lead investor and cofounder Dayo Amzat was named non-executive director.

At the best of times, the exit of a cofounder from a business will raise flags. For Leatherback, it was especially curious given its eventful past year.

In November 2023, the company was under the radar after authorities claimed that a shipping company, SDQ Facilitators, had used a Leatherback account to defraud unknown persons of about $10 million.

There were reports that Leatherback’s Nigerian bank accounts were blocked, and in a bit of the dramatic, the Economic and Financial Crimes Commission (EFCC) declared Ibitade wanted.

Persons with knowledge of the matter said the EFCC has since rescinded that notice, and Ibitade has filed a human rights suit against the commission. Leatherback has also taken SDQ Facilitators to court to recover money on behalf of the victims.

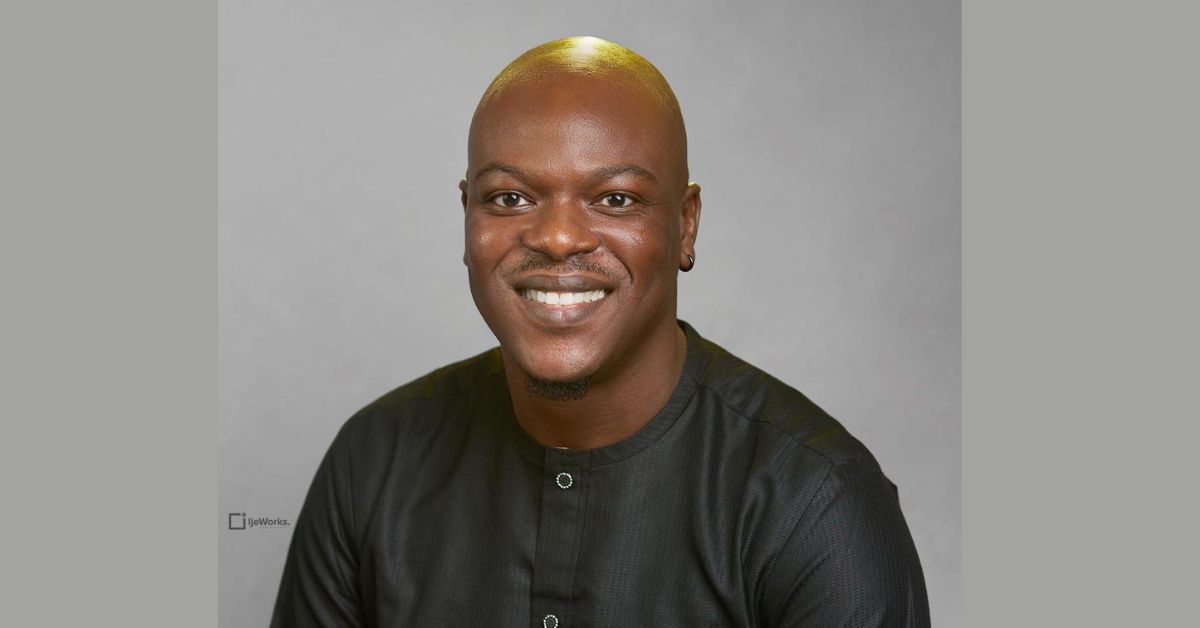

Against this backdrop of events and Leatherback’s terse statement announcing Ibitade’s exit, it feels like there’s more to this change of leadership than meets the eye. Ibrahim Ibitade spoke to TechCabal on leading Leatherback, the incident with the EFCC, and the misalignment of goals that necessitated his exit.

(This interview has been lightly edited for clarity)

TC: On Thursday, Leatherback announced you stepped down from the company. What drove your decision to step away from the business?

I want to start a family. I should be married now with kids, but I’m not. My dream and goals of being a family man do not align with the requirements of the job right now. It’s not something that I can juggle.

I’ve always spoken to people who know me, and I’ve shared that I want to stop doing anything major before I’m 35 and be able to move on to handling things on my own.

Ultimately, it was time. In five years, we’ve done a lot and achieved quite a lot together in the business. I’m leaving primarily to move on to the next phase of life.

TC: Did a disagreement with your major investor play a part in your decision?

Partners disagree.

First of all, Zedcrest is a major investor in Leatherback, but I’m still a significant shareholder.

