GTBank, Nigeria’s most cost-efficient commercial bank, quietly raised staff salaries by 40% in September 2024, responding to the ongoing cost of living crisis, four GTBank employees told TechCabal.

“There was no prior communication before the increase. Even though there were speculations, I was not expecting the increase,” an assistant banking officer (ABO) who now earns ₦720,000 ($442) told TechCabal. An ABO is just one level above entry-level staff in GTBank’s employee structure, which has fewer staff levels than other Tier-1 banks.

The bank, which prides itself on its low cost-to-income ratio, spent only ₦0.29 to make ₦1 in 2023 as it maintained its stance as Nigeria’s most profitable Tier-1 bank. The salary raise will do little to affect GTBank’s standing among Tier-1 banks, as it will now spend ₦0.30 to make ₦1 based on last year’s numbers.

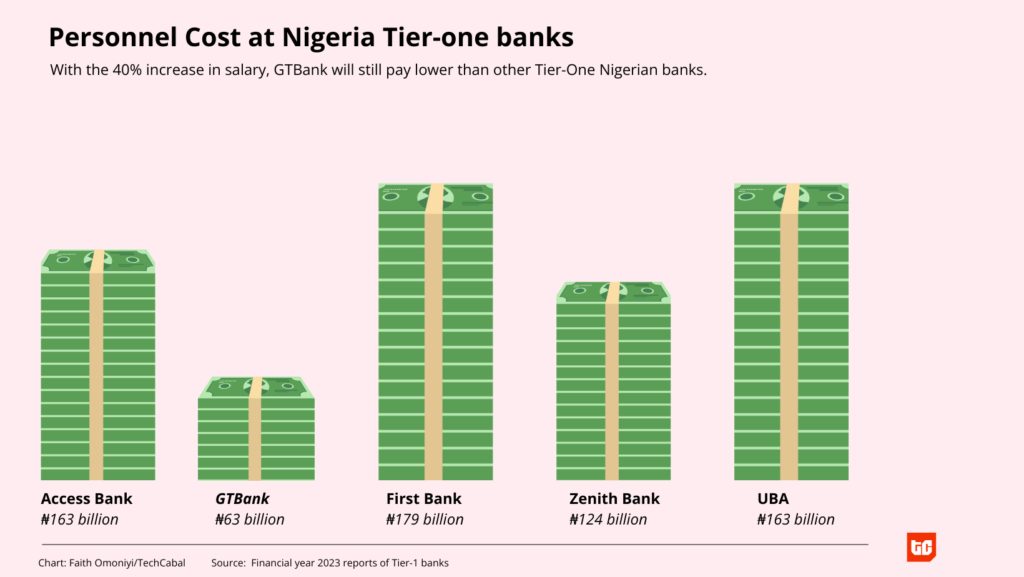

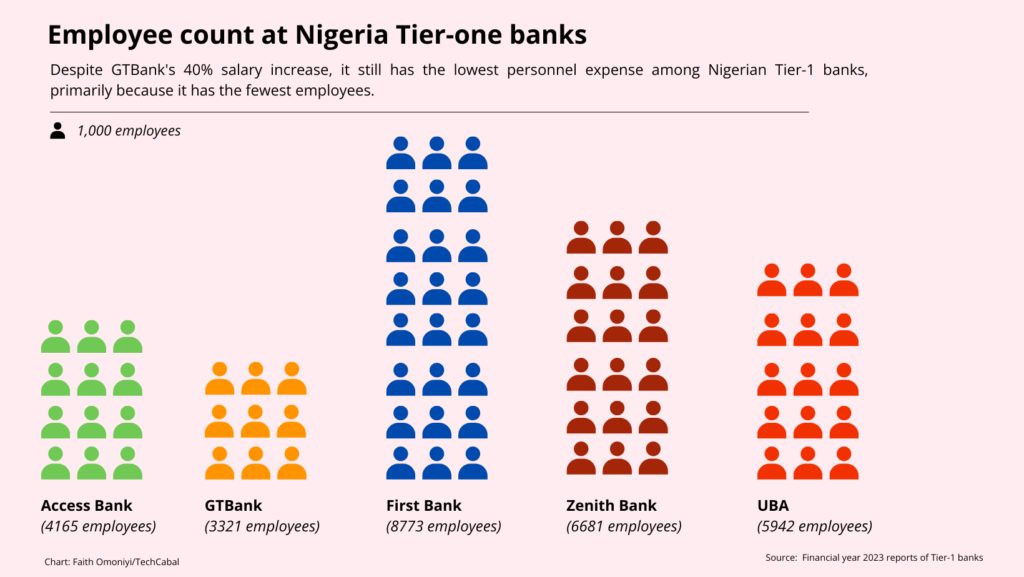

In 2023, the bank spent ₦45.1 billion ($27.7 million)* on salaries, at least three times less than other Tier-1 banks. Despite raising salaries by almost half, which brings GTBank’s total personnel cost to ₦63.1 billion ($38.7 million), the bank still has the cheapest salary bill among other Tier-1 banks, according to the 2023 financial reports of all Tier-1 banks.

GTBank did not immediately respond to a request for comments.

President Tinubu’s economic reforms, including two currency devaluations and the removal of fuel subsidies, have caused the naira to lose nearly 70% of its value against the dollar and driven inflation up to 30%, putting significant pressure on Nigerian pockets.

While the bank is responding to these economic changes, GTBank’s salary raise could have been made to prevent other banks from poaching employees.

The bank doubled the salaries of its technology team in 2022 when multiple employees left GTBank for other banks and countries. The technology team still earns more than other employees in other divisions; a technology employee on the same level as an ABO earns roughly ₦1 million ($613), claimed one person with direct knowledge of the bank’s pay scale.

The salary raise affected all 3,300 GTBank employees, a shift from the common banking sector practice where only head office staff enjoyed such benefits. This is the first salary increase in 2024 but the second in two years for GTBank staff.

*Exchange rate used: $1 = ₦1630

Editors note: An earlier version of this article misstated GT’s cost-to-income ratio. We have updated the article to reflect the accurate information.