On rethinking venture capital in the form of private equity.

The first few work weeks of the year are now dominated by the release of reports on African venture investing and tech. We published ours last week, by the way. These reports cover everything one needs to know about the state of tech and venture investing. But even with additional reporting on acquisitions, the state (and importantly paths to and patterns) of exits on the continent remain unclear.

Every once and again, the question of exit opportunities rears its head in the African tech conversation. That we are talking and thinking more about how investors take money out tells me two things. First, that the hype is dying out (not bad). And second, that more than one fund is near the end of life so naturally there is a bit of worry about returning something, anything to limited partners (LPs).

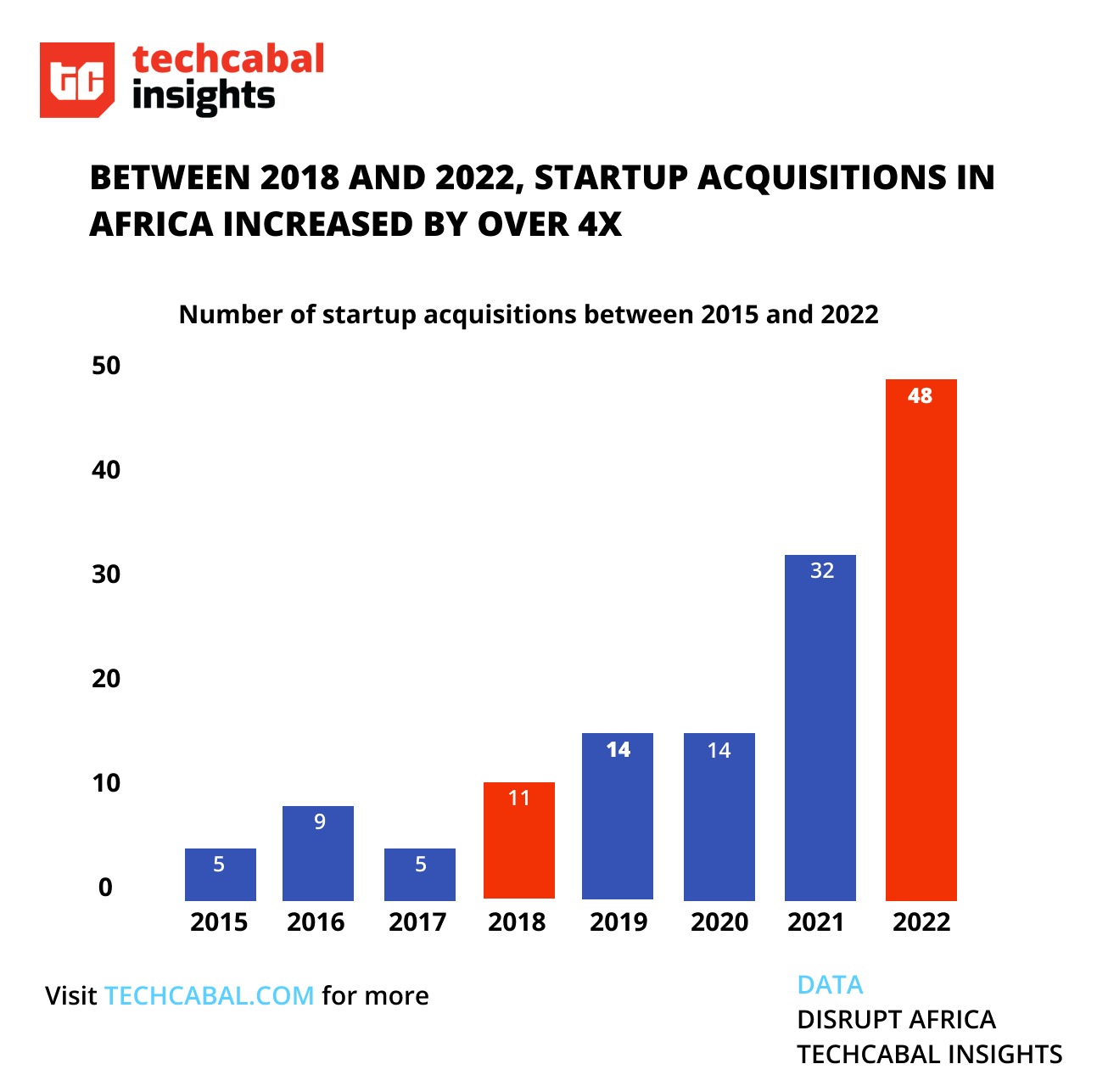

Startup acquisitions in Africa have increased, no doubt. But an acquisition is not always a profitable exit. And the value of acquisitions falls far short of invested capital.

More African companies are being bought, but it is still far from enough. | Chart by Mobolaji Adebayo – TechCabal Insights

The problem of exits is not solely one for venture capital investors. All classes of investors and financiers with exposure to Africa face the same question. The difference however is that venture capital in Africa in the last six years (far too long in hindsight) concentrated attention on finding billion-dollar companies. Everything else was inferior to this position and mergers and acquisitions only served to advance the search for $1 billion+ in valuation.

Correct me if I am wrong, but it wasn’t always that way. Before big American money found African startups, active local and a handful of impact (development) investors were investing on the business (as they understood it) case. Or for development partners, the impact factor. When “big money” made its entrance, the investment case grew apart from the business case and sowed the seeds for today’s interesting exit problems.

