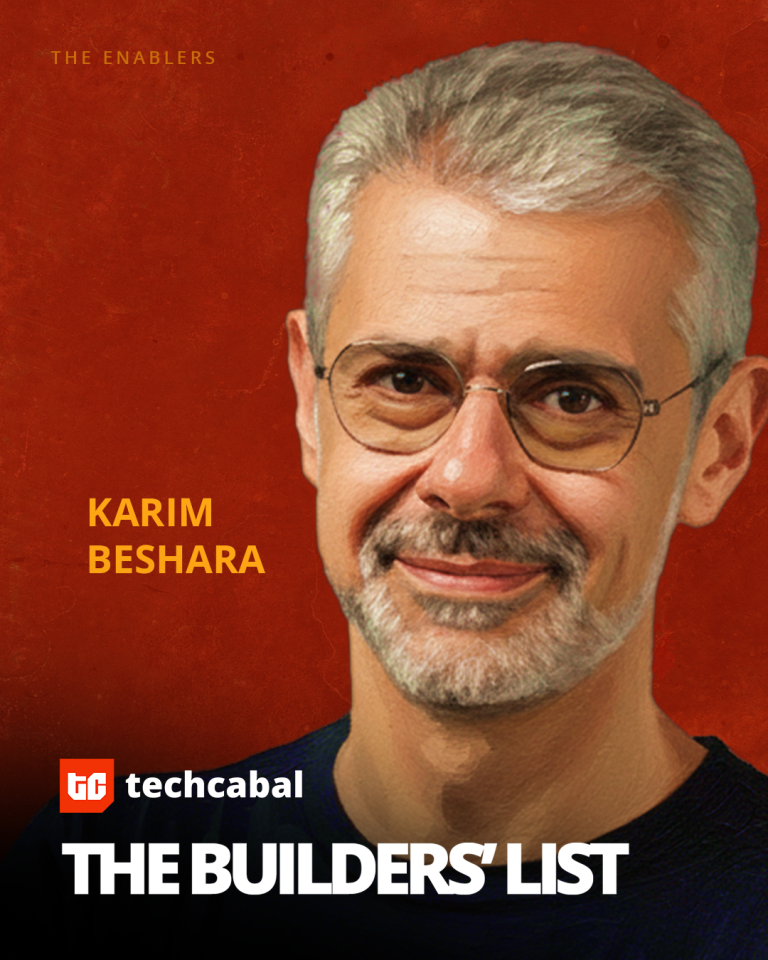

If you want to know if an ecosystem is maturing, look at the exits. If you want to know one of the people driving them, look at Karim Beshara. In July 2025, A15, the Cairo-based venture capital firm he co-founded, delivered a 10x return from its Fund I. The feat was driven by eight portfolio exits. including TPAY Mobile’s acquisition by Helios Investment Partners and Connect Ads’ acquisition by Aleph Group.

2025 saw A15 executing at breakneck speed, leading a number of high-impact rounds across the Middle East and North Africa (MENA) region. It started the year by co-leading a €20M pre-Series A funding round for Tapline, a German fintech, and participated in $8.2 million seed round for Gail, an AI platform designed for the financial services industry.

By October, it participated in a $26.3 million Series A round for Egyptian cleantech company, Tagaddod, and in November, it participated in a $1.1 million seed round for SehaTech, an Egyptian insurtech company. It participated in a proptech platform, Byit Capital’s $1.1 million funding round in December, and led a $1 million raise in seed funding for Bluworks in the same month, and most recently, an undisclosed funding round for iVoiceUp, an AI-powered whistleblowing and ethics case management platform.

One thing is clear: Beshara is proving that the only thing better than a 10x return is doing it all over again.