Collaborate. That’s a word Agada Apochi, the CEO of Unified Payments (formerly ValuCard), used six times in ten minutes as he talked about his company’s new license. It’s easy to understand why: Unified Payments is a product of collaboration, having been founded twenty-six years ago by 14 Nigerian banks.

In April 2024, Unified Payments was granted a Payment Terminal Service Aggregator licence (PTSA), only the second to be issued by Nigeria’s Central Bank.

“There was a single point of failure in NIBSS, the holder of the first licence, so there was a need to bring in another player,” a policy expert told TechCabal.

PTSA holders must have a processing and switching licence, an average uptime of 99% in 2023, and ₦1 billion capital requirement. “We have been consistent in leading innovations and providing leadership in the industry, and we not only met but also surpassed all the criteria required by the regulator,” Apochi said about the application process.

The licence allows Unified Payments to maintain a database of payment terminals and record Point-of-Sale (POS) transactions in Nigeria’s agency banking sector. The fintech began recording payments in June, almost thirteen years after NIBSS started, and is taking a collaborative approach to earning market share.

“As a processor or switch, you are competing with others, but as a payment terminal service aggregator, from our point of view, we are not competing; we are collaborating with everyone in the industry without any form of discrimination to offer services and for the regulators to have oversight over what is going on,” Apochi said.

Unified Payments will also look to partner with NIBSS, its competitor, as Nigeria’s agent banking sector grows exponentially. In March 2024, data from NIBSS showed that 2.7 million POS devices were in circulation—a 48% increase from 2023.

“Upon getting our license, we had a meeting at the highest level between our company and NIBSS to understand [each other] and share points and ideas of how we can work together to ensure that there is service availability because that is what is most important to every operator and the Central Bank of Nigeria is service availability,” Apochi said in his Victoria Island office.

Working with Fintechs

The PTSA license will require Unified Payments to work with leading companies in the agency banking sector, such as Moniepoint, Opay, and Palmpay. These companies have been in regulatory waters in recent months and in April, the central bank directed five Nigerian fintechs to pause onboarding new customers.

“The central bank’s first focus is to grow payment transactions in Nigeria, but in conformity with regulations and guidelines issued by the central bank,” Apochi told TechCabal.

That ban lasted six weeks and was lifted after fintechs committed to a list of conditions set by the central bank. For Apochi, Unified Payments will help fintechs “achieve their business goals without running afoul of” regulatory requirements.

“The primary focus for us as a service aggregator is not about [the] enforcement of rules and regulations. It’s about enabling service providers, industry operators, to provide their services and solutions in compliance with rules and regulations defined by the Central Bank of Nigeria,” he said.

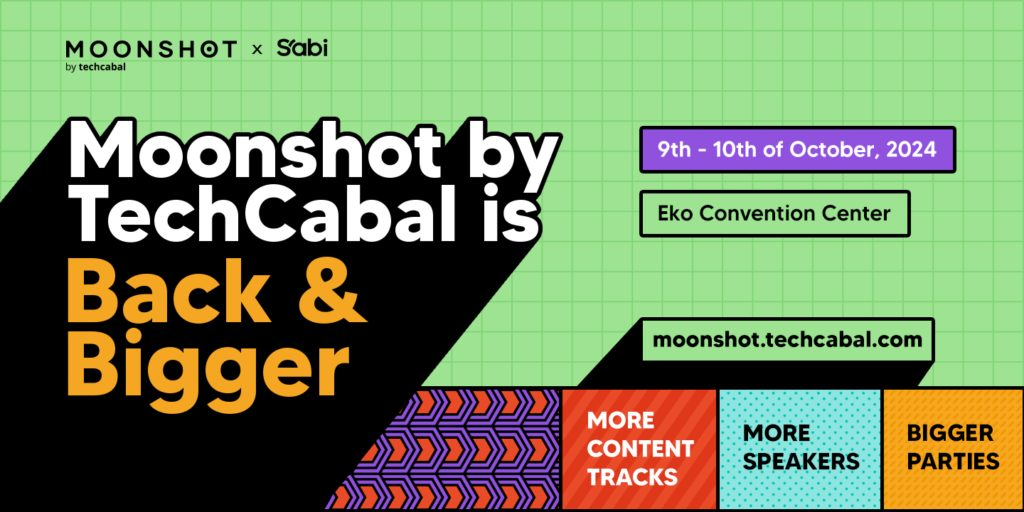

Have you got your early-bird tickets to the Moonshot Conference? Click this link to grab ’em and check out our fast-growing list of speakers coming to the conference!