But there are times when disagreements happen, and after multiple misalignments of goals and visions of both parties, I figured that it was time.

I had already steadied the ship to a large extent. The ship needs a very different trajectory right now, and I had to just make that decision to step down so I can focus on other things and of course, support them in every way they can with growth and development.

TC: But it raises some bells when an investor steps in

I know it raises some bells, but first of all, there was no stepping in. Since 2022, Dayo Amzat has held Friday morning management meetings with the entire Leatherback team, and that was based on my deferring to him to guide and provide his expertise. Zedcrest has always been heavily involved in the entire process, not day to day, but at least in making strategic decisions.

Zedcrest has always been on the Leatherback board, while Dayo has been a board advisor and has not missed one board meeting for the UK board in the last three years. We’ve been working together.

There tends to be disagreement or misalignments. All those factors culminating together made me decide it’s time, and I’ve done my part. This dream is one that I’ve always had; I’ve pushed it to a particular level, and it’s time to move on. So it’s nothing significant or major.

TC: Let’s segue into the issue with SDQ Facilitators. Was Leatherback’s Nigerian bank account blocked in relation to that incident?

Leatherback’s accounts were not blocked; that’s the fact. Our accounts are still functional.

TC: Were Leatherback’s accounts blocked at the time or at any time?

Leatherback has quite several accounts in different countries. None of our accounts in different countries were affected except Nigeria. And that was just one or two of some of our bank accounts in Nigeria. So we had a couple of those accounts that the EFCC placed a lien on for a day or two, and they raised it after a day or two and there is evidence to prove that.

But that’s just one or two of our accounts in Nigeria, and those are the ones that were affected. None of our accounts in any other country was affected in any way or form at all. None of them.

TC: There were claims that they were transactions that Leatherback could not account for.

Transactions are not missing in Leatherback. And I mean this 100%.

To refer again to some of the issues that we faced at Leatherback. The extent of what we faced in Leatherback are situations where maybe a client receives fraudulent funds in their accounts, and we are mandated by law, to place a lien on that client’s account.

Sometimes, the client goes on Instagram or Twitter and LinkedIn and starts talking about it because they don’t understand that legally when your account receives fraudulent transactions, we are mandated to hold on to the funds when the other bank has raised a query and not take any action.

We can’t even inform you because it is tipping off, and tipping off is illegal, and we can be held accountable.

So that period where we can’t really inform people is what makes people start going online and saying different things. And that’s the extent of what you will find.

Some of these comments that you said now sound like some of the things that those people have said. It’s people’s money, and some of them will raise spurious queries. Some people will involve the CBN and the EFCC; unfortunately, we can’t do anything.

We have to just be quiet, watch, listen, and wait till the investigation is done by the other bank so that we can move forward. I’ll tell you something that just happened in the UK.

The ABP fraud law is if I send money from my bank account today to another person in another bank, and that person defrauds me. The law right now in the UK is that if I raise a query, both my bank and the bank that I send that money to that the fraudster has a bank account in, must reimburse me 50% apiece of that money. Whether they are liable or not, whether it’s my fault or not, it doesn’t matter.

There’s a lot of liability that falls on the banks in this situation that many people don’t know.

TC: What is the status of the incident with SDQ Facilitators?

The SDQ matter is in court. There’s an interpleader motion in the court right now where Leatherback has opened up and done its part and told the EFCC, “this is what we’ve been able to recover out of these transactions, because we did our part as a regulated organization.” We reached out to different people, and different banks, and tried to recall some transactions.

We’ve been able to recall a figure, but I can’t release it right now. So the matter is in court, and Muiz Banire represents us. Our lawyers have stated to the EFCC the amount that we’ve been able to recover.

We’re not liable in this matter, but we are telling the courts to decide how to distribute the money amongst the people who have lost money in this situation.

Those who feel that they are party to it can come and join as parties to the matter.

And so that’s in court. If we had anything to hide, we would not be in court. And we are the ones who instituted the action. We went to the court because we didn’t want a situation whereby some people say we got this, we did not get this. That’s on that. That’s where SDQ is right now.

I am not aware of anything or any instance where someone will say their transaction is missing with Leatherback, or the transaction was missing in relation to the SDQ matter, and it has not been attended to.

