Nigeria’s President Bola Tinubu has asked the National Assembly to amend the 2024 Finance Act to tax the realised forex (FX) gains of traditional banks to fund capital infrastructure development, education, healthcare, and welfare projects.

Nine of Nigeria’s leading banks recorded over ₦2 Trillion in FX gains for the first nine months in 2023 after the Central Bank floated the naira and unified the multiple exchange rate markets. In September 2023, the CBN barred commercial banks from using those gains to pay dividends or meet operating expenses.

The one-time windfall tax is part of a proposed amendment to the Finance Bill which the president seeks to increase by ₦6.2 trillion, according to a letter to lawmakers on Wednesday.

The proposed tax is part of the Tinubu administration’s plan to boost revenue collection to fund his Renewed Hope agenda, which hopes to lift 100 million people out of poverty.

Nigeria’s tax collection agency Federal Inland Revenue Service, expects to increase revenue by 57% in 2024, Bloomberg reported in January. Nigeria has one of the lowest tax-to-GDP ratios in the world.

In January 2024, President Tinubu signed the ₦28.7 trillion 2024 budget into law. Now the president wants the National Assembly to approve an additional ₦6.2 trillion: ₦3.2 trillion to fund infrastructure projects and ₦3 trillion for recurrent expenditure.

*This is a developing story

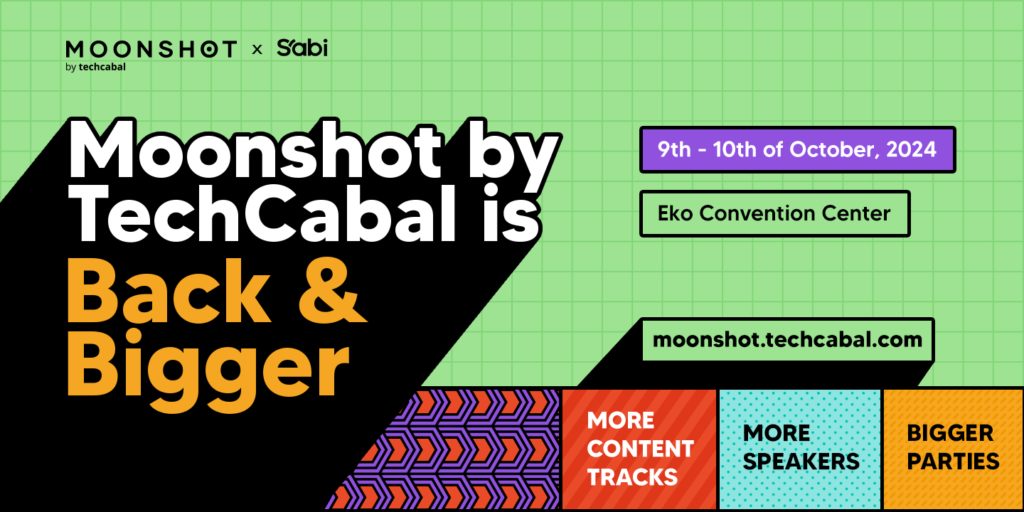

Have you got your early-bird tickets to the Moonshot Conference? Click this link to grab ’em and check out our fast-growing list of speakers coming to the conference!