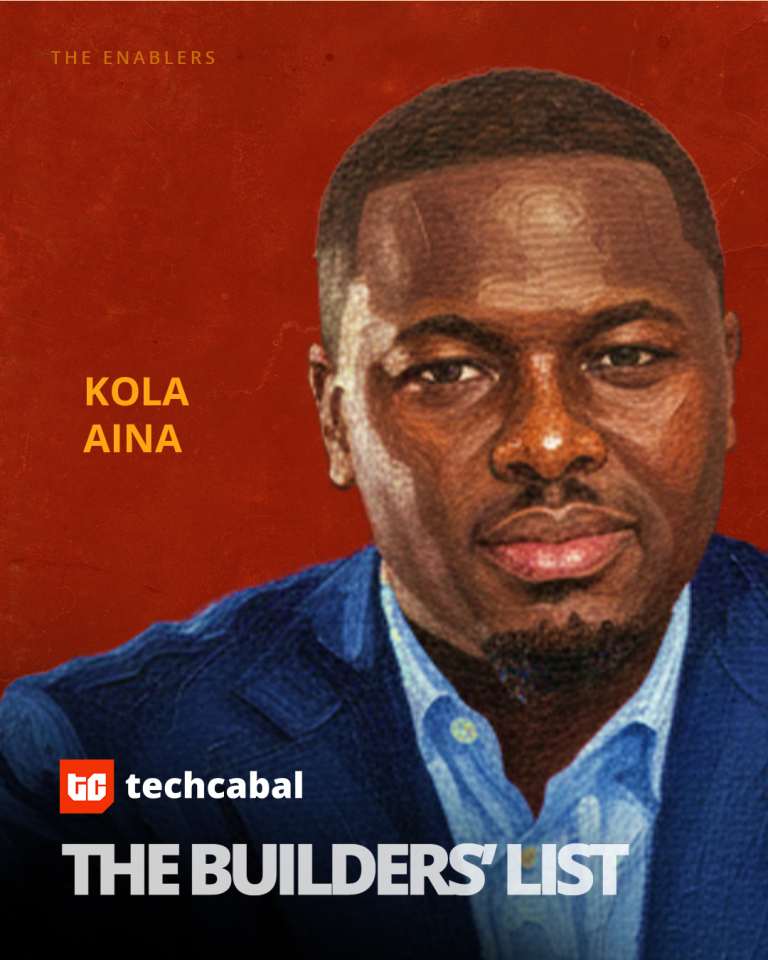

Kola Aina and Ventures Platform spent 2025 doing the one thing that matters most in African venture right now: raising institutional capital and deploying it. In November, Ventures Platform raised a second fund of $64 million, with participation that included the Nigerian government alongside heavyweight institutional backers such as IFC, Standard Bank, BII, and Proparco (Choose Africa VC), plus MSMEDA and AfricaGrow, one of the clearest signals yet of state and institutional confidence in local venture managers.

That fund was a signal of how far the firm has come, from a founder-led early-stage shop to a platform now credible to DFIs, banks, and public capital. The 2025 raise also sharpened Ventures Platform’s power in the ecosystem: more ownership at entry, more ability to defend positions, and more leverage to attract co-investors into later rounds.

Deployment in 2025 reflected that shift. The firm continued backing early-stage companies across fintech, enterprise software, healthtech, and climate, while tightening its emphasis on pricing discipline, founder governance, and capital efficiency. Several portfolio companies raised follow-on rounds during the year, benefiting from Ventures Platform’s increased signalling power with later-stage investors.

In 2025, Aina raised the kind of capital that lets African venture behave like an institution.