Nine years ago, Shola Akinlade, Paystack’s CEO, bet on making online payments frictionless and that bet paid off with a $200 million acquisition by Stripe. Now, his startup is betting on consumers transferring money with Zap, its new app, to fuel its next growth phase—a shift for the fintech known for its business-focused products.

Zap does one thing well: it allows users to send money to any Nigerian bank account within 10 seconds. Customers can fund their Zap account by linking their Nigerian bank accounts to Zap using Paystack’s direct debit infrastructure or depositing money directly into a Paystack-Titan account. “We have a partnership already with Titan Trust Bank and we extended that partnership to Zap,” Akinlade told TechCabal, explaining how Paystack can hold deposits.

Only commercial bank accounts can be linked through Paystack Vault, excluding neobanks like OPay, PalmPay, and Moniepoint from the list of supported institutions. Depositing ₦10,000 via a linked account costs ₦35, while withdrawing ₦9,900 incurs an additional ₦25 fee—meaning customers pay ₦50 in fees for depositing and withdrawing ₦10,000. This pricing makes Zap more expensive for users than OPay, PalmPay, and Moniepoint, which have already established themselves as more affordable alternatives. “The pricing is going to evolve,” Akinlade said.

Users can also link debit or credit cards from any country to Zap. In a demonstration at the company’s Evening With Paystack, Akinlade transferred money from his Bank of America card to a Nigerian account almost instantly. Although the card feature resembles a remittance service by allowing Nigerians abroad to link their cards and instantly send money home, Akinlade told TechCabal that Paystack is not yet entering the remittance market.

“Today, we’re not targeting the remittance scenario. Our ideal scenario is for people from abroad to come to Nigeria and make transfers using Zap. If you’re sending money to Nigeria from abroad, you can wait a couple of minutes. Our priority is immediate delivery,” he said.

Customers can only send or deposit money on the app after completing know-your-customer (KYC) checks. Tier-1 users, who verify with only their Bank Verification Number (BVN), can send up to ₦50,000 daily and maintain a maximum balance of ₦200,000.

For Tier-2 users, who must provide a selfie, physical address, and National Identification Number (NIN), the limits rise to ₦200,000 daily and ₦500,000 maximum balance. Tier-3 users can send up to ₦5 million daily and hold up to ₦100 million in their accounts after verifying their address.

Why bank transfers? Why now?

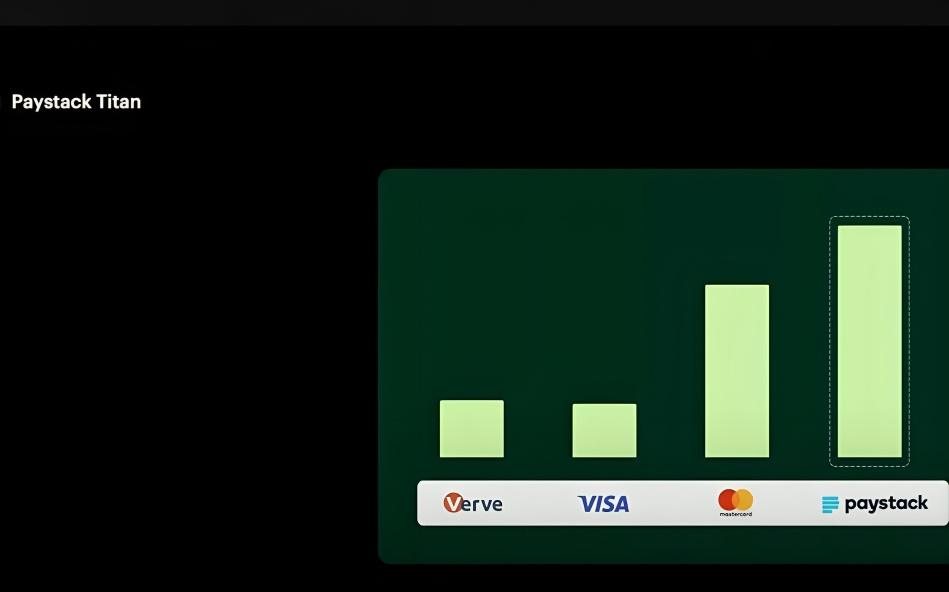

In 2023, bank transfers accounted for over half of the transactions Paystack processed, double the previous year, growing from 28% in 2022 to 58%. In the two years since then, the startup has deepened its pay-by-account infrastructure with several products like Paystack Terminal, its attempt at in-person payments, and integrations with other fintechs like OPay.

These products have all been built on Paystack’s pay-by-bank infrastructure and contributed to the payment channel surpassing card networks like Visa and Mastercard on its network. “What’s important (to Paystack) is building reliable infrastructure: starting from the bottom with the infrastructure, then delivering great experiences, then crossing borders,” Akinlade told TechCabal.

While getting customers to use Zap directly from their phones could drive revenue growth for the Stripe-owned fintech, the app represents Paystack’s ambition to build a financial services ecosystem. After years of dominating Nigeria’s online payment processing, consumer-focused payments will allow Paystack to exert more control over the flow of funds within its network.

If a Chowdeck user pays by transferring money from their Zap account to Chowdeck’s Paystack-Titan account, the money never leaves Paystack’s ecosystem. This closed-loop model could improve the online payment experience, powered by Paystack’s APIs—which process transactions faster than you can blink—and a bank transfer infrastructure where 98% of transactions are confirmed within 10 seconds.

Zap’s minimal homepage also streamlines the user experience. The customer’s balance appears at the top left, recent transactions fill most of the screen, and a single “Send Money” button sits at the bottom.

“Bank transfers are now a big thing but still broken in many ways. So we designed Zap as your everyday tool: when you open it, the only thing you see is sending money out. I should pull out my phone without going through multiple steps. That’s it,” Akinlade said.

Competing against the big boys

Zap places Paystack in direct competition with fintechs like PalmPay, Kuda, OPay, and Moniepoint in Nigeria’s highly competitive consumer banking and payments market. Its new rivals grew rapidly during the cash scarcity in 2023 by offering exactly what Paystack now aims to deliver: fast and reliable transfers.

Despite varying approaches and successes, these fintechs have become entrenched in Nigeria’s financial ecosystem, amassing millions of customers—Kuda with 7.2 million users and OPay with over 30 million users. For Paystack, differentiating itself quickly in this competitive landscape will be the key to success.

Akinlade believes Zap’s success will come from delivering a superior transfer experience. “We are not competing against other fintechs. Our ideal users are people who send money frequently and are on the go a lot; think of Nigerians travelling across Africa. We have our audience: people who deeply care about great experiences—taste, speed, reliability.”

If Zap is to gain traction in Nigeria’s consumer market, Paystack will need to revisit its pricing strategy and compete on more than just design and user experience. With millions of Nigerians facing mounting economic pressure from inflation, affordability is more important than aesthetics.

Yet Akinlade is undeterred. “A lot of our work is shaping the country’s experience. It’s important to me that things in Nigeria are as elegant as everywhere else. Zap will get even better.”