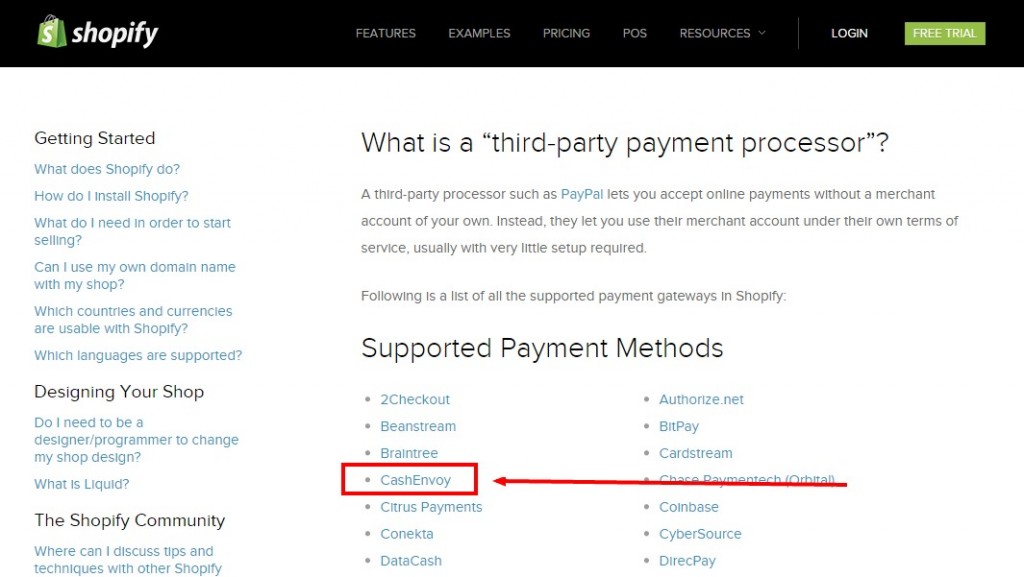

Nigerian online merchant who use Shopify will be happy to learn of the recent addition of CashEnvoy to the popular ecommerce framework’s roster of 3rd party payments processors. And those who already use Shopify but are still stumped for a way to collect payments in Nigeria might want to consider signing up.

CashEnvoy is a Nigerian payments aggregator that accepts all payments from all major Nigerian debit cards. Online merchants typically use payment aggregators to avoid the costs and technical constraints that are typical of direct integrations with Interswitch or eTranzact.

According to CashEnvoy’s CEO Olaolu Awojoodu, the Shopify integration was made possible by another partnership with U-Africa, a South African based Shopify expert. Not roundabout at all, but considering that some people are still wary of doing business with Nigerian entities, it is what it is.

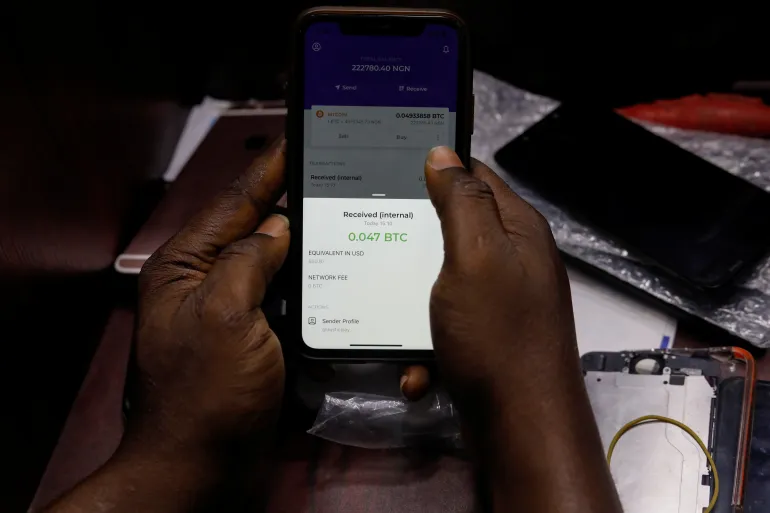

Shopify integration is not all CashEnvoy is up to these days. Also in the works is Paypad, an mPOS solution that allows merchants receive payments on their mobile devices.

“It basically transforms a mobile phone into a POS device”, Olaolu says. According to him, Paypad is the first mPOS solution to be certified by NIBSS in Nigeria, and that the product has also been certified by MasterCard for attaining best practices.

The five year old startup hasn’t quite made good on its promise to become Nigeria’s PayPal. Nobody who’s made that promise has. And now that PayPal is now Nigeria’s PayPal, that pledge has become significantly harder to redeem. PayPal’s self-imposed merchant limitations provide a narrow window to deliver. But it might not be enough.

Olaolu is pretty upbeat, nonetheless.

“We are working hard to provide that magical payment process. We have been growing from strength to strength, every year. More transactions, bigger structures, bigger team”.

To the question of how much capital they have raised from investors till date, he replies “significant enough to change the world”.