Today is payments day in Nigeria, clearly.

I was invited “to witness the launch of revolutionary technology, that will change the way payments are done today”. That sort of invite is hard to decline. All you can hope is that it is not underwhelming.

I’m there now, at the Four Points Sheration, and I’m trying to decide how I feel about these said revolutionary technologies.

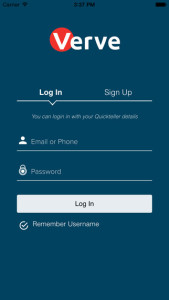

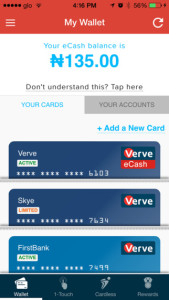

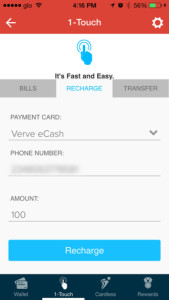

The first is the Verve World App, which is essentially a payments wallet that aggregates payment methods. It’s a lot like Apple Pay, all your cards and stuff in one place and lets you do all sorts of one-touch transactions, from airtime to bank transfers.

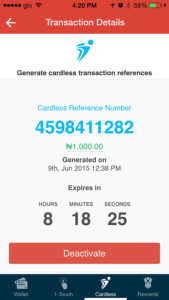

But the Verve World App’s biggest feature is something called Paycode that allows you generate a unique code with which you can access cash from an ATM or make a payment at a point of sale terminal without needing to use your card. You can leave your card at home, and you can still access your cash physically. You can even send the code to someone and have them withdraw cash.

The second is a contactless card that works via NFC technology or QR code scan. And if you stay within your bank’s offline limit (totally at the bank’s discretion how high the threshold is), you won’t have to enter a pin.

Not all the banks support these technologies though. As of today, UBA is the only bank that issues the Verve contactless card. And just six of them support Paycode. Verve World CEO, Charles Ifedi said the plan is for Paycode to be ubiquitous by Q1 2016. But till then, there’s just about 5,000 ATMs that support Paycode. So till further notice, I recommend keeping your debit cards about you.

Cool stuff.

Here’s what the app looks like

And here’s the contactless card in action.

Revolutionary technologies? That’s up to you right now. I must say I was kind of expecting to be shown something to do with developers and merchants. I wasn’t expecting a totally consumer-facing product. But it is what it is. The other question that comes to mind is how the people and banks that are pushing the Pay Attitude technology are feeling about these developments right now.

More to come.