For decades, Africa’s biggest dreamers: its exporters, importers, tech innovators, and regional manufacturers, have battled a problem they didn’t cause: a dysfunctional cross-border payment system.

From Lagos to Nairobi, Accra to Johannesburg, the challenges are the same: dollar shortages, high exchange fees, delayed transactions, and banking systems that fail to meet the needs of businesses. For a cocoa exporter in Ghana, receiving payment can take weeks. For an oil & gas merchant importing products, paying a supplier in the US might cost as much as 12% in FX premiums. For fintech startups looking to scale, accessing USD liquidity is a game of luck.

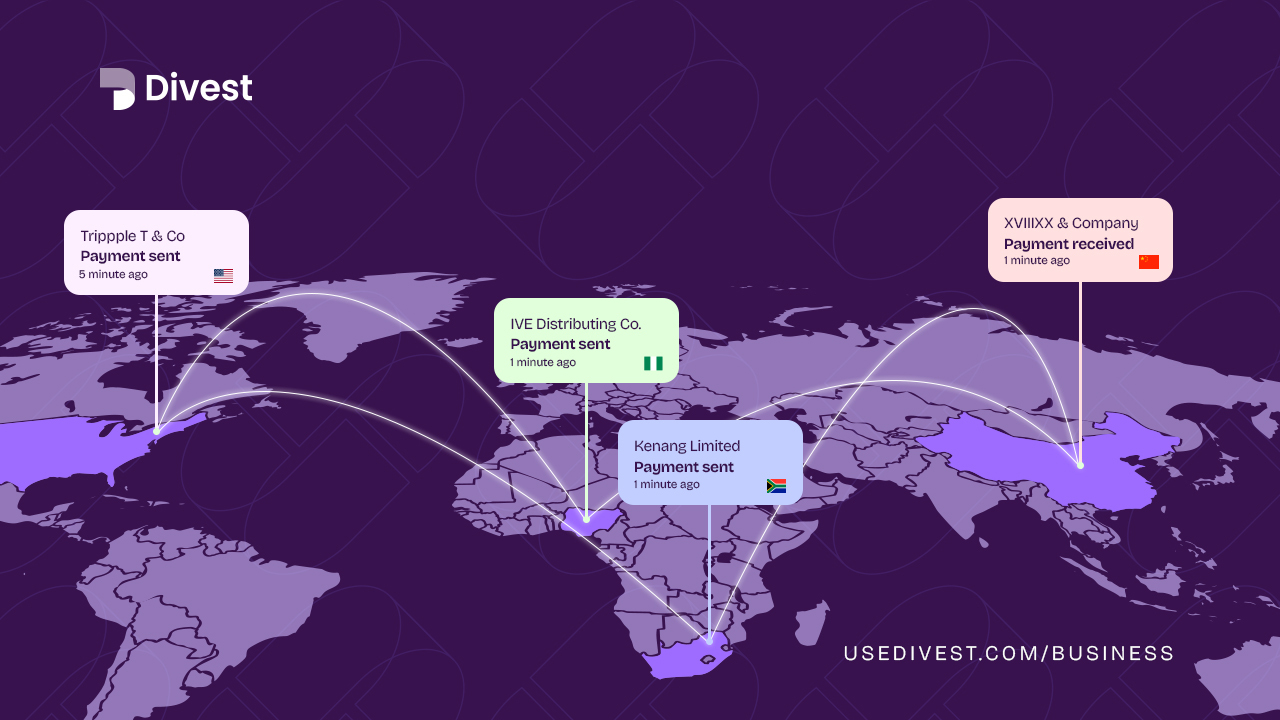

Today, Divest, a stablecoin-powered B2B payment platform, is rewriting that script quietly, but with radical precision.

Divest has spent years building a solution that African businesses have long been waiting for.

“The reality is, African businesses still struggle with seamless cross-border payments — especially when paying international suppliers,” says CEO of Divest.

“That’s why we’re expanding beyond our current offerings, which already allow users to convert crypto to cash with instant bank deposits across multiple countries. Now, we’re making it possible for African businesses to pay overseas suppliers and partners instantly as easily as sending a local bank transfer.”

How Divest works: Fast, simple, reliable

At the heart of Divest is a simple yet powerful system that enables businesses to transition seamlessly from local currencies to global payments, thereby bypassing the delays associated with traditional banking.

This is what the journey looks like:

- The business completes KYB and deposits local currency, i.e., ZAR, NGN, KES, GHS, via bank transfer.

- Conversion: The money is instantly changed into stable digital dollars like USDC or USDT.

- Divest sends the payment through its licensed partners to bank accounts and wallets worldwide in USD, EUR, GBP, or African currencies, within minutes, not days.

The result? What used to take a week now takes minutes. What used to cost an arm and a leg now costs less than 0.5%.

Remittance businesses looking for local payouts in African currencies can also benefit from this solution that Divest offers.

Why it matters now

This is not just new technology for the sake of it. It is a real-world solution for Africa’s cross-border trade, which is projected to grow to over a trillion dollars in a few years. As African businesses trade more with global suppliers, currency volatility, regulatory barriers, and slow payments have become major barriers to growth.

Divest uses a modern digital payment technology without making it complicated. You don’t need to understand stablecoins; you just need to want faster cross-border payments at lower costs.

Use Cases

| Sector | Problem | Divest Fixes It By |

| Exporters | Long USD settlement delays | Payments in minutes via USDC/USDT |

| Importers | High FX costs & delays | Instant EUR/USD/GBP at low rates |

| Cross-border & Remittance | Restrictions on USD payouts | Compliant stablecoin rails |

More than tech: It is infrastructure for growth

Beyond the payments, Divest is also building credibility. The company is fully licensed and operates with partners that ensure compliance across regions. Unlike unregulated DeFi hacks of the past, Divest is taking the long road, integrating local KYC, KYB, treasury transparency, and custodial risk management.

The result is a product that moves like stablecoins but thinks like finance.

Backed by global trends, built for Africa.

While global giants are only just looking Africa’s way, Divest is already powering businesses and institutions across the continent, solving real use cases with stablecoins and processing millions in payment volumes.

The platform isn’t a clone of Silicon Valley’s fintechs. It is homegrown, tested in volatile markets, and refined by firsthand understanding of what it takes to improve cross-border payments across continents.

For Divest, the goal isn’t just adoption. It is reframing what is possible.

If you haven’t heard of Divest yet, that may be by design. But as stablecoins become mainstream and Africa’s trade ambitions demand smarter rails, this fintech is shaping up to be the infrastructure beneath the future of African business.

About Divest

Since Divest launched in 2023, Divest has built a reputation for customer satisfaction, becoming one of Africa’s most trusted payment solutions. Thousands of users rely on Divest daily for crypto-to-cash and cash-to-crypto conversions in under 60 seconds, attesting to its speed, ease of use, and transparency. With thousands of positive App reviews on Google Play Store and Apple iOS, Divest is proving that when it comes to on/off-ramp payment, they can be trusted.

Divest Business is a cross-border B2B payment solution that helps businesses and institutions move payments across borders, using stablecoins like USDC and USDT. Built for exporters, importers, fintechs, and corporates, Divest Business makes global first and third-party settlements faster and cost-effective, without the complexity and delays of traditional banking systems.

Visit https://usedivest.com/business to learn more.