Whenever I walk into a bank and join a very long queue, I can’t help but remember that bank advert in the 90s – a man would walk into the banking hall carrying a mat, go up to the teller and ask for his tally number. When asked why he brought the mat, he would say, “I know I’m going to sleep here overnight.”

That scene makes the wait a little bearable.

Okay, that’s a lie. Nothing makes waiting on a long queue bearable in Nigeria, not even the Nigerian gbedu the banks sometimes stream over the airways.

Thankfully, the Central Bank’s cashless policy aided the proliferation of online shopping and online banking in the country. The services don’t run buttery smooth just yet, but for now we make do and I’m thankful for the options.

In case you’re still apprehensive about paying for stuff online (and I don’t blame you if you are), here are 7 reasons that could change your mind.

1. Security Tokens and One-Time Passwords

A one-time password (OTP) is a password that is valid for only one login session or transaction and usually expires in a few minutes. Your bank will send you this number whenever you try to make online payments with your card. One major advantage of this is the password is sent to a device (like the security token) or a phone number that you have exclusive access to.

Therefore, even if your card details gets into the wrong hands (i.e. the yahoo boys), the OTP verification process ensures they still won’t be able to pay for anything with your card. That’s a win in my book.

2. Payment Processing Services

These are third party services which handle transactions from various channels such as credit cards and debit cards on behalf of the card owner and the online business. Examples include eTranzact, Paga and Paypal. Paga is currently in its fifth year and already has 3 million users.

Paypal is new in Nigeria but is a worldwide brand name with enough street cred.

If you’re really paranoid about online shopping, these guys have your back.

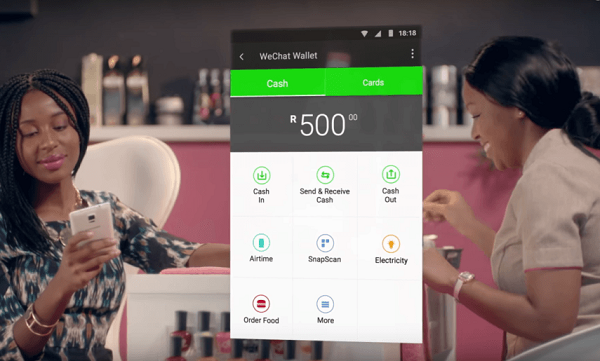

3. Smart phones and secure apps

Most businesses with an online component as well as native online businesses have apps. The proliferation of mobile phones makes the proposition of being able to still drain, sorry serve, your customers on the go irresistible. These apps are usually coded with security features which ensure your transactions are discrete. Another reason to stop going to the bank as though they pay you wages to visit.

4. Social Media

You have friends. They are on Facebook. Some of them already shop online. Trust me, they will have lots of suggestions on where to buy that new bag. Or questions about why you’re still using your crappy bank. Or why you should never bank with theirs.

Look, it’s 2015 and new media drives perception. Any business willing to keep their customers happy and get new customers is currently doing all they can to ensure nothing negative crops up on the social media channels.

So, social media is a check and balance system. Go ahead and do your online shopping. If the company tries to play a fast one, let the world know. Make them regret ever messing with you. Make them pay. (Insert evil laugh here).

5. The Internet

A quick internet search can give you so much information about the website or service you are investigating – their physical location, quality of service, their customer service, and so on. This ensures you’re not falling for a scam.

6. Plenty of safety tips online which are easy to follow

In this age of information overload, it’s easy to get knowledgeable about almost anything. Let’s face it, your money is precious; you worked hard for it. So, getting updated on safety precautions for online payments isn’t too much to ask. And, like the good book says, the commandments are not grievous –

- never use a public computer for online transactions,

- remember to look for the padlock symbol on the address bar and ensure the address begins with “https” not just “http”

- Avoid too good to be true offers and deals. They usually are.

And so on. There are several more tips online which if you adhere to, you’ll be pretty safe.

7. Personal testimonies

I’ve been paying for internet and several other services exclusively online for over 2 years. During that period, I’ve had just one issue which was arguably my fault and it was rectified quickly and yes, I got my money back complete. There are thousands of other testimonials like that. So, online money transactions are not as ill-fated as you may have feared.

After all my grammar, it’s still your prerogative to part with your hard earned cash. I once listened to the Head of Marketing of one of the Nigerian banks say, “It’s quite difficult for some people to adopt cashless transactions. Some folks are just set in their ways. They want to see the physical cash and also whom they are paying the money to. And that’s fine too.”

On the flip side, some people meet their future spouse on such long queues so I guess it does have its advantages.

This post was brought to you in partnership with Tech+. Want to learn more about how technology can improve your lifestyle? Register to attend the Tech+ conference and exhibition.

Photo Credit: Sean MacEntee via Compfight cc