There is nothing of such right now beyond the scope of these two scenarios that I have given, and there’s evidence to show that.

TC: How did Leatherback get involved in the incident concerning SDQ Facilitators?

Leatherback provides multi-currency accounts, local currency accounts in quite a number of countries. We offer collections accounts to people who want to make payments across multiple jurisdictions.

What happened in this situation is Leatherback issued an account to somebody, a company called SDQ Facilitators, a shipping company. When Leatherback issued an account to them, it was fully KYC, fully KYB, everything is properly structured, and we need the same standards that we do in every other country is what we went through with these guys.

We issued them an NGN account, a USD account, also a GBP account. They were collecting funds in their NGN account and exchanging it into other currencies on Leatherback and paying out.

In this situation, Leatherback is like a bank, sort of. The account is in your name, it’s not in Leatherback’s name. So Leatherback cannot log into your account. You have your own username, password, and your mobile application. The same way a full bank will give you, that’s what you have. And when you’re doing transfers, it does not show Leatherback’s name. It shows your name.

SDQ Facilitators was doing transactions on Leatherback for quite a while like every other person.

Leatherback has quite a number of users globally, so they were doing transactions like every other person. We noticed that at one point, some people reached out to us and said they gave one of our clients money, and the client has not delivered the corresponding currency to them.

Now, at that point, we knew only SDQ. When the EFCC reached out to us, we printed over 10,000 pages of documents relating to SDQ transactions. That shows you the extent, and I’m not exaggerating this 10,000- that shows you the extent of KYC, KYB, and additional information that we request from our users. I mean, from users like SDQ, when they even receive money into their Naira account in Nigeria, Leatherback goes a step further to ask them, Why are you receiving money into your account?

We collected the required information and gave it to the EFCC. The EFCC contacted us and said some people petitioned them. Those people said they paid SDQ Naira into SDQ’s Leatherback account, and SDQ did not deliver the corresponding currency.

The EFCC invited us, SDQ, who was at large, and every other person. We shared all the information with them and let them know that we’re a regulated institution. This is the information we have on these transactions. We’ve done our part.

We are just an account provider, and none of these funds sit with us. Exchanges were done and we gave the corresponding currency, and these people paid out. Our own money is not involved at all. None of our funds are involved in this matter.

So if someone gave SDQ money, we don’t know why they did so or why they are involved.

You can’t arrest the Access Bank CEO or Union Bank CEO because I defrauded other people with my Union Bank account. It doesn’t work that way.

TC: Talk to us about being declared wanted by the EFCC

Bfore I knew it, the EFCC declared me wanted, and I came down to Nigeria immediately. Everyone is aware of that. I went to the EFCC headquarters and their branch in Lagos.

I instituted action against the EFCC. I went as far as anyone could go, and ultimately, they were able to pull the notice down.

I have a letter from the EFCC stating that they notified all the other agents that I’m no longer on the watch list and pulled it down. I also have a letter from the EFCC to the DSS and immigration. That was just an aggressive tactic. Unfortunately, at that point, some people were telling the EFCC, from my understanding, that Ibrahim could make this easy.

Because people need their money at that point, they forget that this is a corporate organization, and this is a corporate matter. So go to Ibrahim, he can sort him out. He has money. He can do is put him under pressure, lock him up, and all.

TC: How much did SDQ Facilitators take from these people?

What you’ll find, based on our own records, is probably $8-10 million. Leatherback was able to recover part of it.

Based on that, the EFCC declared me wanted. I went down, and then they said, the reason why they declared me wanted was because I did not come to them.

And I said, but my lawyers have been coming to you, and my compliance managers have been here. My entire team has been here so why do you need me? That’s when I figured that there were some aggressive tactics. So I spoke to them, I was in Nigeria for a couple of weeks, and Alhamdulillah, we were able to get the post down.

Since that time, we also started working with the EFCC to try to recover some of these funds. I need to clarify the part we played in the recovery: our money is not involved here, nobody gave us money. People gave SDQ people.

On some transactions, we were able to initiate recall or tracers to find out where is this money, and even place flags on those monies where they are, to see what can be recovered.

