Guaranty Trust Holding Company (GTCO), the parent company of GTBank, Nigeria’s 5th biggest bank by assets, announced a public offer to raise ₦400 billion, joining Fidelity Bank and Access Bank to raise capital on the stock market to meet the capital requirements imposed by the Central Bank.

On Monday, the lender held a “Facts Behind the Offer” presentation to investors, regulators, and stakeholders on the main floor of the Nigerian Exchange Group (NGX). Here are five interesting takeaways from the presentation.

GTCO was always going to raise fresh capital

According to GTCO’s GCEO Segun Agbaje, the plan to raise fresh capital was in the works months before the CBN increased the capital threshold for lenders by tenfold.

“We aren’t only raising this because the Central Bank asked us to do so. We have decided before that we are going to raise capital. We are going to grow the business in Nigeria and grow the non-banking businesses,” he said.

90 billion shares up for grabs

GTCO will offer 9 billion shares at ₦44.50 each. The lender hopes to conclude the offer by the first week of August.

The Leading issuing house is Stanbic IBTC Capital Limited, while joint issuing houses include Absa Capita Markets Nigeria, FCMB Capital Markets, and Vetiva Advisory.

Aggressive growth

If there is anything to remember about the presentation, it has to be Agbaje’s emphasis on the lender’s growth and expansion ambitions. “There is no Nigerian company that has ever made a billion dollars in profit and we are going to be the first ones to give you that,” he said.

GTCO, which has four main business segments, will use ₦370 billion of the total amount for the growth and expansion of the banking businesses (including recapitalisation of GTBank Nigeria). ₦22.4 billion will be used to expand the company’s asset management and pension business. It also plans to use N133 billion for corporate, commercial, and SME loans.

The group will also expand to new countries like Senegal and grow existing subsidiaries like Ghana, Cote d’Ivoire, and Kenya. GTCO’s thesis for expansion is about scale and not just building across different markets.

“I am not going to name any bank. We aren’t in 40 countries, there is no business in 40 countries. It is a waste of time. We go to countries where there is GDP growth, youthful population, and loan-to-population ratio is low,” Agbaje said.

Maximising shareholder value

Agbaje spoke about how the group prioritises maximising shareholder value. GTCO has averaged a 29% return on average equity (RoAE) in the last ten years. The company, with a market capitalisation of ₦1.39 trillion, accounts for about 9% of stocks traded on the NGX.

“If you have invested in us over the last ten years, your return is about 253%,” Agbaje said.

New subsidiaries growing rapidly

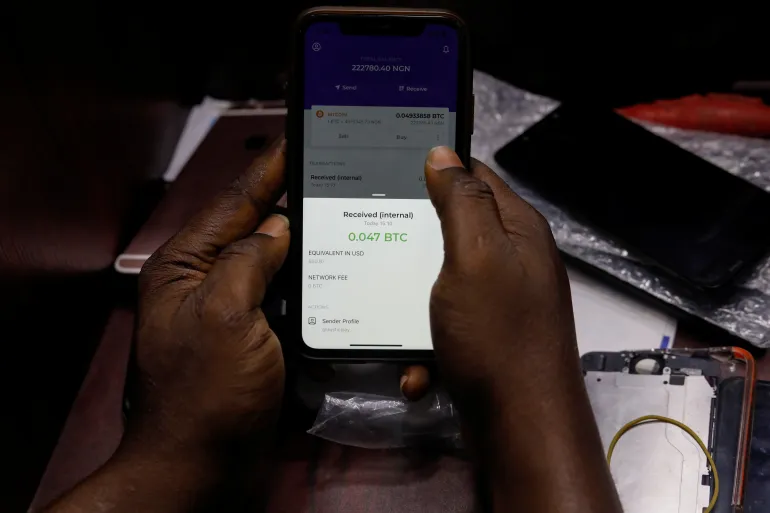

In the last two years, GTCO has made inroads into non-banking industries, launching three new businesses: a fintech subsidiary, HabariPay, GT Fund Managers, and GT Pension Managers. These businesses have grown 10x, Agbaje claimed.

The group hopes to strengthen these businesses with the new capital. “In three years, these businesses must give us 5% of group profit and they must be number one, number two, or number three in whatever industry they find themselves,” Agbaje said.

Have you got your early-bird tickets to the Moonshot Conference? Click this link to grab ’em and check out our fast-growing list of speakers coming to the conference!