TGIVD ☀️️

If you got the acronym in our welcome message, congratulations on finding love.

You can show us some of that Valentine’s love in a couple of ways.

- Follow us @techcabal on TikTok and help us compete with Bella Poarch and all the other TikTok dancers.

- Share our pitch call with all the brilliant feature writers you know.

- Fill out the form at the bottom of this edition to let us know how we’re doing.

Thank you!

Features

Quick Fire 🔥 with Timi Odueso

Timi Odueso is a content strategist who’s spent the past decade helping media and arts companies across Africa craft, manage and grow compelling narratives. When he isn’t obsessing over content or growth questions, Timi can be found writing fiction and playing League of Legends. Coincidentally, and purely so, he’s been writing/editing TC Daily since 2021 and is partly responsible for all bad puns since.

Imagine you have a big box of colourful storybooks, and you want to share them with friends. My job is to help find those friends, make sure they know the storybooks exist, and get them excited to read them every time a new one comes out. I also help make the storybooks fun, easy to read, and interesting, so all our friends keep coming back for more stories!

At first I was afraid, it was part of my job as a journalist.

And then, it offered me the opportunity to learn a lot of things and learn them fast. There’s product management, yes, but there’s also front-end development, UX/UI design, performance marketing, and content strategy. I’ve even done a couple of expense sheets.

Plus law and products are similar in the sense that you can do both in any sector and any company.

It depends on the objective of the newsletter. For a newsletter with an objective to redirect leads or readers outside the product itself, the metric of success is not an open rate but a click-through rate. The value here is not how many people open, it’s how many people click.

Open rates are super critical; I’d say they’re the primary measure of success but look, they’re just percentages, and percentages can be misunderstood.

For example, a newsletter recording an increase in open rates from 35% in January to 40% in June is not necessarily a good thing. In January, the newsletter may have had 100,000 readers which would mean a 35% open rate is 35,000 active readers. In June, they may have dropped to 80,000 which means just 32,000 active subs at a 40% open rate. The percentage increased, sure, but the real numbers tell us that numbers are dropping.

That’s why it’s essential to go beyond percentages and focus on the actual numbers, whether it’s clicks, conversions, or another metric, to truly measure your newsletter’s success.

Be consistent—this is the hardest part. I always like to say that newsletters are hungry-hungry babies. They require consistent attention or they will fester away into irrelevance.

The biggest is that we’re still navigating is email literacy.

Over the past five years, across every company I’ve worked with, we’ve consistently found that our target audiences aren’t as email-literate or email-conscious as we’d like. This gap makes growth tougher by limiting the number of high-quality leads we can generate. For example, you might run an ad and capture 4,000 leads, but only around 400 of them will consistently read the product—many might not even remember clicking the sign-up link.

To address this, we’ve tightened our sign-up process with a double opt-in. This ensures that only genuinely interested readers subscribe, even if it means a narrower funnel. The funnel is so thin it only reinforces my theory on email literacy. I think we continue to grossly overestimate just how many people use emails for their day-to-day tasks.

Collect payments Fincra anytime anywhere 🌟

Are you dealing with the complexities of collecting payments in NGN, GHS or KES? Fincra’s payment gateway makes it easy to accept payments via cards, bank transfers, virtual accounts and mobile money. Get started now.

Startups

MAX laid off 30% of its workforce in January as it pursues EV goals

Nigerian mobility financing startup MAX has made a bold bet on electric vehicles (EVs), but not without casualties. In January, the company laid off 150 employees—30% of its workforce—as it transitioned to exclusively financing EVs across Nigeria, Ghana, and Cameroon.

The move is part of MAX’s ambitious plan to finance 120,000 EVs, triple the number of vehicles it supported in 2024. However, the layoffs have raised concerns among employees, some of whom claim the terminations were abrupt and lacked severance packages. MAX insists the restructuring was necessary, offering support measures like job placement assistance.

