IN PARTNERSHIP WITH

Good morning 🌄

Apple has a new update, and many people are biting back.

According to an update on the App Store, subscriptions will now auto-renew without the users’ explicit permission, even if the subscription price has been increased. This is subject to a few conditions attached to the price increase.

Apple says that it’s making these changes to stop users from unintentionally missing out on subscriptions because of price increases. 🤨 The company has, somehow, decided that most users find it difficult to select a “Renew subscription” button once a month.

This is definitely one of those updates Android users aren’t bragging about “having it first”.

In today’s edition

- What’s up with Elon and Twitter?

- Jumia releases its Q1 2022 report

- CASF’s first Kenyan investment

- Kenya moves to dam Safaricom’s profits

- Opportunities

WHAT’S UP WITH ELON AND TWITTER?

A month after he offered to buy Twitter for $44 billion, billionaire Elon Musk is yet to close out the deal. Musk has been tweeting back and forth between his plans for free speech on Twitter and his concern for Twitter’s reported user base.

Days after accepting Musk’s offer, Twitter revealed—in its Q1 2021 earnings—that it had over-counted its daily users for over 3 years. From 2019 to 2021, about 1.9 million users per quarter were overstated.

Then last week, Reuters published a report stating that 5% of Twitter’s 229 million users are spam bots.

This, normally, wouldn’t be a problem since everyone knows spam bots are on most social media platforms. But one of Musk’s plans for Twitter is to knock out spam bots. Days after Reuters’s report, Musk tweeted that the Twitter acquisition deal would be put on hold until he could confirm Twitter’s calculations. After his tweet, Twitter’s stock price dropped by 20% while Tesla’s plummeted by 6%.

And now

In the latest news, Musk claims that spam bots make up 20% of Twitter’s daily users—about 4x Twitter’s reported numbers. Last week, Musk stated his belief that 20% of Twitter users are fake accounts.

In response, Twitter CEO, Parag Agrawal, reiterated Twitter’s stance that only 5% of its users are spam.

Musk responded with his own tweet on Tuesday stating that the Twitter deal cannot move forward until Twitter shows proof of the 5%. Musk also called on the US Securities and Exchange Commission (SEC) to investigate Twitter’s numbers.

In everything, Twitter and its shareholders may still win. If Musk buys, they get the billion-dollar payday, and if he doesn’t, the billionaire will have to pay Twitter a $1 billion termination fee.

Don’t just send money, send money fast. Send and receive money directly to mobile wallets, bank accounts, Barter or through cash pickup with $end.

Visit send.flutterwave.com and do it now!

This is partner content.

