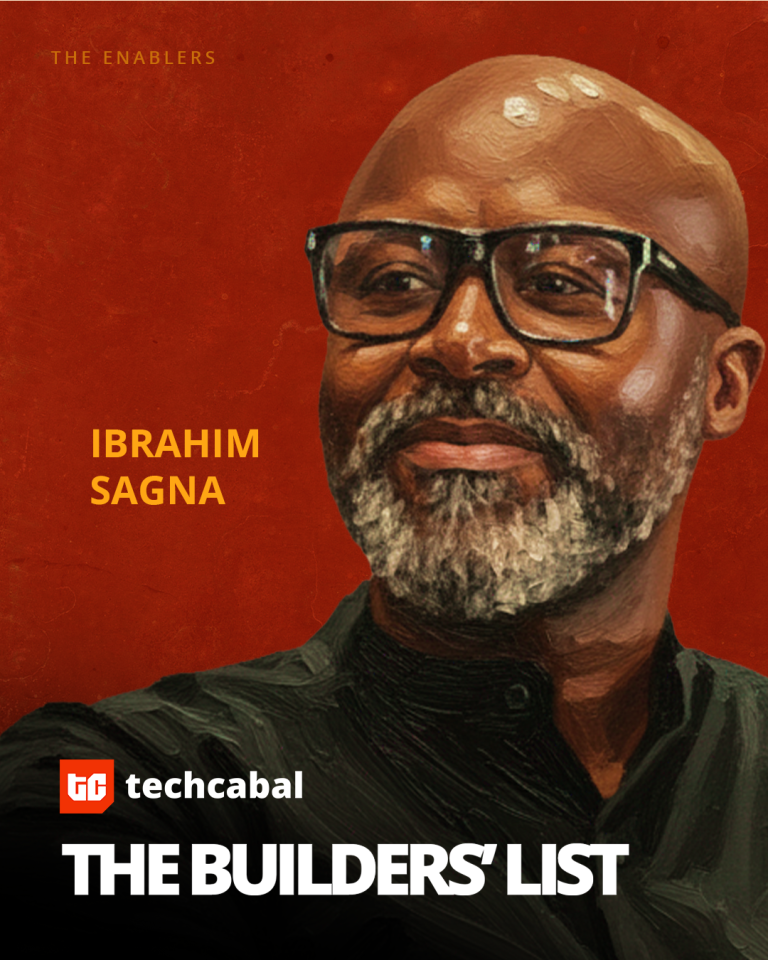

Ibrahim Sagna and Silverbacks Holdings spent 2025 doing what remains rare in African venture and growth investing: exiting, repeatedly, and with disclosed returns. In May, Silverbacks recorded its eighth profitable exit, selling part of its stake in LemFi during the company’s $53 million Series B, generating a 29x return on capital invested.

Just weeks later, the firm announced its ninth profitable exit through a partial divestment in OmniRetail, following the startup’s $20 million Series A round, which included Flour Mills of Nigeria. That transaction returned 5x capital on Silverbacks’ investment, adding to a growing list of realised outcomes rather than paper mark-ups.

More unusually, Silverbacks paired these exits with performance disclosure. In 2025, the firm reported that its Nigerian exits had averaged 10.7x MOIC and 81.5% IRR over roughly two years and eight months, while exits from Egypt averaged 9.7x MOIC and 339% IRR over one year and seven months—numbers aimed squarely at institutional LP scepticism around African liquidity.

In 2025, Sagna published evidence of the exits, reinforcing Silverbacks’ positioning as one of the few Africa-focused platforms with a visible, repeatable exit record.