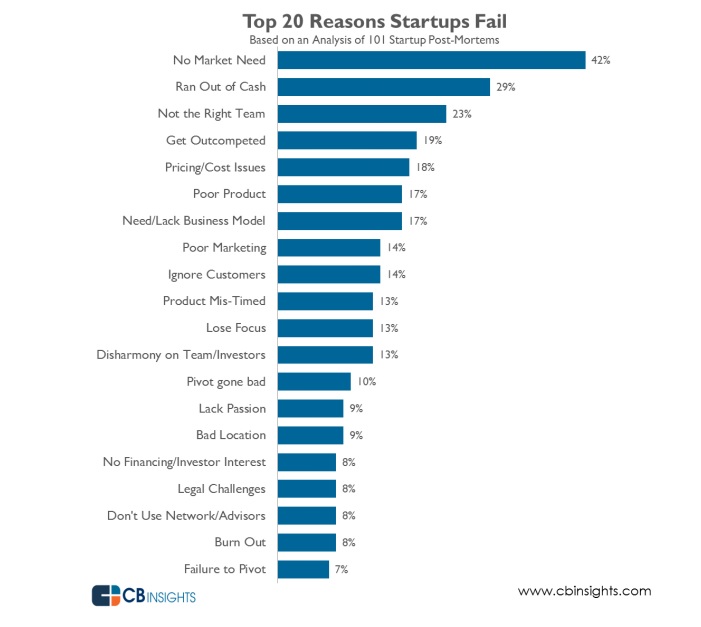

In spite of all the buzz surrounding the startup culture, the sad reality is that about 3 out of every 4 startups are bound to fail.

CB Insights, a Venture Capital Database company based in the US, recently published a report on the top 20 reasons why startups fail. The report is inspired by an earlier published list of 101 startup failure post-mortems, generated using real data from at least 101 real failed startups.

Some of the highlighted causes of startup failure are pretty obvious – lack of funding, investors and domain expertise, no addressable market, etc. – a few others, you don’t come across everyday everyday.

Your pricing is off

Your product is priced either to high or low to make enough money in the context of the particular costs of your company

You’re not pals with your investors

It’s a given that disharmony between co-founders will most likely lead to startup failure. However, a starined invester-founder relationship can be equally as damaging to the health of a startup. And “when things go bad with an investor, it can get ugly pretty quickly.

Pivot Gone Bad

As Flowtab’s post-mortem explains, “Pivoting for pivoting’s sake is worthless. It should be a calculated affair, where changes to the business model are made, hypotheses are tested, and results are measured. Otherwise, you can’t learn anything.”

Location

This might sound odd in the internet age but apparently, lack of correlation between your startups concept and location is one of the most common reasons for startup failure. Location also plays a role in failure of remote teams.

Legal challenges

It’s one thing to have a brilliant novel idea. It’s another thing to be able to maneuver the many legal complexities that may come with developing the idea.

There’s more

Read the detailed report here

Photo Credit: star5112 via Compfight cc