JUMIA RELEASES ITS Q1 2022 REPORT

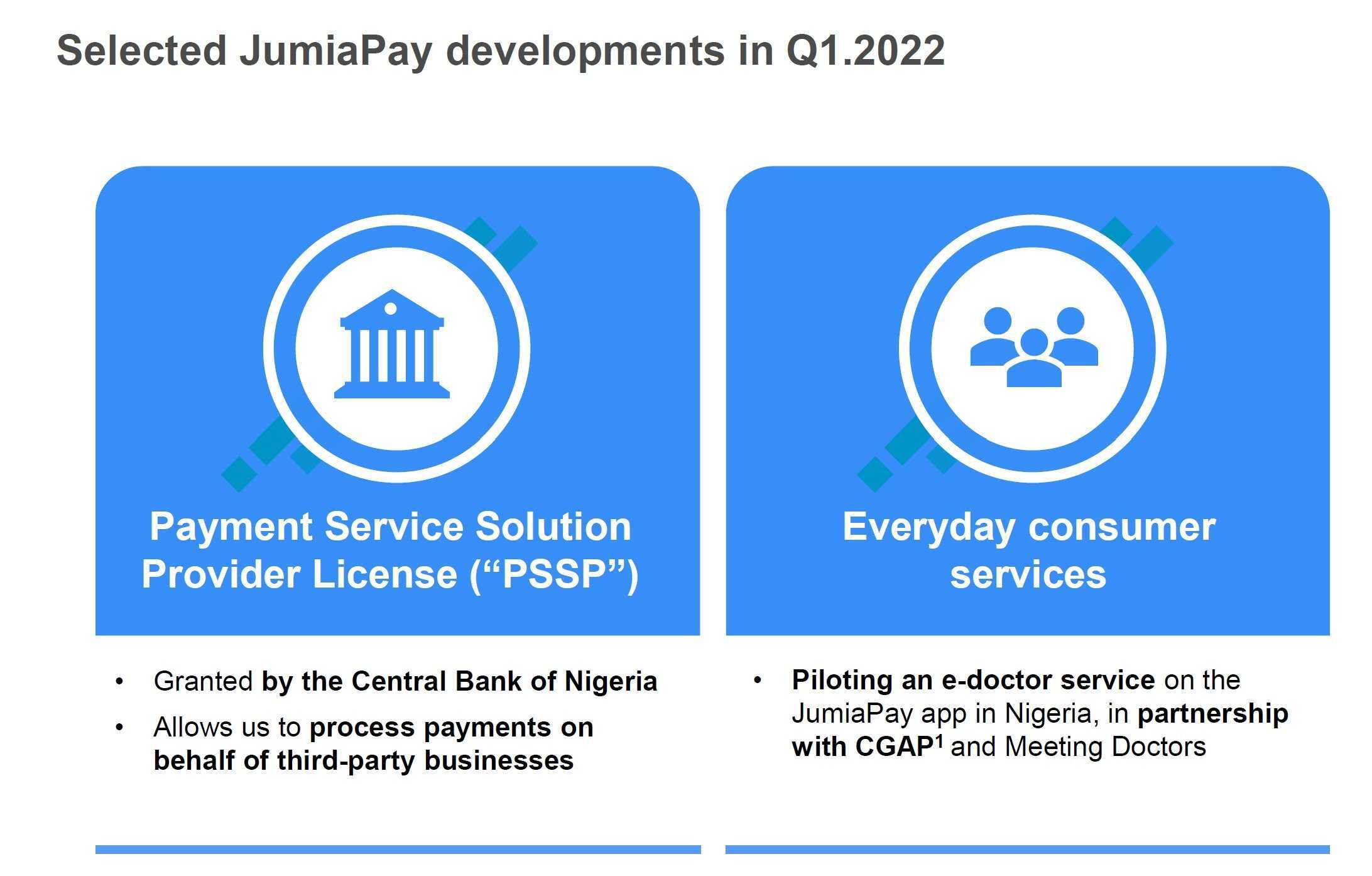

Jumia has been granted its Payment Service Solution Provider (PSSP) License for JumiaPay.

In its Q1 2022 financial report released yesterday, the e-commerce giant revealed that the Central Bank of Nigeria, in April 2022, granted it the licence. This means that the company is now licensed to establish payment processing portals and develop payment solutions. According to Jumia, it means they can now process payments on behalf of third parties.

This is sure to boost JumiaPay’s numbers, which saw a 36.7% total portfolio value (TPV) increase from $51.7 million in Q1 2021 to $70.7 million in Q1 2022.

Everything is still up at Jumia

The financial report also highlights Jumia’s wins in the first quarter of 2022.

According to it, orders on Jumia experienced a 40% year-over-year (YoY) increase in its first quarter. Compared to Q1 2021 when 6.6 million orders were made, Jumia processed a staggering 9.3 million orders from January to March 2022.

Its gross merchandise volume (GMV)—which is the total value of products sold—also increased by 27% YoY. Revenue increased by 44% YoY while its quarterly active subscribers increased by 28.7%, from 2.4 million in Q1 2021 to 3.1 million in Q1 2022.

As was with its last 2 quarters, the fastest-growing category on Jumia is its fast-moving-consumer-goods sector which grew by 180% YoY. Its food delivery category came second with an 86% YoY growth.

On the downside, Jumia’s operating loss is also up by 64%—as a result of increased growth investments, it claims.

Venturing into healthtech

In the report, Jumia also announced its venture into healthtech in a global partnership which will see it launch Meeting Doctors, an e-doctor service to help “workers, sellers and consumers in general access doctors remotely for a monthly subscription fee of around $1”.

CASF’S FIRST INVESTMENT IN KENYA

A lot of great things are going to Kenya.

Over the last quarter, several global players have announced some form of investment in the East African country. Google, Mastercard, Visa, and even Nigeria’s Eden Life, have all launched an office or a studio in the country’s capital, and this signals a booming tech economy in Kenya.

In more recent news, the Cairo Angels Syndicate Fund (CASF) has also announced its first investment in Kenya through FlexPay, a fintech startup.

Launched in 2020 by the Cairo Angels, CASF is a micro venture capital fund that is investing $100,000–$250,000 tickets in post-seed and pre-series A startups in the Middle East and Africa. Since launch, the fund has invested in 2 startups across 2 countries including Egypt’s Nawah Scientific and UAE’s QiDZ App.