Beyond workforce cuts, the company has introduced cost-saving measures, including reduced energy consumption and a push for cleaner energy sources at its offices and battery swap stations. MAX is also scaling its EV charging infrastructure, securing a $10 million partnership with PASH Global in November 2024.

Despite its aggressive pivot, MAX faces huge financial demands. Since 2019, it has raised $63 million in equity and debt financing, but with EVs costing up to $900 per unit, securing additional capital will be critical.

The mass job cuts signal that the mobility financing startup is on a path to becoming cost-efficient. Nigeria’s EV industry has seen some remarkable advancements. Over the past few months, players like Siltech, are increasingly betting that Nigeria, despite the infrastructural lack, is ready for EVs.

MAX is part of that bubble; however, its EV bet is a question of whether the startup can balance its ambitious goals with the human cost of its transition. It needs to raise money to finance and prioritise its new growth efforts, sacrificing profitability—or the hopes of it—in the process.

How Paystack protects your business from cyber fraud

Discover Paystack’s many security features and best practices for fraud prevention. Learn more→

Banking

Nigerian government takes over Keystone Bank after court ruling

At the start of the week, rumours spread about the Nigerian government taking over Keystone Bank, a commercial bank with ₦307.5 billion ($204 million) in total assets. This follows the Central Bank of Nigeria’s (CBN) decision in January 2024 to sack the boards of Keystone, Union Bank, and Polaris Bank over “regulatory non-compliance and corporate governance failure.” The apex bank said they were also involved in activities threatening their financial stability.

To address the rumours and avert a potential bank run, Keystone Bank issued a statement on Tuesday clarifying that the Lagos State Special Offences Court had ordered the forfeiture of shares previously held by its shareholders, transferring ownership to the federal government.

When a government takes over a bank, it often signals deep financial or corporate governance troubles. In Keystone’s case, the move could suggest that the government is stepping in to stabilise operations, protect depositors, and ensure compliance with regulatory standards. While this intervention is intended to prevent a collapse and maintain confidence in the financial system, it also raises questions about the bank’s future and its recapitalisation efforts. Keystone Bank stated that the clarity around ownership will allow it to focus on raising the required capital to maintain its banking licence.

This is not the first time the Nigerian government has taken such action. In 2009, the CBN intervened in several banks, including Afribank, Finbank, Intercontinental Bank, Union Bank, and Oceanic Bank, firing their executive directors after audits revealed severe financial mismanagement. The CBN injected ₦400 billion ($2.5 billion at the time) to stabilise their balance sheets. Some of these banks were later acquired by new investors or rebranded. For instance, Skye Bank, which faced similar issues, was taken over and eventually became Polaris Bank in 2018.

Keystone Bank itself has a history of revival. It was created in 2011 after taking over the assets of the distressed BankPHB. BankPHB’s licence was revoked for failing to meet the recapitalisation deadline.

That moment in history could come full circle if Keystone fails to recapitalise by the March 2026 deadline set by the CBN. While the bank shows no immediate signs of weakness, rumours about consolidation among smaller banks continue to swirl—with Keystone Bank featuring heavily in the early talks.

With the takeover of Keystone Bank, the government could inject much-needed funds to stabilise the bank’s financial books in the short term while figuring out long-term solutions. Despite talks of a bank run, it is in the CBN’s interest to maintain confidence in the retail banking sector.