Venture capitalists cannot escape shouldering the lion’s share of the blame. As they will for the solution. In the words of Jonathan Swift, but bereft of his satire, here’s my modest proposal. What if we give African VC a stronger private equity colour? I’ll be frank. It may or may not resolve the question of exits, but as a thought experiment, it is interesting nonetheless. So hear me out.

Colour me PE

What does it mean to paint venture capital investing the colours of PE? In brief, it means first accepting that the African venture capitalist will play the role of more than a chequewriter. It means reorganizing the functioning of the VC. For entrepreneurs, it means a modest increase in the value that venture capitalists bring to the table. Far more than simply financing the venture, VCs will need to become more adept at working with management to craft and pursue exit scenarios.

If you think of venture capitalism as value-finding, it is then easier to appreciate that a core distinction between VC and private equity investments, is that PE is focused on value-capture.

To be clear, wearing the colours of PE does not mean becoming a PE firm. It simply means that the African VC will need to combine the hunting skills of the private equity investor and the charm of the angel investor into one package.

PE firms in Africa have grown accustomed to the lack of significant IPO opportunities and have had to creatively find the exit (or at least the directions to it) even before coming through the door and closing a deal. This is what we missed as venture investing in Africa gained momentum—a rigorous analysis and attempt to identify exits—opting instead to sit back and hope to sell growth deals to pre-IPO investors from California.

Both VCs and PE investors are going through tough times today, that much is very true. Unlike VCs however, PE firms do not have to only wait for the elusive IPO or pray their portfolio companies to find someone to merge with, in order for them to find some liquidity.

As an illustration of how the options for PE have improved, in 2017, 1/4 of African PE exits were made through management buyouts (MBO), while 60% of exits involved sales to financial or strategic buyers, per the Africa Private Equity and Venture Capital Association. In 2021, however, strategic and financial buyers accounted for nearly 80% of exits, while MBO-related exits shrank to 15%. For PE investors (depending on how they are distributed across sectors) it is clear that the range of potential buyers is broadening and pointing to a more lucrative market, even as economic clouds gather.

Colouring venture investment with PE paint is not for everyone. It is best suited for mid-to-late-stage investment models, but it can be a helpful way for even first-cheque investors to think and build strategic market models. With every firm looking like everyone else and hunting for younger and younger companies, thinking in PE (which really is thinking in value capture) can help build differentiation.

Private equity activity in Africa is growing and finding its depth as a more mature sport maybe we can take lessons from it.

What will this mean?

In one sentence, the end of extremely asset-light VC-ing. That is to say, the model of running a venture firm where you depend on someone else to do all the work and you simply follow.

The Pareto principle basis of venture capital investing is severely stretched in emerging markets. It is not very easy for 20% of your portfolio to 10x your investment. Not to talk of 3xing the fund or even allowing you to return capital to your LPs. And investors, especially local investors, still struggle with portfolio construction.

I don’t know that anyone will welcome a lesson in how emerging markets are the only true test of the adventure in venture capital. But thinking like a PE—not necessarily doing leveraged buyouts (LBOs)—allows you to find some measure of control over some of the risks.

Investors advise founders to maintain focus. Operating a VC that is painted in PE colours means investors need to take double the dose of their medicine. In the mundane, they will need to keep the end in view (avoid distraction). To paraphrase the adage, they will have to find out how they will make money when they’re buying (as opposed to selling). And to do this without putting the business in jeopardy because even though they are painted PE, they don’t have to import the toxic PE behaviour.

Read: The future of African payments with FCMB and CB Insights

Dealing with the Concorde Fallacy

Also known as the sunk cost fallacy, the concorde fallacy refers to how the British and French governments continued to fund the Concorde aircraft even after it became apparent there was no longer an economic case for it. — Cambridge dictionary.

It is tempting to deal only with the familiar. And the familiar for the past 3 years has been something along the lines of: Collect money from DFIs, HNWIs and others > Invest in pre-seed, seed and Series A > Sell to Sequoia or similar > Repeat. Now VCs will need to look beyond any errors that were born from this strategy and reorganise the entire approach.

Not everyone behaves like my caricature of VC investing in Africa, true. But it broadly conforms to patterns from the era where the hype was the greatest globally. Unfortunately, a lot of people may be invested in this thinking and might find it difficult to eat their losses and find their way to the mean. Some people treat venture capital as a gentleman’s sport, when in reality it is, like private equity, just as much of a contact sport as football is to rugby, with only a superficial difference.

Having said all of the above, I don’t expect that putting on a PE lens to look at venture investments is a proposal that is beyond question, so I fully expect to be challenged on this thinking. As I don’t have any funds myself to invest, I am more than happy to pursue this intellectual exercise. Amen?

We’d love to hear from you

Psst! Down here!

Thanks for reading The Next Wave. Subscribe here for free to get fresh perspectives on the progress of digital innovation in Africa every Sunday.

Please share today’s edition with your network on WhatsApp, Telegram and other platforms, and feel free to send a reply to let us know if you enjoyed this essay

Subscribe to our TC Daily newsletter to receive all the technology and business stories you need each weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.

Abraham Augustine,

Senior Writer, TechCabal.