The battle for Nigerian mobile market share is a fiercely fought one. Once dominated by Nokia, the market is now host to a plethora of OEMs fighting for increasingly fickle consumer attention.

In our minds, Tecno is winning, or at least, it looks like its winning. If only we had the figures to back it. Well we do. Sort of.

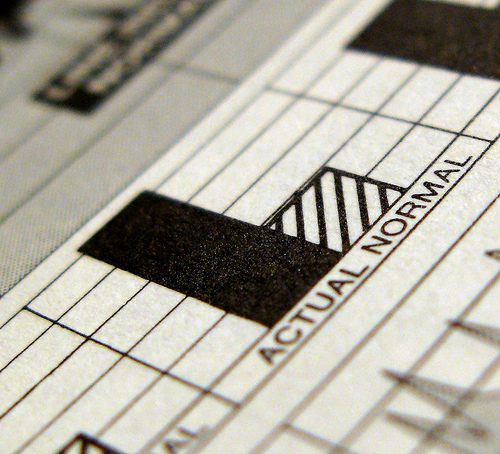

There isn’t a lot of data to work with, but Global Stats from Statcounter is decent and gives a good idea of what’s going on in the mobile landscape. How Global Stats works is they analyse billions of monthly page views, on the over 3 million sites that have Statcounter installed, to determine what devices and software platforms are used to access these sites. The data generated can then be presented in easy to interpret graphs and charts. The only flaw to this approach is that it is heavily dependent on internet access. This means the stats don’t include non-internet enabled phones or phones that aren’t used to connect to the internet at all.

So what does the Nigerian mobile landscape currently look like, according to Global Stats? Let’s go back a couple of years. It is worthy of note that the statcounter sample size of the below graphs for Nigeria is 17 million

2011 – 2012

In the beginning, it was Nokia. And the force was with Nokia. And the force was Nokia.

This was between 2011 and 2012, Nokia’s share of the Nigerian market was undisputed. Other OEMs were in a closely fought battle for second place. By the end of 2012, Samsung claimed the spot, around the time when the Samsung Galaxy S II was the popular high-end device of choice.

But the most interesting OEM on this graph is “T-mobile”. T-mobile is a carrier and doesn’t make phones and is certainly not in Africa. As far as we can tell, these would likely refer to the second-hand “London used” Blackberry devices that were the grey market staple for those who at the height of the Nigerian BlackBerry craze were desirous of acquiring the devices, but couldn’t afford brand new ones.

2012 – 2013

Things begin to get interesting around here. By February 2012, the Elop Effect appears to reach the Nigerian market and Nokia began to lose marketshare.

The striking thing about this graph is to whom Nokia was losing most of its marketshare – “unknown” OEMs – and how little other major OEMs like Samsung, Blackberry and Sony grew. We are inclined to believe that these unknown phones are actually devices of Asian origin that began to flood the market. Notorious for their ability to cram all kinds of features into cheap devices, these “chinko” phones running Java-based operating systems rapidly gained marketshare. Eventually, Tecno would emerge from the fray to become the dominant Asian OEM operating in the region by leveraging the android platform.

2013 – 2014

Nokia continues to lose marketshare steadily. Nokia’s loss is Unknown’s gain, it seems. The converging trajectories of the Nokia and Unknown lines suggests that the next phone Nigerians pick up after dropping their Nokia is a Tecno, or one of the other cheap java-based devices.

Meanwhile, at the bottom of the pile, Samsung, BlackBerry and the others continue to duke it out. For all the huge marketing campaigns and perceived swag, Samsung doesn’t seem to be doing as well as we might have imagined. Price is definitely a factor here. Samsung phones cost as much as 3 times more than Tecno devices, which Nigerians believe to be just as capable.

One interesting trend we’re seeing here — Blackberry is actually seeing an uptick. Perhaps BB10 is really catching on? The London-used/T-mobile/grey market segment is still alive, but just barely.

All three graphs viewed as on look like this –

Nokia is this close to losing first place in Nigeria. The persistence of its hardy devices that enables them to be passed down from hand to hand for years are probably why it still controls this much of the market.

By now, it’s safe to assume that “unknown” is Tecno. At least for the most part. Judging by Samsung’s middling performance, might we conclude that Tecno has won?

Finally, BlackBerry refuses to die. However, it’s real battle for survival is being fought on an entirely different battlefield.

Image courtesy: CcHub MX Lab