Insights

Funding Tracker

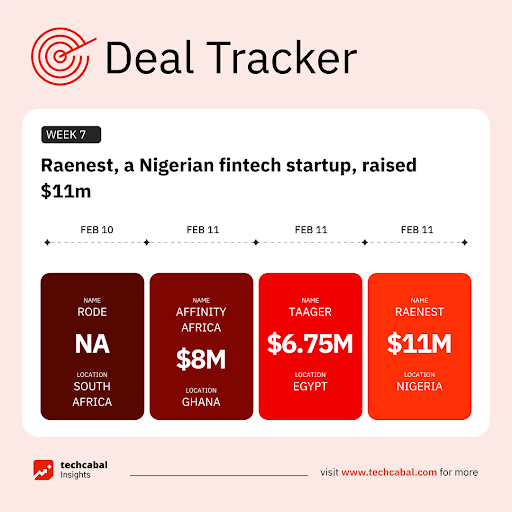

This week, Raenest, a Nigerian fintech platform, raised $11 million in Series A funding. The round was led by QED Investors, with participation from Norrsken22, Ventures Platform, P1 Ventures, and Seedstars. (February 11)

Here are other deals for the week:

- Egyptian social e-commerce platform Taager secured a $6.75 million Pre-Series B funding round led by Norrsken22. The round included participation from Endeavor Catalyst, Beltone VC, and existing investors such as 4DX Ventures, RAED Ventures, BECO Capital, and Breyer Capital. (February 11)

- Affinity Africa, a Ghanaian digital banking platform, secured $8 million in seed funding in a round led by Grazia Equity and BACKED VC. Other participants include Enza Capital, Launch Africa, Renew Capital, Finca International, Attijariwafa Ventures, Impact Assets, and other prominent angels. (February 11)

- Rode Publications & Media, a South African startup, secured an undisclosed investment from REdimension Capital’s Real Estate Technology and Sustainability Fund I. (February 10)

Follow us on Twitter, Instagram, and LinkedIn for more funding announcements. Before you go, read our State of Tech in Africa review for 2024. Click this link to read it.

Expand with Cedar Money

Expand your business globally with Cedar Money! Our cross-border stablecoin solutions offer fast, secure, and reliable transactions, simplifying payments and fueling growth. Unlock seamless global trade today. Visit www.cedar.money to get started!

CRYPTO TRACKER

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $96,720 |

+ 0.04% |

– 0.18% |

|

| $2,693 |

– 1.11% |

– 16.52% |

|

|

$2.57 |

+ 3.92% |

– 9.35% |

|

| $195.45 |

– 0.41% |

+ 3.32% |

* Data as of 06:45 AM WAT, February 14, 2025.

Events

- The ATCG Abuja 2025 Convening, themed “From Potential to Practice—Accelerating AfCFTA Implementation for African Tech and Creative Sectors” will be held from February 24-25, 2025. A centrepiece of the programme will be a ministerial roundtable featuring Nigeria’s Ministers of Communication, Innovation & Digital Economy, and Trade & Industry. During this two-day event, anticipate game-changing insights, powerful partnerships, and high-energy discussions that challenge boundaries and unlock new opportunities across the continent. If you work in the technology and creative sectors in Africa and wish to create new business opportunities by leveraging pan-African digital trade, then this event is for you. Don’t just witness Africa’s digital transformation—be a part of it! Register here.

- The Africa Tech Summit in Nairobi, Kenya taking place 12th & 13th Feb 2025 will once again provide unrivaled insight, networking and business opportunities for African and international investors and tech leaders who want to drive growth across the Continent. The event connects 2000+ industry leaders, 1000+ companies, and 160+ speakers via four tracks plus workshops, expo and multiple fantastic networking opportunities. Tickets are on sale now.

- Join Africa’s creative innovators, entrepreneurs & leaders at The Omniverse Africa Summit, at Landmark Event Centre, between 25 – 28 Feb 2025. Explore transformative tech, business & sustainable growth. Register now.

- GITEX AFRICA 3rd edition is NOW OPEN for registration. Africa’s largest tech and start-up event will be held from 14-16 April 2025 in Marrakech, Morocco. Attend to see the leading brands in tech, and the most innovative startups, and network with tech leaders, investors, speakers and government delegations from across Africa and across the globe. Register here.

Written by: Faith Omoniyi, Stephen Agwaibor & Emmanuel Nwosu

Edited by: Timi Odueso & Olumuyiwa Olowogboyega

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.