Faced with intense pressure to control inflation, Nigeria’s Central Bank has raised its benchmark interest rate by 50 basis points to 26.75%. The decision, while in line with market expectations, indicates a decision to maintain a hawkish stance.

The median estimate of four economists in a TechCabal survey expected the 12-member monetary policy committee led by Governor Olayemi Cardoso to raise interest rates by 50 basis points to 26.75%.

The monetary policy committee decided on a rate hike on the basis of persistent food inflation despite three consecutive hikes.

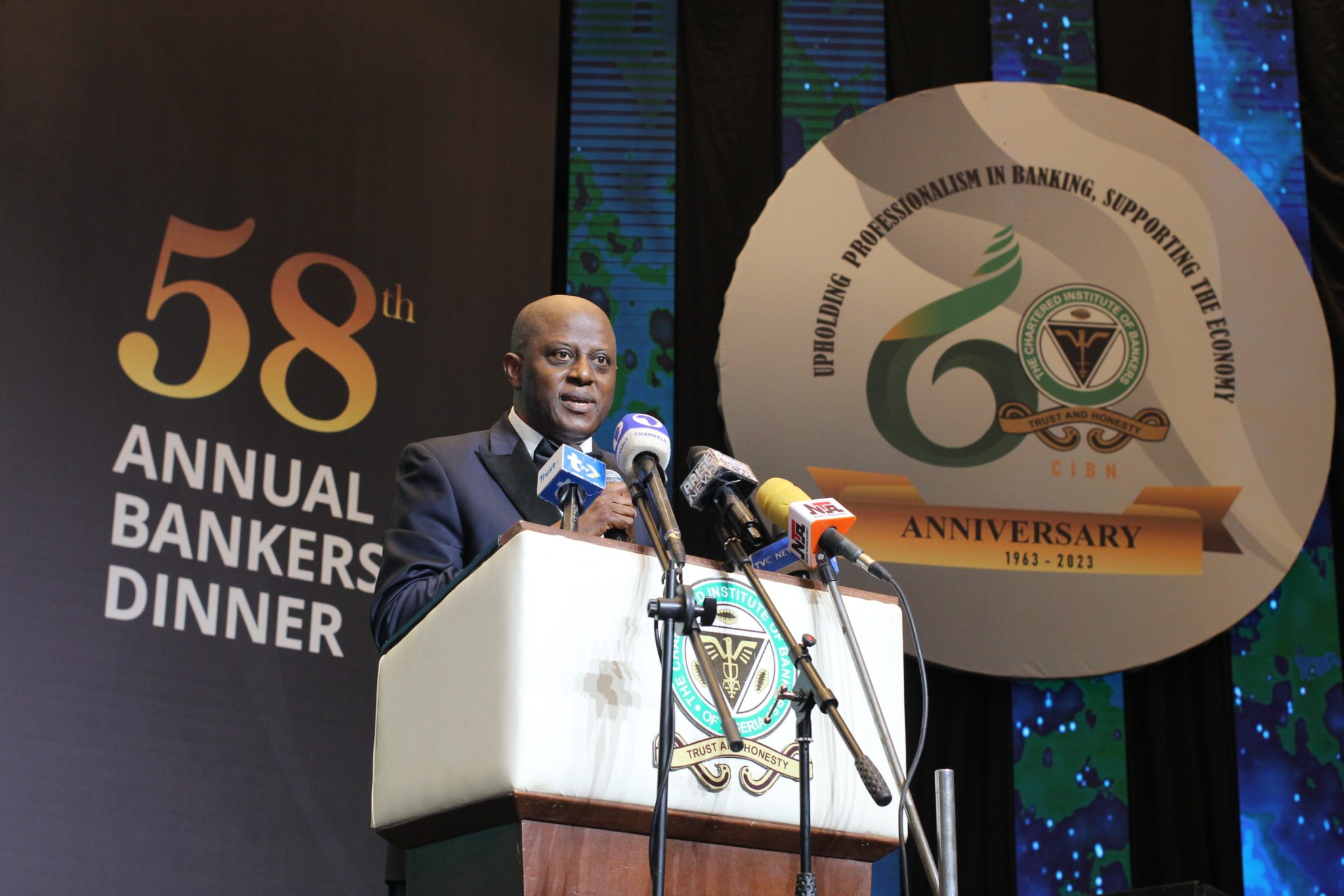

“The committee was mindful of the effect of rising prices on household and businesses and expressed its resolve to take necessary measures to bring inflation under control,” said Olayemi Cardoso, the Central Bank chief at the press briefing of the committee meeting.

“It re-emphasises a commitment to the bank’s price stability mandate and remains optimistic that despite the June 2024 uptick in headline inflation, prices are expected to moderate in the near term.” According to Cardoso, these decisions were hinged on the success of the monetary policy in addition to other measures by the fiscal authority to address food inflation.

The CBN chief said the MPC committee would continue to tighten rates, as a key tool in addressing inflationary pressures.

*This is a developing story

Have you got your early-bird tickets to the Moonshot Conference? Click this link to grab ’em and check out our fast-growing list of speakers coming to the conference!