“Paradigm shifts appear to be more likely to occur in an industry where one or both of the following conditions are in place. First the established technology in the industry is mature and approaching or at its “natural limit,” and second, a new “disruptive technology” has entered the marketplace and is taking root in niches that are poorly served by incumbent companies using established technology“. – Strategic Management Theory: An integrated Approach by Hill, Jones & Schilling

Context

If the above statement holds true in developed markets, it certainly would hold true in frontier markets where a myriad of services are non-existent or at best poorly delivered. I’m sure many of you have already been inundated by the stories of Africa rising. The term is so ubiquitous that it’s even been leveraged into an organization that hold conferences based on the theme.

Africa is rising but not because people talk about it or attend conferences. It’s rising because technology has made it easier, cheaper, and more affordable for individuals to create value without having to depend on governments, influence brokers, and other self-proclaimed gate keepers.

I grew up in Nigeria through the 1980s and early 1990s. During that period of time almost every public entity was either fully or party state owned. “The 1969 Nigerian Banking Decree required that all banking institutions be incorporated in Nigeria, and a 1976 law gave the government 60% ownership of all foreign banks”, Encyclopedia of Nations. Web. The 1976 law was in place till 1986 when liberalization commenced with the adoption of the Structural Adjustment Program (SAP).

SAP allowed entrepreneurs to start banks and compete with government owned banks. This marked the beginning of real competition in the Nigerian banking sector. 1986 was a watershed year for Nigerian banking, and is an important milestone. While this may seem like a small innovation, it was instrumental in transitioning Nigeria into a more functional financial system that continues to evolve.

What do we know today

Nigeria is still working through its transition from a state built on patronage, to a democracy with independent institutions supported by the rule of law. While this is happening slower than the many hope for, transformation is happening as a much faster pace in the tech sector. From 2002 to 2012, “Nigeria’s telecommunications sectors is estimated to have generated up to three million jobs in the absence of the state telecom monopoly”, Africa at work: Job creation and inclusive growth Mckinsey and Co. 2012. Web. 14 Jan. 2015.

There is an increasing number of examples of technology enabled companies that are creating wealth and jobs. Interswitch Limited is an integrated payment and transaction processing company in Nigeria. “Interswitch was recently ranked by Deloitte as the fasted growing company in Africa with a growth rate of 1226%. This from a company that was initially financed with a $1.2 million bank loan in 2002 and was valued at $163 million in 2010”, Africa’s five fastest-growing technology companies. How we made it in Africa. David Mwanambuyu.Web.9 Dec.2014.

Interswitch brought innovation into an unsophisticated banking system. It established some of the key building blocks that allow for electronic transactions. While it took Nigeria twenty six years from independence to liberalize basic banking, it has taken about half that time to evolve from innovations like Automatic Teller Machines (ATMs), to mobile banking and mobile payments.

Regulation often lags innovation but some credit is due to forward thinking leadership in select Nigerian Institutions. In 2012 the Central Bank of Nigeria (CBN) introduced a new policy on cash-based transactions which put limits on daily cash withdrawals from banks by individuals and companies, Cashless Nigeria.The Central Bank of Nigeria.2012.Web. “Within two years of implementing the cashless policy of the CBN, the value of interbank transfers, captured through the Nigerian Inter-Bank Settlement System (NIBSS), jumped from N51 billion monthly in January 2012 to over N1.5 trillion as at June 2014”, Ensuring the success of cashless policy in Nigeria. Daily Independent.Web.Aug.2014.

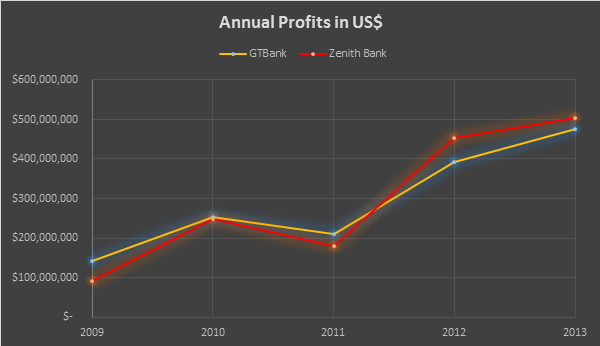

Growth in annual profit of GT Bank and Zenith Bank, both founded in 1990, Source: Market Atlas – INET BFA Expert

What’s in Store for the future?

Innovation is allowing frontier markets like Nigeria leapfrog the advances of the 20th century, and run full speed into the 21st century. While many external analysts may see weak institutions and a less developed regulatory environment as reasons to be cautious, I see these seeming impediments as opportunities. Newly emerging frontier economies can establish rules as they go along that are relevant for the world we live in today.

The majority of African countries are not encumbered by decades old regulatory environments such as exist in The United States. In a USA Today article titled: Government regulations hinder economic growth, Donna Wiesner Keene discusses how an antiquated regulatory environment is negatively impacting job creation in the United States. She states that, “Innovations and jobs cannot cross borders due to conflicting regulations. Someone has to pay for the senseless American regulatory systems we see today — and that someone is us”, Donna Wisner Keene.

While many western economies are beleaguered by political polarization, infighting, and the protection of incumbents, many countries that represent the final frontier for economic development are taking center stage. They not only have the opportunity to innovate locally, they have the opportunity to ride the trend of reverse innovation that Vijay Govindarajan and Chris Trimble eloquently detail in their book: Reverse Innovation: Create far From Home, Win Everywhere.

An African technology renaissance is upon us and is in its early stages. The positive headlines are just the tip of the iceberg, the facts and details are even more fascinating.

Photo Credit: griseldangelo1 via Compfight cc