We worked with the EFCC to see what we could recover. And we’ve gone to the court to say, “Well, court, at this point, it looks like this is all we can recover so we want you to advise us on how people will split these funds accordingly.”

Leatherback funds were not involved in SDQ issues. It was a tough period for Leatherback, no doubt, but we pulled out of it. We’re still here. We’re not going anywhere.

None of these things going on or me stepping and has anything to do with SDQ, this is not a situation of an investor stepping in or something, even though there are people.

TC: Was the EFCC issue and the optics of it a distraction nonetheless? And what do you think about the fact that this looks like an investor stepped in?

First of all, the EFCC issue made me a tough person. Very daunting things happened to me during that period that I can’t even start explaining right now, but those things made me stronger. The SDQ issue is almost a year old now, and we’re here.

Beyond that, for the business, it has come to the point where I want to take a step back and let someone else drive the reins to a particular point.

At the end of the day, many founders have issues. The Zedcrest relationship with Ibrahim is not an investor-type relationship alone. We are cofounders.

Dayo Amzat and I are co-founders of the business. The journey has been topsy-turvy, quite a number of things.

I will say conveniently and authoritatively that of all the portfolio companies that Zedcrest has today, Leatherback is probably the only one surviving and still flying high and very fast.

It’s been good, it’s been bad, ups and downs and all.

At the end of the day, for investors, I don’t think there is anything shaky to consider.

I think it’s more of a transition going on. The transition might not have happened the way we expected it to, but it’s still ongoing. And then there are things that will still happen to ensure that things are done later and that, at the end of the day, it will flow smoothly.

So I know that Leatherback will soon actively commence a couple of announcements that will show what the next batch is, and also a lot of information will also come out from me to show what I’m focused on next. Maybe I’ll be seen on a tomato farm or something.

If SDQ did not make me step down from Leatherback a year ago, and trust me, SDQ issue was very tough. I can’t imagine if you can relate to what it means for you to be declared wanted. I was just 31 at that time and it was tough for me.

It affected my family. If such significant thing did not make me step down at that point in time. I mean, trust me, every other thing that could be said to have happened, either read disagreement or something is meagre or paltry to what will influence me to properly step down.

TC: But some people will argue that rifts build up over time

I alluded to that. There are many factors, and as I mentioned at the beginning of this conversation, misalignment of goals matters. I’ve done this for five years, so it’s a question of whether my goals align with those of my cofounder, the board, and the business.

I’ll give you an example. My goal might be that Leatherback needs to go on an aggressive fundraising drive because businesses like ours have done this and that, but the business goal might be that, you know what? No, let’s still keep down, and let’s keep building organic right now.

So it could be different. But for me, definitely, like I mentioned earlier, we’re also at the point where there’s a misalignment of some goals in there. But that’s not enough. It’s a lot of things; I even mentioned needing to get married. I need to do so many things.

If you ask people who are close to me, everybody knows I’ve always said it. I want to be I want to stop by 35. I really want to stop by 35. I’ve always wanted to.

I’m a staunch Muslim. I just got back from Umrah two days ago. I have so many dreams, so many things that I want to do Islamically. Five years is enough.

The next goal, the next steps, are things that someone else will drive and take. And I’m just saying that, yes, there are things, don’t get me wrong, but those things are not enough to make me back down if the SDQ issue did not make it back down.

TC: Is Toni Campbell, the interim CEO, an investor?

There are only two investors in Leatherback today: Zedcrest and I.

Toni Campbell is not an investor. He’s an interim CEO who was appointed and has no shares in Leatherback.

There are still many things that will happen, decisions that will be made gradually to get Leatherback to a point where a substantive CEO may be announced, and many other things.

Toni Campbell’s appointment is not any way to position Leatherback in a way that we can go and raise funds from anybody. It was a decision for someone who’s good enough to at least step into the shoes for now.

TC: How did the board handle your decision to step down?

Emotions will go around. It’s not possible for me to step down without reaction. If I told you my cofounder took it well, that would be a lie. It’s the hardest thing I’ve ever had to do, but it’s a personal decision and they definitely were not happy.

There was some back-and-forth on this before the final decision was made. I remember a conversation with the board where they said they wouldn’t accept my resignation.

Ultimately, it was something I decided to do.