Kenya’s FlexPay is the fund’s third disclosed investment and its second in Africa. Founded in 2016 by Richard Machomba, FlexPay is an online and offline payment gateway that allows merchants to offer interest-free targeted savings to their customers in Africa. The startup reportedly grew its GMV by 500% over the past year.

“We are thrilled to have The Cairo Angels as investors as we plan to grow and scale to more markets in Africa,” said CEO Richard Machomba in a statement sent to TechCabal. “As Africa’s first merchant-embedded saving-based purchase experience that rewards customers for saving (Save Now, Buy Later), we aim to solve the un-affordability gap for the large under-banked African population without subjecting them to the debt trap.”

The startup also announced that in addition to the investment, it will work with the CASF on FlexPay’s expansion into other African markets including Nigeria, and Egypt.

Payment collection just got easier on Fincra!

Receive payments from your customers via debit/credit cards or bank transfers and settle these payments to your Fincra wallet or your bank account.

Create an account in less than 2 mins and Try the Fincra checkout here.

This is partner content.

KENYA MOVES TO DAM SAFARICOM’S PROFITS

The Kenyan government is moving to control the mobile termination rates (MTR) that Safaricom charges rivals for terminating calls on its network.

This is based on new regulations set by the government to stop dominant telecoms like Safaricom from making profits from mobile termination rates (MTRs). The goal, according to the government, is to protect small telecommunications firms and to encourage healthy competition.

Sidebar: Mobile termination rates are the costs involved in providing telephone services in an area. Calls, especially long-distance ones, involve 3 aspects: origination of the call, transportation of the call signal, and termination of the call from the receiving company. All of these 3 aspects may be controlled by separate companies. In Kenya, Safaricom controls the majority of the voice call market which also means that most calls from other networks are terminated on its service. Presently, competitors pay Ksh0.99 (~ $0.1) per minute per call terminated on Safaricom’s network.

How Safaricom’s competitors have been faring

Kenyan telcos reportedly made $2.4-billion in revenue last year with Safaricom taking 82.4% of the voice revenue, 78.4% of data, 83.8% of SMS, and 97% of other mobile services.

This is inclusive of the rates that Safaricom reportedly charges Kenyan rivals like Airtel and Telkom who say that the current rates are making it unduly hectic for them to compete with Safaricom. Airtel claims that it pays Safaricom $2.6 million every month or $31 million per annum in MTRs.

The way forward

With new government regulations, Safaricom will autonomously charge fees to cover the costs of interconnecting calls from its competitors but not MTRs. Telcos will be able to negotiate mutually acceptable MTR rates. However, if the bigger telecoms like Safaricom fail to strike a fair deal with the smaller ones, the Communications Authority of Kenya (CA) will be forced to set lower rates to allow the smaller telcos to compete with the dominant ones.

The new regulation sets the stage for these changes, the Kenya Information and Communication (Interconnection) Regulations 2022, and also allows the Communications Authority of Kenya (CA) to control Safaricom’s rates of interconnecting calls. This will only happen if Safaricom controls more than 25% of mobile services revenues which it already does. All this, of course, is subject to publication in the Kenya Gazzette, the official publication of the Kenyan government. Until then, the CA can’t enforce it.

OPPORTUNITIES

- The Seedstars Migration Entrepreneurship Prize 2022 is now open to Applications. Twenty startups from the Middle East and Africa (MEA) region harnessing the positive benefits of migration will get to join the Seedstars Investment Readiness Programme, join the Online Seedstars World Competition activities, and access increased visibility. Move it!

- The Last Mile Money Startup Accelerator is now open to ventures working at the intersection of last-mile users and financial empowerment. Selected startups will receive design support, access to Last Mile Money’s network, and up to $50,000 in equity-free grants. Apply here.

- Applications are now open for the 2022 Africa’s Business Heroes Prize Competition. Ten outstanding entrepreneurs across the continent will get to share a myriad of prizes including access to a community of international leaders and a $1.5 million grant. Co-founders of African origin can apply or be nominated for the prize here.

What else we’re reading

- Centre Stage: Adora Nwodo’s journey into mixed reality and cloud engineering.

- Egyptian bug reporting firm Instabug secures $46 million.

- Spotify has also fallen for the NFT craze. It’s now testing a feature that will let artists promote their NFTs.

- Dotun Olowoporoku joins Ventures Platform as a New Venture Partner.

- BII pledges $220 million to improve high-quality internet in Kenya.