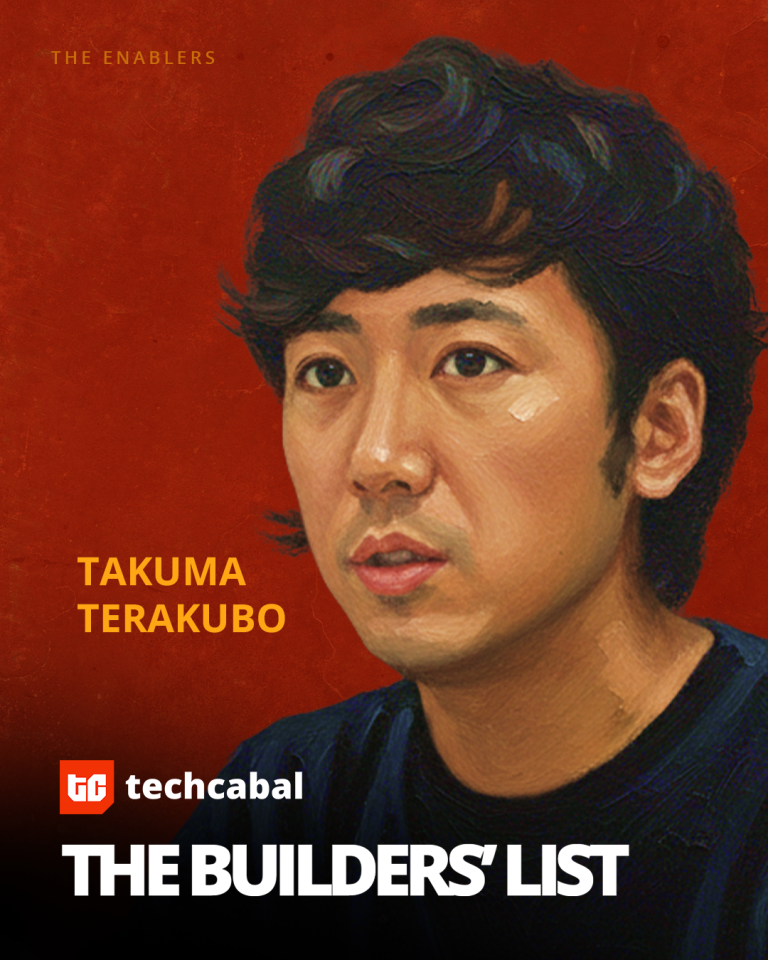

Takuma Terakubo and UNCOVERED FUND spent 2025 formalising their evolution from an active Africa–Japan bridge investor into a more structured capital platform. In August, Uncovered partnered with Monex Ventures to launch the Uncovered Monex Africa Investment Partnership (UMAIP), a $20 million vehicle designed to invest in approximately 30 African startups.

The mechanics of the fund were the headline. UMAIP set initial cheque sizes at $100,000–$500,000, reserved around 50% of capital for follow-ons, and planned to write $1–2 million into later rounds—an explicit departure from spray-and-pray early-stage strategies.

The fund also outlined an intention to raise low-cost debt in Japan to provide structured and non-dilutive financing to African fintechs, reflecting a more sophisticated approach to startup investment in Africa.

Throughout 2025, Uncovered continued deploying across fintech, logistics, mobility, and climate startups, expanding beyond its earlier West and East African concentration. The firm also leaned further into its corporate-access thesis, facilitating commercial introductions between African portfolio companies and Japanese corporates.

In 2025, Terakubo moved Uncovered from enthusiasm to infrastructure. The year was less about discovering Africa and more about building a repeatable fund model—with reserves, rules, and leverage—capable of backing companies beyond the first cheque.