Sendsprint, a cross-border payments startup operating in the UK, Ghana, Kenya, South Africa and Nigeria, has acquired Nobel Financial Inc., a US-based remittance company, for an undisclosed amount. The acquisition will enable Sendsprint to offer money transfers and gift-sending from customers in 16 US states.

“The US presents a massive opportunity for us as a company and we are excited to bring our unique blend of people-focused technology solutions and nuanced understanding of Africans in the US market to make this expansion into the US a remarkable success,” Damisi Busari, CEO and founder of Sendsprint said.

As part of the acquisition, Nobel Financial Inc.’s Chief Compliance Officer, Scott McClain, will join the Sendsprint team as Chief Compliance Officer.

Launched in 2022, Sendsprint operates in the competitive remittance market with established players like Western Union and MoneyGram and new entrants like LemFi and Leatherback. The company charges a $5 flat fee across all transactions. The company claims it partners with over 3,000 retailers across Africa—including big names like Shoprite, Dapper Monkey, Jumia, and Cake City—to allow users to send gift cards to recipients in Africa.

Founded in 2014, Nobel Financial Inc. offers international remittance services from the USA to over 32 countries across Africa, Latin America, Asia and the Middle East. The company also allows users to send in-kind gifts such as bags of rice and other gifts to recipients in Africa.

The acquisition comes at a time when remittance flows to Africa continues to grow. In 2022, remittances to the continent reached $100 billion, outpacing both Official Development Assistance (ODA) and Foreign Direct Investment (FDI). The increase in remittances from the US to Africa is fueled by rising migration and improved financial wellbeing among Africans in the diaspora.

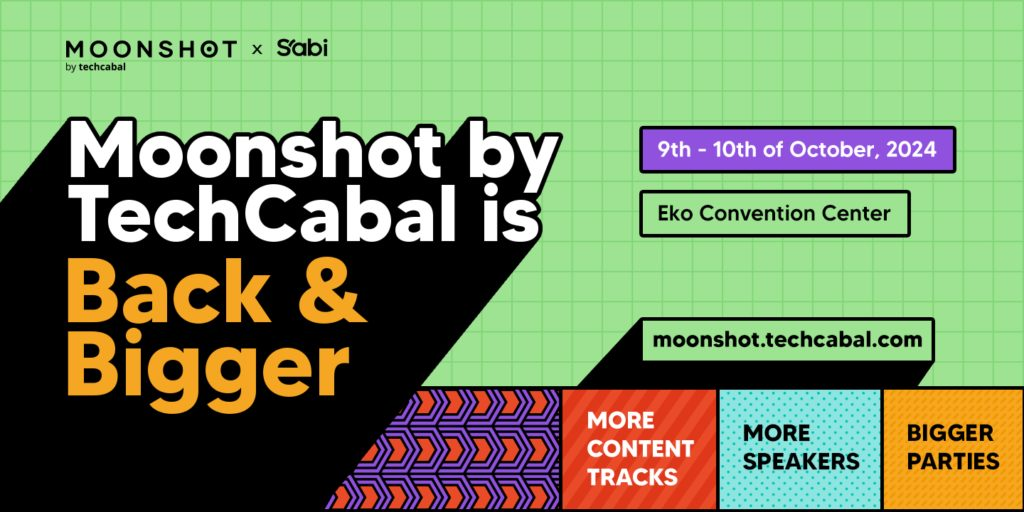

Have you got your early-bird tickets to the Moonshot Conference? Click this link to grab ’em and check out our fast-growing list of speakers coming to the conference!