TGIF. ☀️️

We are dropping our Predictions project today. In it, we ask some of Africa’s most experienced executives, investors, and journalists to help us make sense of what to expect in African tech this year.

We got a lot of different predictions ranging from Kenyan youths focusing on agritech, to VCs thinking that the asset light model has lost its advantage, cybersecurity being an investable sector and even a prediction on Africa’s digital media economy.

Our predictors work at Antler, Launch Africa, VunaPay, Redtech, Bayse (formerly Gowagr), Verod-Kepple, TLcom, Flourish Ventures and other companies and firms.

Check our website by noon to see these predictions.

telecoms

MTN moves to acquire IHS Towers

MTN Group, Africa’s largest telecommunications company, is in talks with the Johannesburg Stock Exchange to acquire a controlling stake in IHS Towers, an independent owner and operator of shared communications infrastructure, and the same company that bought over 5,000 of MTN’s South African towers in 2022. If the deal goes through, MTN would own about 75% of IHS, effectively buying back the infrastructure it once sold.

Why MTN sold the towers in the first place: Like many telcos, MTN sold its towers to free up cash and reduce capital expenditure. Towers are expensive to build and maintain. Tower companies like IHS specialise in owning and maintaining passive infrastructure, like steel towers, while operators focus on customers, spectrum, and services.

So why buy them back now? Owning towers again could lower long-term operating costs and reduce reliance on a third party. By acquiring IHS, MTN would internalise those costs and regain direct control over where and how fast network infrastructure is deployed. MTN has informed shareholders that this deal could move its share price. Buying IHS would reshape MTN’s balance sheet, cash flow, and risk exposure.

Nothing is final. MTN still needs regulatory approvals, shareholder comfort, and agreement on price and structure. Until those boxes are ticked, this remains a proposal.

FINCRA X ATS Nairobi 2026

As Headline Sponsor of ATS 2026, Fincra is building the financial rails that connect Africa to the global financial ecosystem through resilient infrastructure that delivers. Get started with Fincra.

companies

Rwanda partners with Zipline to use drones to deliver medicine

Rwanda has signed an expansion agreement with Zipline, a US-based drone logistics company that recently secured a $150 million US funding to scale drone-powered medical deliveries across Africa.

Why this deal is different: The money is coming through a “pay-for-performance” model backed by the United States Department of State. The US wants African governments to adopt drone logistics as national infrastructure, and not an experiment that fades after a few years. Rwanda is the first beneficiary.

What Zipline is actually building: Under the agreement, Zipline will roll out its urban delivery system in Kigali, where a large share of Rwanda’s healthcare demand sits. It’s also adding a new long-range distribution hub and expanding coverage to more than 11 million people. On top of that, Rwanda will host Zipline’s first overseas AI and robotics testing centre.

What this deal means: Drones becoming a core infrastructure in African countries’ health systems means faster delivery of blood, vaccines, and medicines, which can directly improve outcomes in emergencies.

Discover providers and manage logistics in one secure platform.

Logistics Marketplace connects logistics buyers with logistics providers across Africa. Build your profile, respond to tenders, and grow your business. Free, backed by Global Fund & Gates Foundation. Use Access Code: WELCOME2026!

Insights

Funding Tracker

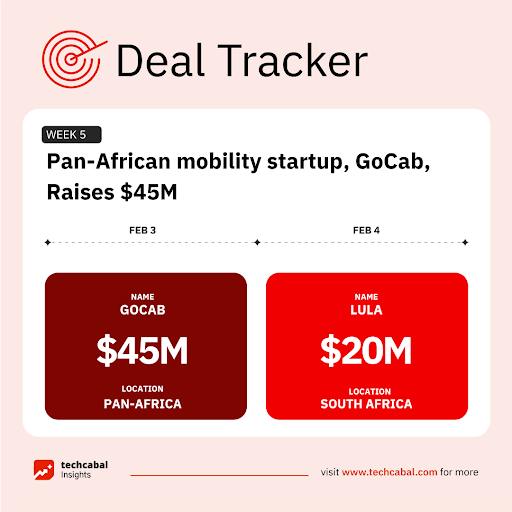

GoCab, a Pan-African mobility startup, secured $45 million in funding. The round comprised of $15 million in equity co-led by E3 Capital and JANNGO Capital, alongside KawiSafi Ventures and Cur8 Capital, and $30 million in debt. (Feb 3)

Here is the other deal for the week:

- Lula, a South African fintech startup, raised $20 million in funding from Dutch development bank FMO (Feb 4)

Follow us on Twitter, Instagram, and LinkedIn for more funding announcements. Before you go,here’s what we covered in the launch of our State of Tech in Africa Review for 2025. Find out more here.

CRYPTO TRACKER

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $65,676 |

– 6.61% |

– 29.20% |

|

| $1,925 |

– 7.76% |

– 40.87% |

|

| $630 |

– 8.39% |

– 30.95% |

|

| $79.30 |

– 12.00% |

– 42.97% |

* Data as of 06.34 AM WAT, February 6, 2026.

JOB OPENINGS

- Big Cabal Media — Associate Videographer/Video Editor (full-time); Senior Financial Analyst (full-time); Zikoko Citizen Reporter (full-time); Content Creator (contract); Journalist (contract); Project Associate (contract); Senior Editor (contract); Senior Writer (contract) — Lagos, Nigeria

- Piggyvest — Senior Accounting Associate, Customer Success Intern — Lagos, Nigeria

- Buffer — Senior Engineer, Growth Marketing — Remote

- Moniepoint — Several roles — Remote (Nigeria)

- FirstBank — Business Development Lead, eCommerce & Retail — Lagos, Nigeria

- Wave — Machine Learning Scientist — Nairobi, Kenya

- Pavago — Customer Success Manager — Remote (Kenya)

There are more jobs on TechCabal’s job board. If you have job opportunities to share, please submit them at bit.ly/tcxjobs.

Written by: Success Sotonwa and Opeyemi Kareem

Edited by: Ganiu Oloruntade

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Francophone Weekly by TechCabal: insider insights and analysis of Francophone’s tech ecosystem

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.